MicroFinance South Africa urges urgent reform to credit regulations to curb illegal lending.

MicroFinance South Africa (MFSA) is urging immediate changes to the country’s outdated credit regulations, warning that current lending fee caps are driving vulnerable borrowers into the hands of unregistered lenders and threatening the future of formal credit providers.

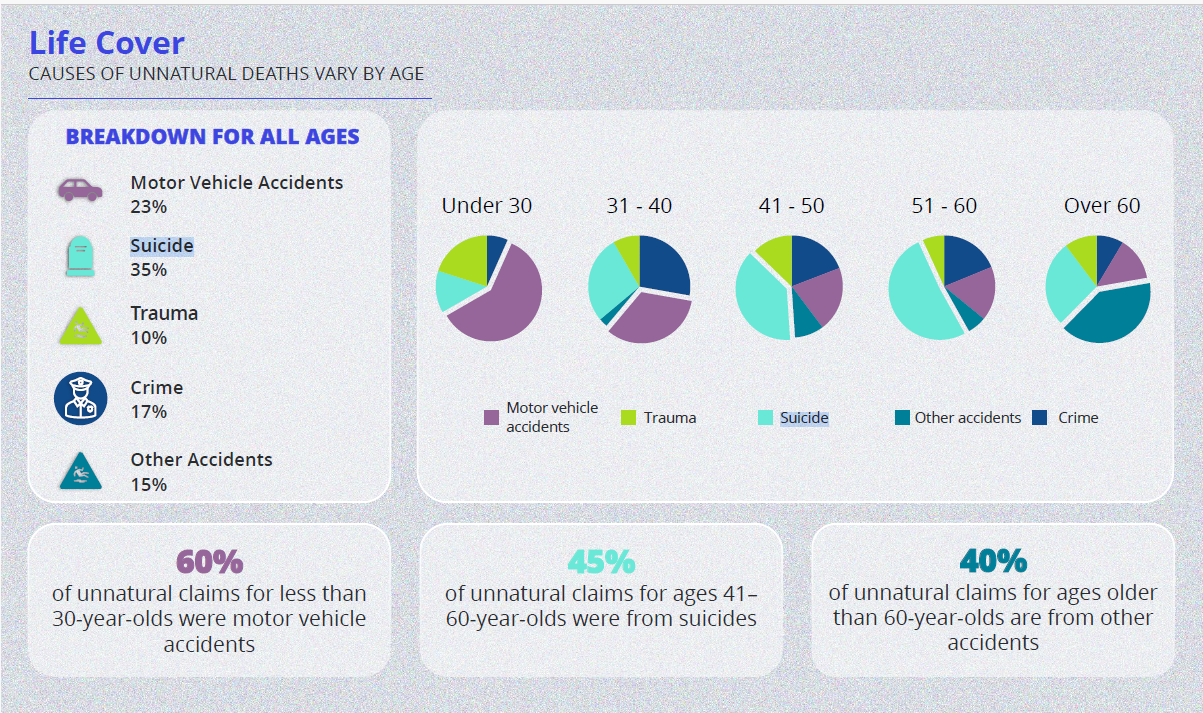

A study conducted by 71point4 Consulting reveals that nearly 60% of borrowers who were denied formal credit turned to informal lenders, known as mashonisas, who often charge interest rates of up to 50% per month and use coercive collection practices such as seizing bank cards and ID documents.

“When regulated credit is unavailable, people don’t stop needing finance, they turn to the shadows,” says Leonie van Pletzen, CEO of MFSA.

The research found that over 40% of borrowers sought loans for developmental purposes such as education, starting small businesses, or improving housing.

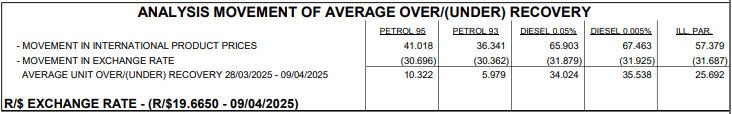

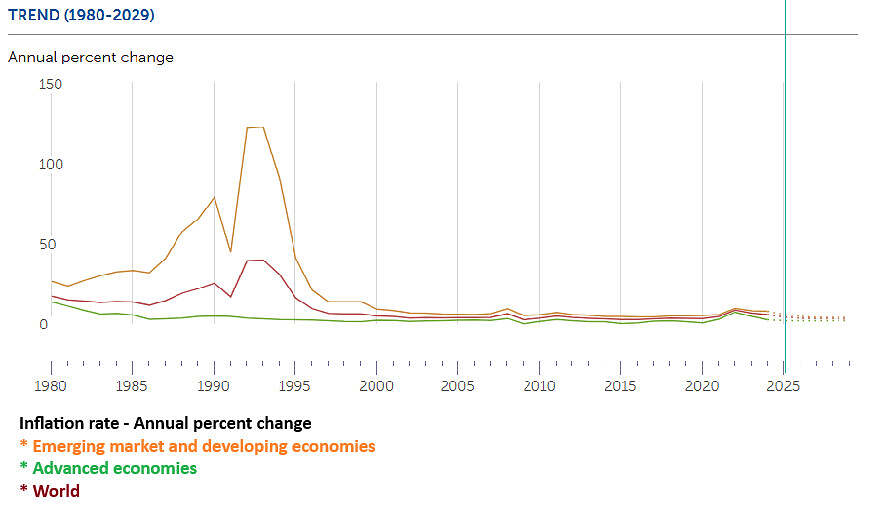

However, the rigid price caps under the National Credit Act have restricted the ability of formal lenders to serve this growing demand, especially among low-income and rural borrowers.

ALSO READ: Consumers warned about 4 000 credit providers with lapsed registration: Here’s how to check

Van Pletzen stresses that fairly priced credit plays a crucial role in enabling financial independence.

“Fairly priced credit unlocks opportunity,” she says.

“For an entrepreneur, it means buying stock. For a parent, it means paying school fees. For a household, it means fixing a leaking roof. Development finance transforms lives and communities, but only if the formal credit market is allowed to function sustainably.”

According to the study, regulations unchanged since 2015 have resulted in more than 70% of loan applications being declined by formal lenders, disproportionately affecting first-time and rural borrowers. Without inflation-linked adjustments to lending fees, MFSA warns more lenders may leave the market, further limiting access to safe, affordable credit.

“These reforms are not just about sustaining the microfinance industry,” says Van Pletzen. “They’re about ensuring that families and small businesses can access the credit they need to thrive.

“If we fail to act, we risk driving more borrowers into the hands of illegal lenders, with devastating social and economic consequences.”

ALSO READ: Beware of loan sharks in difficult economic times for consumers

MFSA is calling on lawmakers, regulators, and industry players to prioritise this issue during ongoing financial inclusion discussions. The association believes modernising credit pricing rules could strengthen the microfinance industry and support broader economic participation.

“We cannot build an inclusive economy while ignoring the financial realities of those most in need,” says Van Pletzen.

“Development finance is the engine of grassroots economic growth. It’s time we ensured that fair credit pricing reflects today’s economic realities and empowers communities to build better futures.”

This article was republished from Moneyweb. Read the original here.