South Africa already got a taste of Trump’s tariffs that he imposed on steel and aluminium in his first term in office.

The world already got a taste of Trump’s tariffs and the US is already in a trade war with Canada, Mexico and China after tariffs of 25% came into effect on Tuesday for US imports from Canada and Mexico. With Trump also having an eye on South Africa for tariffs, the question is how it will affect the local economy.

The US is South Africa’s third biggest trading partner after China and India and any tariffs on South African exports to the US will therefore have a significant impact on the country’s economic growth. However, without any certainty about what Trump will do next, and if he will entertain South Africa’s official response, it is difficult to say exactly what the impact of Trump’s tariffs will be.

ALSO READ: South Africa will pay the price for Trump’s tariffs

South Africa’s imports from the US

Sanisha Packirisamy, economist at Momentum Investments, says in January this year, 7.2% of South Africa’s imports worth R148 966 738 858 came from the US, while 6.6% of South Africa’s exports worth R148 966 738 858 went to the US.

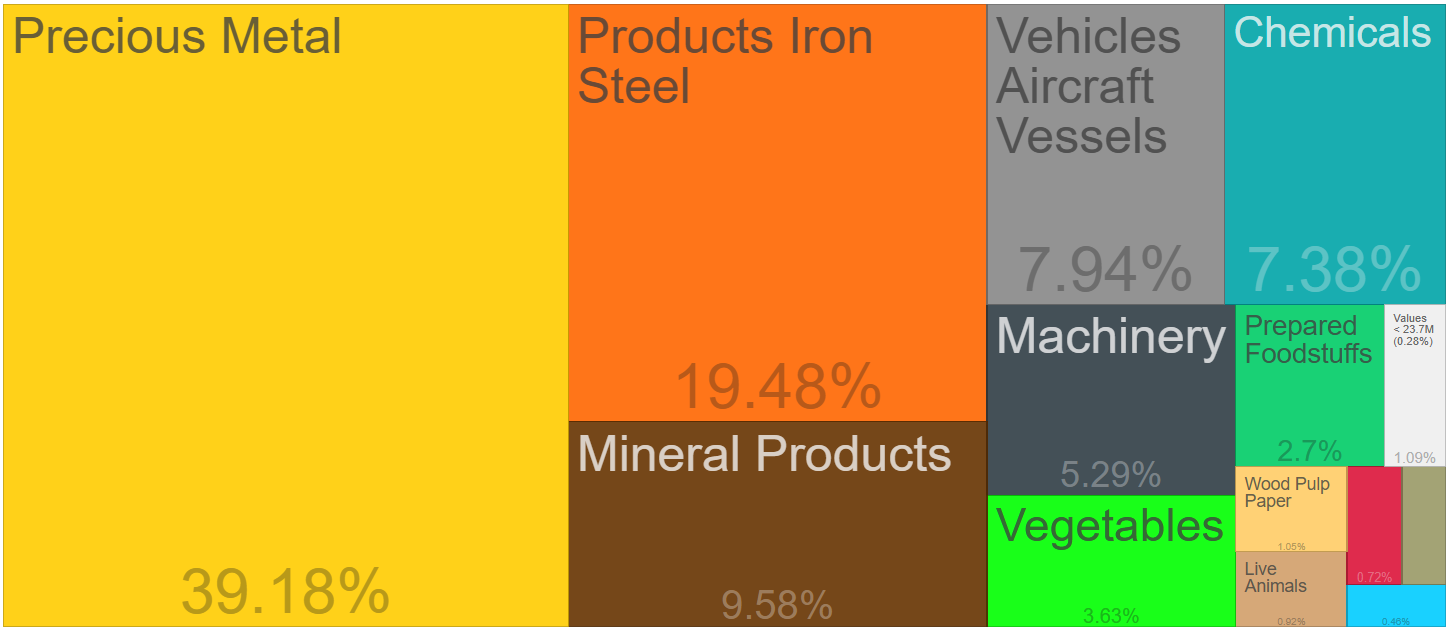

This graphic from Sars shows South Africa’s imports in 2023:

South Africa currently levies tariffs on imports from the US. Packirisamy says under the reciprocal tariff arrangement, this would include 15% VAT, ad valorem excise duties and trade barriers such as quota permits on bone-in leg chicken quarters, with health certificates required.

South Africa’s exports to the US

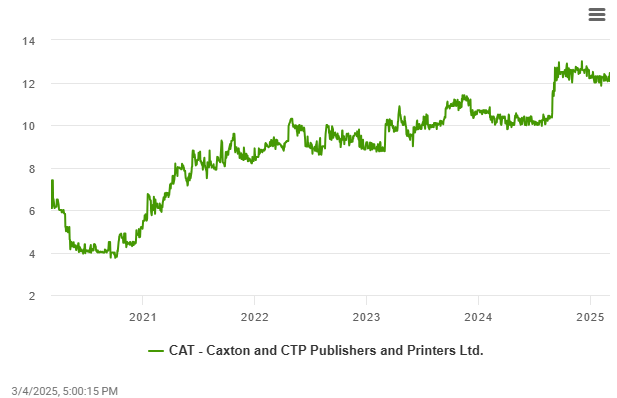

She says during his first term, Trump imposed tariffs of 25% on steel and 10% on aluminium, which had a significant effect on South Africa’s exports, with the volume of US imports of aluminium products from South Africa falling by 57% and iron and steel by 27% between 2017 and 2019. These US imports have still not recovered.

This graphic shows South Africa’s exports to the US:

A full list of current US tariffs on South African imports can be found here.

ALSO READ: Concern about SA steel industry: Trump’s tariffs and ArcelorMittal closure looming

Is Trump already aiming at replacing Agoa with tariffs?

Does Trump’s threats not already destroy South Africa’s benefits under the African Growth and Opportunity Act (Agoa) even before any negotiations start? Packirisamy points out that the favourable tariff arrangement will apply until 30 September.

“Souring foreign relations are nevertheless a broader threat to South Africa’s reputation on the international political stage. It is imperative that South Africa’s foreign stance does not appear contradictory and that President Cyril Ramaphosa displays assertive leadership despite the legacy of apartheid influencing foreign policy decisions.”

Jing Chien and Prof Lawrence Edwards from the School of Economics at UCT, believe that based on Trump’s previous comments, there is a risk he will withdraw US support for Agoa which will have significant implications for South Africa and other African countries.

They point out that South Africa currently exports goods to the value of about $3 billion to the US under Agoa preferences which makes up just more than 20% of all South Africa’s exports to the US.

“The bulk of South African exports to the US are, therefore, not directly vulnerable to the loss of preferential access under Agoa. The effects will also be concentrated among a few products. Vehicles represent by far the largest share (49.73%) of all South African exports to the US under Agoa.”

Other sectors that benefit from Agoa are edible fruits and nuts, particularly citrus products, as well as beverages, spirits and vinegar, particularly wine and a few articles of apparel and clothing. Chien and Edwards say if Agoa is not renewed, these products will be the hardest hit, although the losses may be small as the preference margins are generally below 4%.

ALSO READ: Trump’s tariff threats will affect SA’s economy — experts

Biggest risks not Agoa, but if Trump imposes reciprocal tariffs…

They say a greater risk for South Africa is Trump’s to impose reciprocal tariffs on US imports. South Africa’s main exports to the US under Agoa are passenger motor vehicles with a cylinder capacity exceeding 1 500cmᶟ but not more than 3 000cmᶟ.

“These exports from South Africa benefit from a 2.5% preference into the US market compared to other competitors without preferential market access. South Africa, however, imposes tariffs of between 20% to 25% on US exports of these products.

“Therefore, the imposition of reciprocal tariffs could boost US tariffs on South African exports of these motor vehicles by up to 25%. More broadly, using South African export data for 2022 and 2023, the imposition of reciprocal tariffs would see the general US tariff on South African goods increase from below 1.5% to 5.5%.

“However, it is not all doom and gloom. Should preferential access under Agoa be renewed, South African firms could potentially benefit from import tariffs that specifically target other countries or regions, such as China and the EU.”

ALSO READ: Trump picking on SA triggering spike in economic uncertainty – economists

SA’s mean tariff rate is low, but Trump’s tariffs will be reciprocal

Prof. Waldo Krugell, professor in economics at NWU, says since 2022 South Africa’s applied weighted mean tariff rate across all products was approximately 4.66%.

“While specific data on the average effective tariff rate exclusively for US imports into South Africa is not readily available, it is reasonable to infer that US goods are subject to similar tariff rates, given South Africa’s application of Most Favoured Nation (MFN) rates to imports from countries without preferential trade agreements, according to Trading Economics.”

He says when it comes to Trump’s threats of reciprocal tariffs, it will not be 4.66%. “Trump is talking about matching tariffs on a product by product basis and for some products, our tariff rate is much higher.

He points out that under Agoa our exports to the US are duty free, except for very specific ones such as their anti-dumping tariffs on steel for example. “I also think that the imposition of reciprocal tariffs will mean the end of Agoa. I cannot see him making an exception for African countries.”

ALSO READ: Trump as president: What it will mean for SA

New sheriff in town with Trump’s tariffs

Meanwhile, Andrew Rymer, CFA, senior strategist at the strategic research unit at Schroders, warns that there is a new sheriff in town. “Global investors have been digesting the change in policy direction after Trump’s return to the White House. In contrast to his first term, actions on the trade front have been a policy priority and the rules of the game are changing.”

Within his first month back in office Trump has already announced 25% tariffs on goods imports from Mexico and Canada, 10% tariffs on Chinese goods imports in addition to the 25% tariff already in place on some goods and a 25% tariff on all aluminium and steel imports.

He also directed his administration to draw up plans for reciprocal tariffs equivalent to those imposed by other countries on US goods.

“Trump has been unequivocal when it comes to trade and his policy agenda prioritises tariffs as a tool to protect domestic industries and jobs. He has frequently cited trade imbalances as a key concern, both during his first term in office and more recently. US trade deficits (where the value of imports exceeds exports) with partner countries therefore offer a proxy to gauge tariff risk.”

ALSO READ: South Africa can live without Trump

Proportion of GDP exported to US is important for Trump’s tariffs

Rymer says for those exporting to the US, the key question is what proportion of gross domestic product (GDP) they export to the US represent, as this captures the economic impact. Mexico and Canada are the most affected on this measure. Asian exporters, Taiwan and Thailand also have a sizeable exposure.

“There are a range of economies at risk from tariffs, measured by those with which the US has a trade deficit. However, there is some nuance when it comes to the economic and market impact.

“So far this year, the announced tariffs appear to have been milder than financial markets anticipated.”

He warns that tariffs have the potential to disrupt supply chains for US and international listed companies. “For companies in targeted economies, these could also suffer reduced competitiveness, or reduced market access. A potential for trade to be re-directed away from the US could lead to spillover effects for companies elsewhere in the world.

“The same could be argued for US companies if reciprocal measures are implemented. The ability of impacted companies to pass on the tariff impact to customers is a key factor. There may be some companies which are insulated from, or which can weather tariffs more than others.”

Rymer says anticipating tariffs is complex, particularly given Trump’s unpredictable approach. “Some economies may stand out as at greater threat of tariffs, but understanding the risks and differences between economies, markets and individual company exposures remains crucial.”