The relationship between national budgets and constitutional courts represents a fascinating intersection of fiscal policy and constitutional law. And a new chapter was written by the DA and EFF in the Western Cape High Court today.

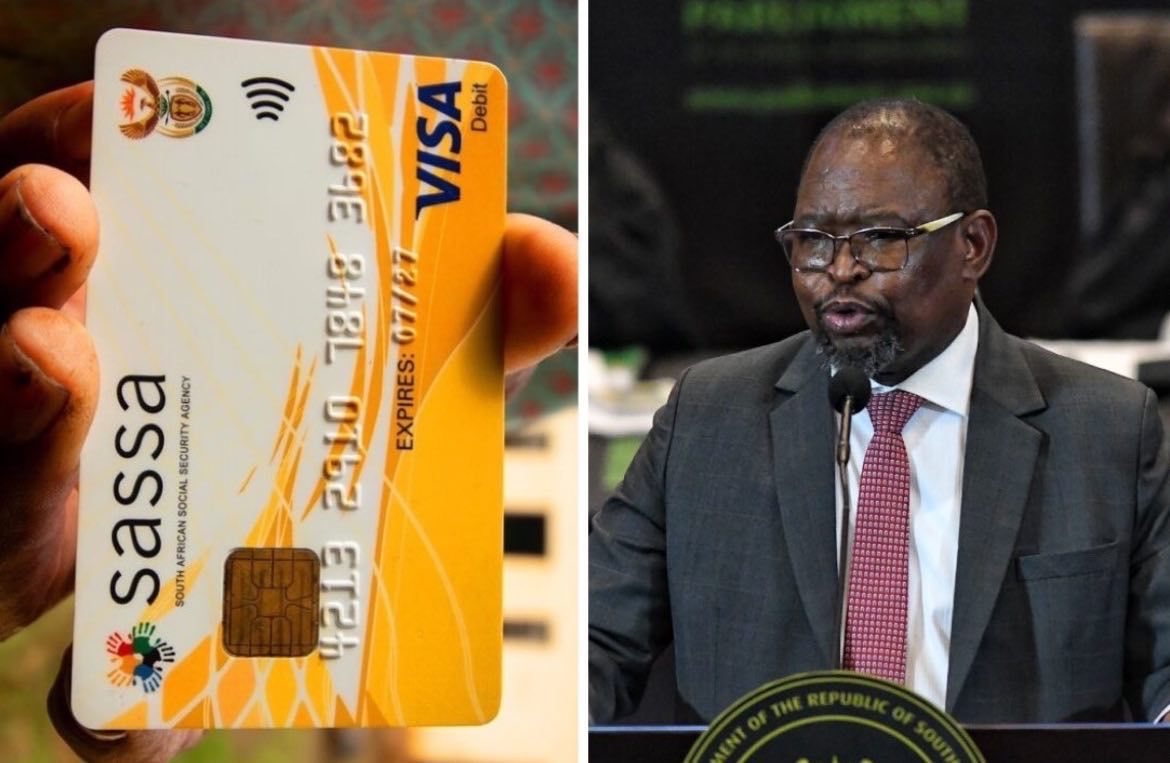

Their interdict against 2025 VAT increases filed earlier this week was upheld. Marking yet another improbable first for South Africa under its Government of National Unity (GNU). It all started with Finance Minister Enoch Godongwana’s postponed Budget Speech in February.

And now it’s concluded in the courts just days before VAT increases were set to go ahead on Thursday 1 May 2025. This is, as many predicted, a victory for South Africa’s constitutional framework that held strong in the face of misguided fiscal policy from the ANC.

OVERTURNED BUDGETS THROUGH THE YEARS

Moreover, there have been several global precedents where national budgets were overturned in court. Unsurprisingly, most often these are in emerging economies, where misappropriation of budgets is rife:

HUNGARY (1995)

Perhaps one of the first overturned budgets come from the Hungarian Constitutional Court. It invalidated significant portions of 1995’s austerity measures in the country, known as the ‘Bokros package.’ Social welfare cuts were reversed as they were deemed to violate citizens’ constitutional rights to social security.

COLOMBIA (1997-2000)

One of the most notable examples occurred in Colombia, where courts declared a ‘state of unconstitutional affairs.’ As such, government was ordered to reallocate budgets for funding of displaced persons. Thus, establishing the principle that budgetary decisions are not immune from constitutional review.

INDIA (2001)

India’s Supreme Court, in the landmark Right to Food case, ordered government to implement and fund specific nutrition programs. While not directly overturning budgets outright, this effectively mandated budget allocations for initiatives not planned for. �

SO, WHAT HAPPENS NEXT?

Much like the successful overturning of VAT increases in 2025, these examples illustrate the courts’ power to redirect fiscal priorities when constitutional rights are seen to be threatened. In most instances, the following precedents were set:

- Governments must typically reallocate funds within existing constraints rather than increase expenditure.

- Many courts focused on procedural reforms to improve budgetary processes, so it wouldn’t happen again.

- Greater transparency, public participation and rights-impact assessments are typically the lasting legacy from overturned budgets.

These precedents from other emerging nations suggest that intervention is cautious but meaningful when the allocation of public funds is deemed to undermine the best interests of the people.

ARE YOU HAPPY TO SEE VAT INCREASES OVERTURNED?

Let us know by leaving a comment below, or send a WhatsApp to 060 011 021 1.

Subscribe to The South African website’s newsletters and follow us on WhatsApp, Facebook, X and Bluesky for the latest news.