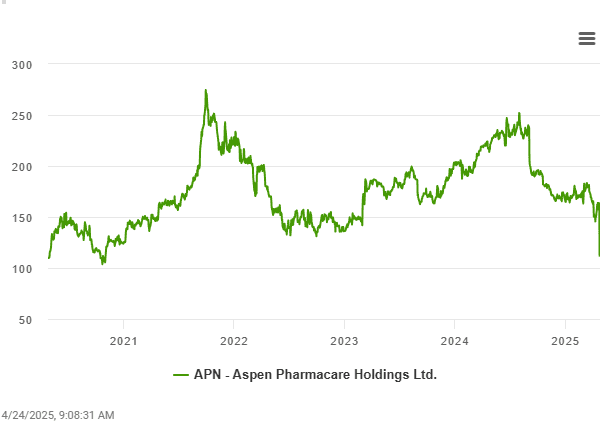

Share selloff saw stock plunge over 30% on Wednesday.

South African global pharmaceutical giant Aspen Pharmacare has found itself caught in Trump tariff-related market volatility, as it witnessed R22 billion being wiped off its JSE market capitalisation following a fallout related to a contractual dispute with an unnamed client linked to the manufacture of mRNA products.

The company flagged the dispute in a Sens filing after market close on Tuesday, confirming the financial impact could be as much as R2.77 billion in its core Aspen Manufacturing business for FY2025 alone.

The group is also facing further pressure from the Donald Trump administration following the US substantially cutting its healthcare aid globally, including treatment of HIV/Aids in SA.

Aspen was forced to do a hastily convened investor call, addressed by its group CEO and co-founder Stephen Saad, at 8am on Wednesday morning in the wake of the dispute. However, it was before markets opened and failed to curb a massive selloff in the company’s shares.

The stock closed at R112 a share, a plunge of 30.71% on the day. This is its lowest point in almost four-and-a-half years.

“It goes without saying that industries across the world are experiencing extreme volatility and uncertainty. This is reflected in daily prices – daily price swings in equities, commodities and currencies,” Saad said.

“The pharmaceutical industry is no different, [but] it also has an elevated risk profile … We in global pharma expect to be soon impacted by tariffs to be imposed by the US administration,” conceded Saad.

“Further tariffs, the retaliatory tariffs that might be imposed by other countries in response [to the US] can’t be ruled out … Tariffs and even the threat of tariffs have already changed market behaviour across the industry,” he said.

“There’s a clear indication that all territories need to take greater responsibility for their [own] health and dependence …

“This is going to be challenging in some of our regions, particularly those that are reliant on US-sponsored agencies and other global funders who’ve cut their global funding,” added Saad.

ALSO READ: Aspen to stop local vaccine production in Gqeberha as orders dry up

Contractual dispute

On the dispute, Aspen said the details are subject to contractual confidentiality, but the matter “relates to a manufacturing and technology agreement with a contract manufacturing customer for mRNA products”.

“As a consequence, shareholders are advised that normalised Ebitda [earnings before interest, taxes, depreciation and amortisation] from the Manufacturing business for FY2025 in constant exchange rate [terms] will potentially be R2 billion lower than last guided,” the group noted in its Sens filing.

Aspen said that depending on the outcome of the dispute, Ebitda from the Manufacturing business for its current financial year to the end of June 2025 could be less than 50% of that reported in FY2024. The group will release its full-year results in September.

“In addition … an impairment of R770 million in respect of related technology could also arise in FY2025,” it said.

While Aspen did not specifically mention the company with which the dispute had arisen, it is likely an American giant considering the comments lower down in its Sens statement.

“It really did come from left field” and management wasn’t aware of the dispute until “just a few weeks back,” Saad said on Wednesday’s investor call.

He added that the dispute relates to Aspen’s production facility in France, and that it has “a direct impact on the profitability” of the unit. The contract was on take-or-pay terms, he noted.

“This development is clearly a significant disappointment, exacerbated by the loss of the value of our investment we have made to access the mRNA technology,” said Saad.

ALSO READ: Trump tariffs’ seesaw impact on Southern Africa

Impairment

The possible R770 million write-off was “also subject to the dispute,” Aspen’s group CFO Sean Capazorio said, adding there is a potential of losing access to the mRNA technology’s intellectual property.

Aspen has assigned some capacity at the French factory toward producing GLP-1 obesity and diabetes drugs, but it still has as much as 120 million units of annual available capacity.

Aspen’s “absolute highest priority” is to get a return on its manufacturing assets, said Capazorio. “Until they perform, no one is going to ascribe value to them.”

The company is already engaging third parties about using the facilities, and a few new contracts on the site “can have a material impact on group profitability,” Saad added.

While confident Aspen can replace the contract and increase volumes through the facility, he wouldn’t commit to timings for new agreements.

JPMorgan Chase & Co slashed its recommendation on the stock to underweight from overweight, cut the target price to R128 and trimmed the forecast for Ebitda for the 2026 financial year by about 20%.

Absa Bank analyst Rendani Magalela said consensus downgrades could continue.

Aspen’s “foundations are all intact and opportunities remain, although not immediate,” Saad said.

Recent geopolitical turbulence from US tariffs and aid cuts, while disruptive, “have started galvanising actions from those who were previously indecisive,” he said.

* With additional reporting from Bloomberg.�

This article was republished from Moneyweb. Read the original here.