Watchdog orders banks to freeze Banxso’s accounts as it believes it is a ‘criminal enterprise’.

The Financial Intelligence Centre (FIC) has ordered three banks to freeze all the bank accounts of the controversial contracts-for-difference (CFD) trading platform Banxso. The FIC believes the company is a “criminal enterprise designed to defraud innocent members of the public”.

In court papers, the FIC states that it issued the instructions to Standard Bank, Nedbank, and Capitec because it had “reasonable grounds for suspecting that the transactions in Banxso’s bank accounts were the proceeds of unlawful activity”.

The action came after the Financial Sector Conduct Authority (FSCA), which has been investigating Banxso for months, requested the FIC to instruct the banks to freeze the accounts and to refer Banxso to the Asset Forfeiture Unit to secure a preservation order for the remaining money in the accounts. This order has since been granted.

The FIC’s directives to the banks were issued under Section 34 of the Financial Intelligence Centre Act.

Banxso, which claimed there was R72 million in the accounts at the time, denied any wrongdoing and launched an urgent application in the Western Cape High Court to have its accounts unfrozen. However, the application was dismissed with costs.

The FSCA also announced today that it has provisionally suspended Banxso’s licence.

Banxso issued a press release late Wednesday, emphasizing that the FSCA has not completed its investigation and that the license was provisionally suspended. The company also denied allegations of financial misappropriation and impropriety. (Read the full press release here.)

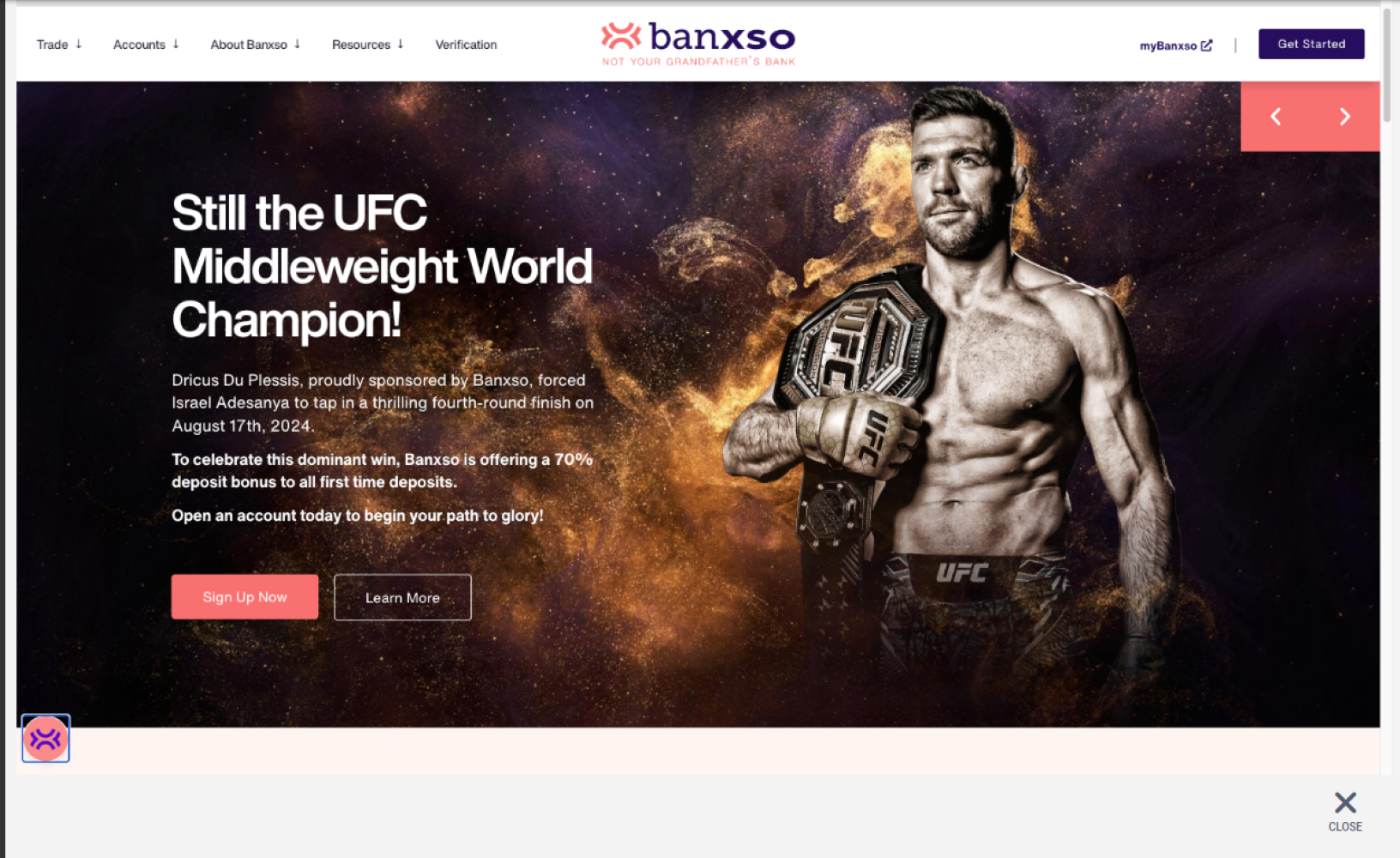

Banxso sponsors UFC champion Dricus du Plessis and Bafana Bafana. Image: Banxso website.

ALSO READ: Ashburton Fund Managers fined R16 million for not complying with FICA

Who is Banxso?

Cape Town-based Banxso is registered with the FSCA and has a high public profile through sponsorships of national soccer team Bafana Bafana and Ultimate Fighting Championship (UFC) champion Dricus du Plessis.

In February, Moneyweb revealed Banxso was a significant beneficiary of deep fake advertisements, which saw celebrity billionaires such as Elon Musk, Johann Rupert, and Nicky Oppenheimer market investment products promising monthly profits of R300 000 for a once-off investment of R4 700.

A company, Immediate Matrix, produced these ads.

At the time, and in court papers, Banxso denied any link to Immediate Matrix and claimed it was the victim of hackers.

It also claimed in the court papers that it received only R14.1 million from people who reacted to the ads and that they were refunded.

However, since Moneyweb’s first article was published, nearly 200 people have contacted Moneyweb and claimed they have collectively lost almost R110 million. Virtually all reacted to the fake ads.

This may be the tip of the iceberg, as Banxso claims in court papers that it has 7 320 active clients.

ALSO READ: Additional reporting requirements to curb money laundering kicks in

‘Criminal enterprise’

Pieter Smit, an executive manager of the FIC, states in a lengthy affidavit that Banxso’s bank accounts contain “multiple unlawful transactions, and the conclusion that the FIC has drawn is that Banxso’s business is a criminal enterprise”.

Smit describes a modus operandi in which the fake ads lured investors to Banxso’s platform. Banxso agents then assisted them in opening trading accounts and making their first deposits.

The agents then used aggressive and high-pressure sales techniques to convince clients to invest additional funds. These funds went into a “system” that resulted in “clients losing all the funds they deposited with Banxso”.

Smit states that an analysis of Banxso’s bank statements revealed that 1 606 credit transactions of R4 700 each – the amount touted in the fake ads – were made into various Banxso bank accounts.

ALSO READ: FSCA warns that scammers are impersonating financial services providers

FSCA affidavit

The most explosive revelations were contained in an FSCA affidavit annexed to the FIC’s affidavit.

The affidavit, deposed by FSCA investigator Sanele Phuthuma Magazi, analyses many transactions in Banxso’s various bank accounts over the past few years. It reveals complex transactions, internal transfers, payments, and cash withdrawals.

Magazi highlights suspicious activity in two Standard Bank accounts that saw inflows of nearly R1 billion each, although significant amounts were transferred between the two accounts.

The analysis also shows that at least R880 million in client funds was deposited into its accounts with Standard Bank, Nedbank and Capitec.

Magazi also flags that “approximately R43 million worth of personal/business payments were made at, inter alia, Vodacom, Woolworths, Pick n Pay, Bay Hotel and the Bar Keeper”.

“From the analysis of this account, it appears that some client funds were used for personal and/or business-related expenses.”

Smit refers to these transactions in the FIC affidavit, stating: “Such frequent inter-account transfers are typically used when someone is trying to disguise the identity and source of funds and is a red flag. It is not immediately apparent why Banxso would need to move funds between its various accounts.”

ALSO READ: FSCA imposed about R943 million in penalties and debarred 156 people

Payments to crypto platforms

Magazi also flagged numerous transactions through which Banxso paid “R615 million of client funds” to two FSCA-registered crypto platforms, FiveWest and Blockkoin.

Magazi states that both FiveWest and Blockkoin claimed Banxso made deposits in rands, which they converted to USDT (a crypto currency pegged against the US dollar), and transferred to crypto wallets nominated by Banxso.

Magazi said the FSCA’s analysis “did not show that these client funds were paid to a financial product provider as required”. This refers to external liquidity providers, which Banxso had to use as it doesn’t have a relevant licence to act as a liquidity provider.

ALSO READ: FSCA’s Regulatory Actions Report shows impressive numbers of enforcement

Banxso response

Manuel de Andrade, Banxso’s chief operational officer, responded to the FIC’s affidavit and accused the FSCA of being “guilty of material non-disclosure to the FIC”.

He stated that Banxso has comprehensively cooperated with the FSCA during its investigation and addressed all the issues the FSCA raised regarding Banxso’s operations.

“It is inexplicable that the FSCA did not disclose the information to the FIC. If the FIC had made a simple enquiry, Banxso could have provided it with the information. Instead, the FIC has seen fit to employ its extraordinarily wide and unregulated powers under Section 34 [of the Financial Intelligence Centre Act] to effectively shut down Banxso’s entire business.”

De Andrade also repeated Banxso’s denial that it had any links with Immediate Matrix and that it was the victim of a cyber attack.

He also stated that Banxso refunded investors R14.1 million, which it believes is the total impact of the Immediate Matrix scheme. “There are no longer any unlawful proceeds of the IM scheme in any bank account.”

He also denied that Banxso is a criminal enterprise and said the majority of Banxso’s clients were making money. He said the “winning ratio” of clients’ trades in September was 72% for short or intraday trades, 66% for weekly trades and 38% for long-term trades, and that “by and large, clients of Banxso are making a profit, not a loss”.

De Andrade denied that Banxso comingles client funds with operational funds, stating that client and operational funds are separated, and “in no way does Banxso, nor has it ever, dipped into client funds”.

He claims the FSCA made an “error” and confused Banxso’s bank accounts and that the account from which cash withdrawals and retail purchases were made was not the one the FSCA referred to.

Regarding the frequent transfers between accounts, De Andrade explained that they stem from the “liquidity and recon management that Banxso does on a daily basis”.

De Andrade also denied that Banxso did not pay its offshore liquidity providers.

“It is also patently untrue that Banxso does not remit funds to its offshore ODPs. This is facilitated through FiveWest’s global payment solution and their use of cryptocurrency. Since 2 January 2024, a total amount of R672 192 435 has been paid to Banxso’s liquidity provider.”

These payments were all made to Flamingo Clearing House, based in the Comoros.

Harel Sekler owns both Banxso and Flamingo Clearing House.

Moneyweb has also linked Sekler to a massive international binary options scam, Banc de Binary.

In the 2010s, Banc de Binary was fined in the US for unlawful operations. Many regulators around the world also issued warnings against Banc de Binary.

* Following the publication of this article, FiveWest issued the following statement:

FiveWest wishes to clarify its role in relation to Banxso’s operations. Our involvement was strictly limited to facilitating the conversion of Rands to cryptocurrency. At no point did FiveWest participate in or facilitate the remittance of funds to any offshore liquidity providers. We were not involved in transferring the reported sum of R672,192,435 to any entity. FiveWest remains committed to transparency and accuracy in all its business dealings.

This article was republished from Moneyweb. Read the original here.