Most people have not saved enough and experts now predict that people will have to work until they turn 80 before they can afford to retire.

People are living longer than they thought they would when they initially started working and saving for retirement.

Edward Wall, portfolio specialist at Morningstar South Africa, says life expectancies are increasing, people are living longer and there is a growing concern that current retirement savings will not be enough when people reach retirement age.

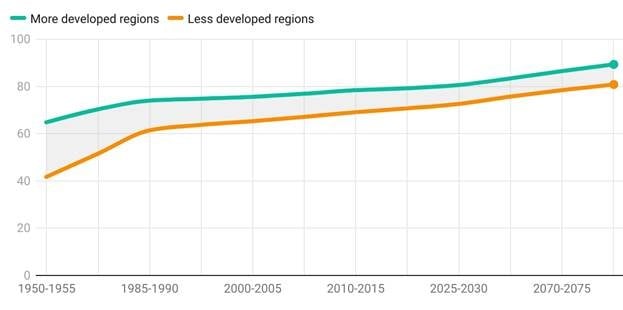

“People’s life expectancy has doubled over the past decade, according to the World Health Organisation (WHO). What is noticeable in the data is that a gap remains between countries, with developed countries typically having a higher life expectancy than developing nations.

ALSO READ: The three phases of retirement and how to maintain your quality of life

“There is a strong correlation between a country’s healthcare spending and the life expectancy of its people. According to experts, the gap between developed and developing nations is expected to decrease over time as they play catch-up, with healthcare and access to it improving.”

Why are we living longer?

He says significant contributors include improvements in nutrition, sanitation and clean water, enhanced healthcare and increasingly higher living standards.

Socioeconomic progress, characterised by higher incomes and poverty reduction, also facilitated greater access to healthcare and healthier lifestyles.

ALSO READ: South Africa’s real retirement age? 80!

This graph of estimated years of life expectancy at birth from 1950-1955 to 2095-2100 (projected) shows how it has increased:

Wall says in South Africa life expectancy trends mirrored global progress until the 1990s, when the country faced a sharp reversal in life expectancy due to HIV/Aids, falling from 63 years in 1990 to only 53 years in 2005, before widespread antiretroviral treatment helped to restore it to 65.5 years by 2019.

“Overall, the long-term trajectory for most countries is upward and future projections indicate continued gains. Global life expectancy is expected to reach the high seventies by 2050. Humanity is experiencing a longevity boom, a triumph of development with advances in medicine, public health and living conditions, but one that requires individuals and societies to adapt, particularly in planning for retirement and old age.”

The concept of ‘retirement’

He says we all grow up with this idea of life where we go through the cycle of life, attending school, beginning our working careers and starting and raising a family. “Then, one day, when we are older, we retire.

“There have been changes to this cycle over time, more recently with people often getting married and starting a family later in life.”

The concept of “retirement” is much different today than it was before the 20th century. Wall points out. “People used to work until their death or until they reached old age. Today, the concept generally means you can stop working and enjoy the fruits of your labour. However, the reality is a lot more complex than this, with not all people following the same retirement journey.”

ALSO READ: Warning! The retirement savings gap is widening in South Africa

Retirement age across the globe

In South Africa, the public sector’s old age grant is paid to people older than 60 who qualify. In the private sector, many employers, through company policies or employment contracts, have a retirement age that ranges between 60 and 65, when service comes to an end, although this can be extended in some circumstances.

In the US, Congress passed a law in 1983 that increased the full retirement age from 65 to 67, aiming to deal with rising life expectancy and the financial strain on social security. People can start claiming social security benefits at the age of 62, but they will receive a reduced monthly payment and only qualify for the full benefit when they turn 67.

France experienced a period of unrest and strikes as President Emmanuel Macron implemented a retirement reform bill, which increased the retirement age from 62 to 64 by 2030. The French system is a bit more complex than most, but it ultimately came down to gradually increasing the retirement age over time to ensure the system’s sustainability.

ALSO READ: 50 and still haven’t saved? Here’s how to kickstart your retirement plan today

In the UK, the state pension age is currently set at 66 and is scheduled to increase to 67 by 2028 and 68 by 2046, while the government is required by UK law to review it regularly. During its 2021 review, they even considered whether the increase to 68 should be brought forward to 2037-39, but this proposal did not make it into the final submission.

Wall says this raises an important question regarding the evolution of the retirement age and what a sustainable age is when people can retire to support the public and private systems.

How to save for a longer retirement

People are expected to live longer and developed countries are beginning to raise their retirement age. Wall says longevity risk is one of the most significant risks to retirement planning, as it amplifies all other risks.

“There are many approaches to this pre- and post-retirement. Regarding pre-retirement, one of the most important factors in deciding whether someone will have enough money saved for retirement is how long they have been contributing and saving for retirement. Therefore, it is so important for younger individuals and families to ensure that retirement savings start with their first salary.”

He says when considering post-retirement, the 4% rule springs to mind, where you can withdraw 4% of your retirement savings in your first year of retirement and then adjust this amount for inflation in the following years.

“This approach offers you approximately an 87% chance of avoiding the depletion of your retirement savings over a retirement period of 30 years.

Morningstar’s latest State of Retirement Income 2024 report for the US retirement industry reveals that the “safe” starting withdrawal rate has decreased from 4% to 3.7%.

“Safe is considered a 90% success rate where your money does not run out, assuming a 30-year retirement period. This decline is attributed to equities posting the best 15-year period returns since 1970. Consequently, due to the recent robust market performance, valuations are high, which raises the likelihood that future returns may be lower.”

ALSO READ: Gen Zs have better opportunity for financially secure retirement

Consider risk of living longer now

He says it is now more important than ever to consider the risk of people living for longer than anticipated and how this should be approached before and after retirement. “Planning for retirement in the era of longevity requires a proactive and multifaceted approach.

“We should assume we may live longer than average and rather err on the side of caution by saving more, investing wisely and seeking professional advice. At the same time, employers and policymakers have a role in facilitating this process through plan design, incentives and systems that adapt to changing demographics.”

Wall points out that retirement planning is evolving into a lifelong process and those adjustments made now, such as working a bit longer, saving a bit more, diversifying investments and insuring against extreme outcomes, will pay off in the form of greater peace of mind in your later years.

“Ensuring financial sustainability for the added years of life is a challenge, but with prudent planning and supportive policy, people can enjoy their longevity dividend without fear of running out of resources.