Could trade in a range of R17 to R19.50 to the dollar for the rest of 2024, says analyst.

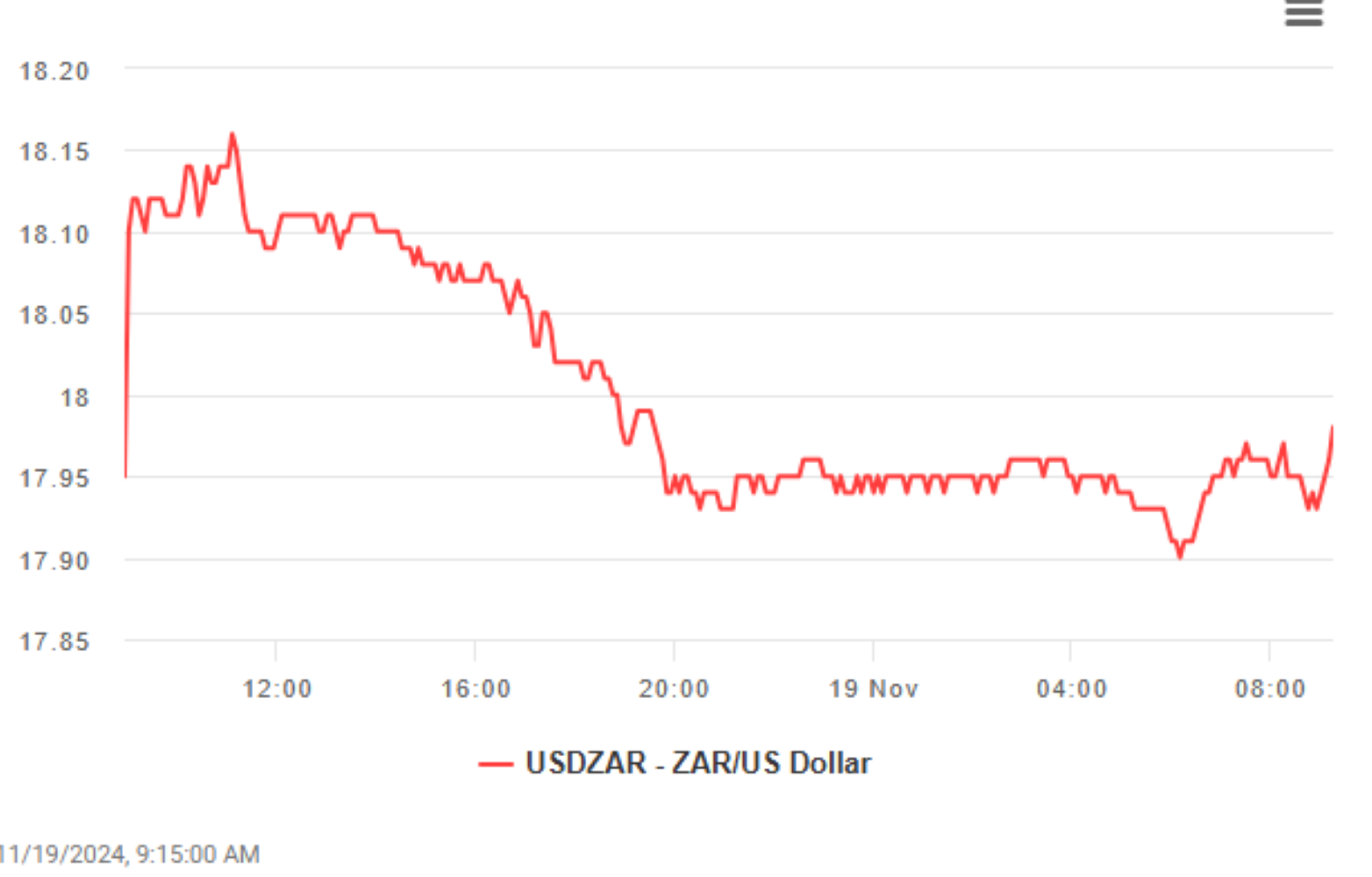

The rand has started the week on a firmer footing after weakening significantly against the dollar since Donald Trump’s re-election as US president on 6 November.

On Monday, the local currency strengthened more than 1.3% and broke through the R18 level, trading at R17.94 against the greenback.

Before the US election, the rand traded at R17.49 against the dollar, but it dropped to R18.64 on Friday – a level last seen in August.

The rand started strengthening over the weekend following S&P Global Ratings upgrading its outlook on South Africa from stable to positive.

ALSO READ: Trump victory: Trouble for the rand and Brics allies, joy for crypto

Currency forecast

JC Louw, CEO and portfolio manager at DFM Global, says the previous week’s rand weakness was an overreaction from markets following the decisive Trump win.

He expects the local currency to strengthen further this week. However, the rand seesaw could continue into December.

Louw says the rand could trade in a range of R17 to R19.50 for the remainder of 2024 – adding that South Africa’s “well-functioning” government of national unity, the attractive yields on 10-year government bonds, and the fact that local companies are not expensive count in South Africa’s favour.

Looking 12 to 18 months into the future, South Africa appears attractive relative to its peers, he says.

“Besides the fact that we are still on the grey list, there’s not much else that should weigh on investors’ minds.”

André Cilliers, currency strategist at TreasuryOne, also believes markets overreacted and foresees a period of “consolidation” until Trump’s inauguration in January 2025.

“I’m not saying the volatility is over, but the first reaction is done and dusted,” he notes.

ALSO READ: Rand still riding high but risks still close

On the one hand, US companies are expected to perform well under a Trump presidency with its growth agenda and promises of corporate tax cuts, but Cilliers says there are also concerns about a possible trade war if Trump implements his much-talked-about tariff increases.

Tax cuts and tariff policies are anticipated to strengthen the dollar.

Kevin Lings, Stanlib’s chief economist, wrote in his weekly market update that although the rand was the worst-performing emerging market currency, declining by 3.7% against the US dollar, it is still up 0.3% in the year to date.

“This is not a bad outcome considering the Emerging Market Currency Index is down 5.2% year-to-date and the EM commodity currency index is down a significant 8.9%.”

In the year to date, the dollar has gained 4.5% against the euro, bolstered by the decisive Trump victory, Lings notes.

This article was republished from Moneyweb. Read the original here.