Rising number of complaints relate to keeping within legislative timelines.

The South African Revenue Service (Sars) has a problem with timekeeping. This is apparent from the 2023/24 Annual Report of the Office of the Tax Ombud, released on Wednesday.

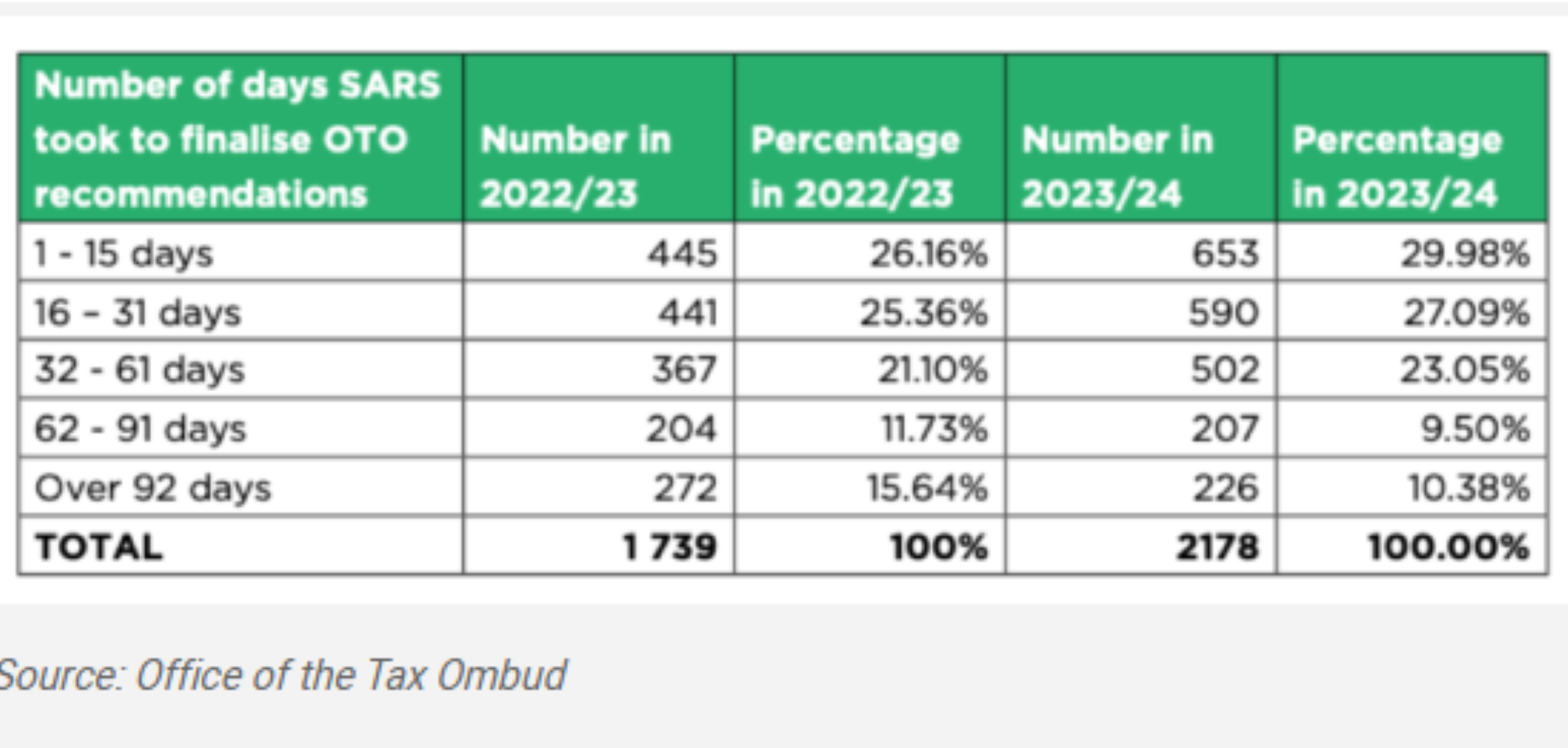

The non-adherence to timeframes has been escalated to the senior leadership of Sars’s complaints management office. Although the tax collection agency implements most of the Tax Ombud’s recommendations there is a concerning trend that it does not do so timeously.

The Office of the Tax Ombud (OTO) identified 10 of the most serious issues encountered by taxpayers, and in more than half of the cases, taxpayers complained about Sars not adhering to specific timelines set out in its own legislation.

When their complaints have been addressed by the OTO it can still take up to 92 days before the recommendations are adhered to by Sars.

Taxpayers and their practitioners have for years consistently raised concerns regarding the non-binding nature of the ombud’s recommendations to Sars.

If the recommendation is accepted but not implemented there are few remedies available to either the OTO or the taxpayer to enforce it.

ALSO READ: Tax Ombud working with Australia to stop e-Filing profile hijackings

Refund headaches continue

The non-payment of refunds continues to frustrate taxpayers. This is despite a highly publicised investigation and recommendations on how Sars must resolve issues.

Thabo Legwaila, CEO of the OTO, says they have again received numerous complaints about delayed payment of refunds, indicating a persistent issue that should be resolved with Sars.

According to the annual report, the finalisation of a verification and the payment of refunds (if applicable) represents 51% (1 222) of the overall number of complaints received.

“The retention of refunds negatively affects the cash flow of small businesses and individuals, jeopardising their financial stability,” Legwaila stresses.

Tax Ombud Yanga Mputa says her office’s intervention led to the top 10 tax refunds being paid out – totalling R179 million compared to R103 million in the prior year.

ALSO READ: Evidence of practitioner involvement in eFiling hijackings

Increase in complaints

The OTO has seen a 16% increase in the number of complaints compared to the previous financial year, up from 3 960 to 4 618.

Of the total accepted complaints in the reporting period, the OTO sent 51.82% to Sars for resolution and rejected 28.8% (1 330) as these fell outside the mandate of the OTO.

In the previous financial year, 42.85% of the total accepted complaints were referred to Sars for resolution, while 44% were rejected for being outside the mandate of the OTO.

“While the OTO sees the decrease in rejected complaints as positive, the number of complaints remains significant and is concerning since most rejections are due to complaints being prematurely lodged with the OTO.”

More than 19% of the accepted complaints were terminated as Sars concluded them before the OTO could complete its review. In the previous year 13% were terminated before the OTO review.

ALSO READ: Balancing Sars’ powers and duties with taxpayers’ rights and obligations

Timeframes ignored

High on the list of complaints is the finalisation of objections and taking the next step in the alternative dispute resolution (ADR) process. Almost 14% of complaints dealt with delays in finalising an objection.

In terms of the Tax Administration Act, Sars must finalise the objection within 60 days after receiving the objection if no additional supporting documentation was requested. If it does request additional supporting documentation, the objection must be finalised within 45 days after receiving the supporting documentation.

Currently, the ADR process is only available at the appeal stage. This means that the taxpayer must wait until Sars either allows the objection, partially allows it, or rejects it.

If the objection is rejected the taxpayer can appeal the decision and only then engage with Sars in an ADR process.

National Treasury has now proposed an amendment to the TAA that will allow taxpayers to use ADR proceedings at the objection stage.

The OTO considers this delay with the finalisation of objections as a serious matter. It has been on the OTO’s watchlist for 46 months and is still an ongoing concern.

When Sars issues an assessment, a taxpayer can request reasons but must do so within 30 days of receiving the assessment. Sars then has 45 days to respond to the request but can extend it by not more than 45 days if the matter is complex or the amount involved is high.

However, once again Sars has not been keeping within these timeframes. This matter has also been on the watchlist for 46 months and is still ongoing.

ALSO READ: Taxpayer trust in Sars stagnates

Still to do

A significant task still ahead of the Tax Ombud is addressing the growing incidence of eFiling profile hijacking, says Mputa. She says they are committed to addressing the scourge of profile hijacking.

“It is unsettling that scammers have been gaining unauthorised access to taxpayer filing accounts by using technology for criminal ends, such as by filing false tax returns, redirecting tax refunds to their bank accounts, or using stolen information for other fraudulent activities.”

This article was republished from Moneyweb. Read the original here.