Thursday’s repo rate cut is unlikely to bring much relief to cash-strapped consumers, as any savings will be offset by the rising fuel levy eating into their income.

Although the Reserve Bank’s decision to cut the repo rate by 25 basis points on Thursday is good news for economists, it will not shield South Africans from the burden of the fuel and sin tax levies introduced by Budget 3.0.

Neil Roets, CEO of Debt Rescue, warns that increased taxing of the workforce is not the answer and will put further financial strain on households, driving them to new depths of despair at a time when they are buckling under the weight of multiple unsustainable inflation-related living costs.

“The reality is that the finance minister’s decision to impose new tax measures will hurt lower-income families most, as they will bear a proportionally higher burden, forcing them to make impossible lifestyle choices with the little disposable income they have left.”

Before the South African Reserve Bank (Sarb) governor, Lesetja Kganyago, announced the repo rate cut this afternoon, economists polled by Reuters accurately predicted that the Bank would restart its repo rate cutting cycle this month, trimming the repo rate by 25 basis points to bring down the interest rate to 7.25% as the latest inflation data strengthens the case for monetary easing.

ALSO READ: Reserve Bank cuts repo rate thanks to lower inflation, stronger rand

Repo rate cut too small to matter for consumers

“While any cut in the repo rate benefits consumers, the change is simply not big enough to make any real difference in their lives, or to encourage growth in the economy. The impact on consumers will be minimal, as the 25 basis points cut will mean a tiny saving of R254 per month on a R1.5 million home loan and around R65 on a R500 000 car loan.

“Ultimately, a growing economy is the only solution that will slowly lift the weight of unsustainably high living costs from the shoulders of South Africans,” Roets says.

Inflation currently remains outside the Sarb’s target range of 3% to 6%, with the most recent data showing that consumer inflation was 2.8% in April, just slightly above March’s 2.7%. However, Roets points out, inflation on food and non-alcoholic beverages was 4.0%, the highest it has been since September 2024.

“Overall, inflation is still considered low, which would have been a strong incentive to cut the current repo rate. The exchange rate of the rand also remains a key factor in economic stability and would have influenced the MPC’s decision.”�

ALSO READ: Reserve Bank could cut repo rate on Thursday, but will it decide to?

Move to lower inflation target will affect repo rate

Kganyago is a longstanding advocate of shifting to a lower inflation target, arguing this would ensure South Africa is better placed to compete with its trading partners. He said earlier that a single-point target of 3% would be in line with South Africa’s peers and lead to lower interest rates in the long term.

However, his critics worry that reaching a lower inflation target will require tighter monetary policy that will impede growth and employment in a country with one of the highest jobless and poverty rates in the world.

On Thursday, Kganyago reiterated his view, saying that the Monetary Policy Committee (MPC) believes that the 3% scenario is more attractive than the 4.5% baseline and would like to see inflation expectations move lower, towards the bottom end of their target range. He also said the MPC will consider scenarios with a 3% objective at future meetings.

However, Annabel Bishop, chief economist at Investec, warns that a lower inflation target risks scuppering further interest rate cuts this year too. “With a change to the inflation target reportedly occurring soon this year, the Sarb has chosen to cut interest rates this month to avoid the limitation of doing so in the future but then could easily be at risk of needing to reverse the cut.”

ALSO READ: Salaries decreased by 2% in April, but higher than a year ago

Slow pace of repo rate cuts perpetuates debt trap

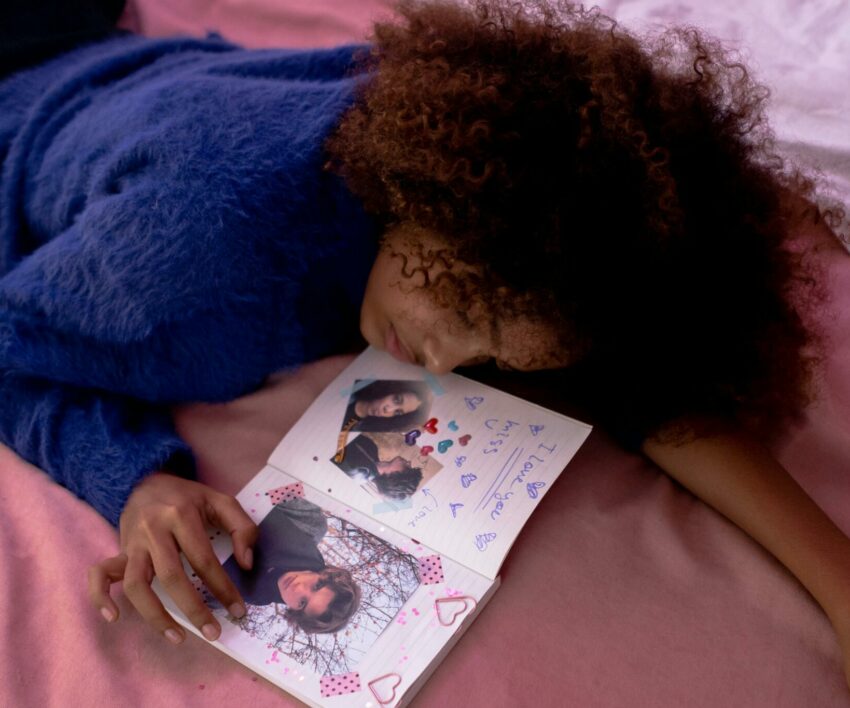

Roets says the reality is that the slow pace of the country’s repo rate reductions is perpetuating the debt trap that millions of ordinary South Africans find themselves in, leaving millions with no option but to survive on credit.

“This scenario has been escalating since the prolonged tightening cycle began towards the end of 2021, when the MPC raised the repo rate by a cumulative 4.75% between November 2021 and May 2023, taking it from 3.50% to 8.25%, the highest level since 2014. “

Against this backdrop, the latest Statistics SA General Household Survey, released on Tuesday this week, reveals shocking statistics about hunger in the country. According to the survey results, almost a quarter of South African households did not have enough food to eat last year.

This means that around 14 million people out of South Africa’s population of 63 million went hungry. Of those polled, 22.2% of households considered access to food inadequate or severely inadequate.

“South Africans need real financial relief. This is a glaring red flag that should be at the top of the list of concerns for government. Sadly, this means more and more South Africans are relying on their credit and store cards to put food on the table and keep the lights on.

“The likelihood is that they will default on debt and fall into an even deeper trap, as the cost of credit increases due to existing debt. This is most evident with big purchases like home and car loans.”