Economists say they agree with the decision to cut the repo rate by 25 basis points, but only expect one more this year.

After the MPC had a hawkish stance in the past few repo rate decisions, economists thought that another cut would not be on the cards today. But after inflation for April was still below 3%, they started to wonder if a cut could indeed happen.

Tertia Jacobs, treasury economist and fixed income specialist at Investec, says the surprise was not the 25 basis points cut, but the fact that the governor of the South African Reserve Bank (Sarb), Lesetja Kganyago, was in favour of a 50 basis point rate cut.

“We would have concurred with the 50-basis point rate cut because we see that the Sarb is behind in the rate cutting cycle. It was interesting that there was a lot of time spent on discussing a lower inflation target. The Sarb really pushed hard for the lower target, but the governor said they need the buy-in from Treasury.”

ALSO READ: Reserve Bank cuts repo rate thanks to lower inflation, stronger rand

Unanimous decision to cut repo rate

Jee-A van der Linde, senior economist at Oxford Economics Africa, points out that five members of the Monetary Policy Committee voted for a 25 basis points cut, while one member preferred a larger cut of 50.

“Although our subjective odds shifted in favour of a 25 basis points cut, our forecast for this meeting indicated an unchanged policy rate, with voting patterns remaining tight due to the exceptionally uncertain external environment.”

He says the latest repo rate cut suggests that the Sarb is comfortable with South Africa’s inflation outlook, including potential upside risks to prices. “Looking ahead, we forecast headline inflation will consistently average above 3% from the second half of 2025, trending gradually higher over the near term.

“This suggests that monetary authorities will have their work cut out for them if they want inflation expectations to decrease from current levels (4.3% in 2025 and 4.6% in 2026) to 3%. The Sarb said it will consider scenarios with a 3% objective at future MPC meetings.”

ALSO READ: Repo rate cut offers no shelter from Budget 3.0 fallout for consumers

It was the right decision – economist

Prof Raymond Parsons, economist at the NWU Business School, says he believes the MPC decision to resume its interest rate-easing cycle by reducing rates by another 25 basis points is the right one. “It is a welcome recognition of the changed economic circumstances which have made this possible.

“The majority view of the MPC therefore recognised the other factors which made it both desirable and practical to further cut borrowing costs for business and consumers at this key juncture in South Africa’s business cycle.

“At this stage even a small reduction in interest rates can have a big positive impact on the national economic mood and on confidence levels. Although it is recognised that monetary policy cannot do the heavy lifting in South Africa’s growth performance, lower borrowing costs are nevertheless supportive of the country’s incipient but weak economic recovery.”

ALSO READ: Reserve Bank could cut repo rate on Thursday, but will it decide to?

More positive inflation outlook can bring more repo rate cuts

Harry Kellan, CEO of FNB, says the repo rate cut comes at a time when there is a more positive inflation outlook for the rest of the year, along with growing urgency to boost economic activity. He expects that the repo rate will be reduced once more this year.

“Interest rates and inflation must be viewed in a wider context. We saw a sharp decline in the FNB/BER consumer sentiment measure in the first quarter of 2025, driven largely by indications of a potential VAT hike which has been removed.

“While the VAT hike uncertainty has been resolved, the recent approved budget does continue to reflect continued fiscal pressures. Consumer sentiment is also impacted by the lower-than-expected inflation increases in house prices as noted in the FNB Property Barometer.”

Mamello Matikinca-Ngwenya, chief economist at FNB, says the MPC’s decision to cut the repo rate highlights a greater focus on domestic fundamentals. “The outlook on interest rates will continue to reflect the risks. Should muted local inflation and expectations that the US Fed will resume its cutting cycle before year-end prevail, our current view that another 25 basis points cut is probable this year would be supported.”

ALSO READ: Repo rate: Will Reserve Bank cut or err on side of caution?

Low inflation and recovery in exchange rate to thank for repo rate cut

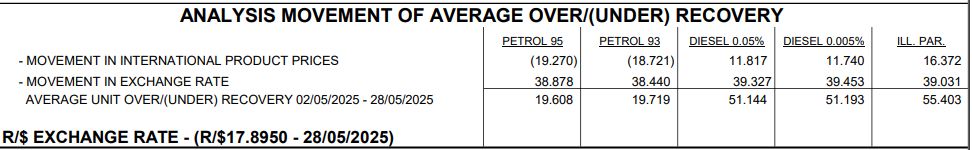

Angelika Goliger, chief economist at EY Africa, says the decision to cut the repo rate was influenced by several factors, including South Africa’s low inflation, a recovery in the exchange rate and declining fuel prices.

“Globally, the US Federal Reserve remains cautious due to uncertainties around government policies and their net effect on the economy, with only two rate cuts expected this year, starting in September.

“However, the outlook for US inflation has improved following yesterday’s US Court for International Trade ruling that the reciprocal tariffs imposed under the International Emergency Economic Powers Act (IEEPA) by the Trump Administration are unlawful and subject to removal. By bringing more trade policy certainty, this could build a case for the US Fed to reduce rates sooner.”