Treasury and the GNU will have a big job to change Budget 2025 into a budget all parties approve of, especially if the VAT increase is off the table.

The postponement of Budget 2025 to 12 March does not pose any immediate economic risks for South Africa, as Section 29 of the Public Finance Management Act gives some time for a new budget to be tabled and allows spending to continue until a budget is passed.

Lisette IJssel de Schepper, chief economist at the Bureau for Economic Research (BER), says Budget 2025 week in South Africa was always going to be eventful, but the postponement on Wednesday was unprecedented.

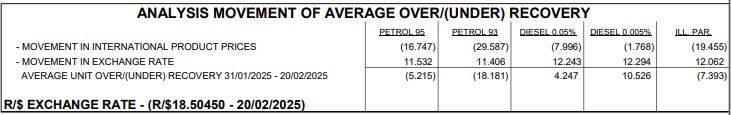

“The initial uncertainty about what caused the 11th-hour delay and what it would mean for the way forward led to a depreciation of the rand exchange rate, while bond yields ticked up. Both have recovered since, with the rand actually trading stronger than pre-budget levels. The 10-year government bond yield was still somewhat higher compared to last week.”

She says it will be a daunting task to put together a ‘new’ Budget 2025 by 12 March, especially one that would appease all partners in the government of national unity (GNU), but it makes sense that their input should be considered.

IJssel de Schepper says the National Treasury pulled out the big bazooka of a 2% increase in the VAT rate to keep its debt stabilisation plan largely on course, but while the Budget 2025 showed that this means the debt ratio will still stabilise this year (though slightly higher than before) and more funds will be shifted towards infrastructure investment and protecting frontline services and the poor, it will come at a significant cost to the taxpayer.

ALSO READ: What Budget 2025, although not delivered, shows – economist

Potential VAT increase was anticipated to fund BIG or NHI

“Our suspicion has always been that a VAT hike would potentially be used to fund a Basic Income Grant (BIG) or the rollout of National Health Insurance (NHI), given Treasury’s emphasis that it would need a revenue source to fund these expenditures.”

“If the aborted budget had been tabled (and subsequently passed), that tax wiggle room would have all been used up and even then, there was still nothing new in the budget for Transnet or to permanently fund the social relief of distress (SRD) grant as the basis of sustainable basic income support as promised by President Cyril Ramaphosa in his State of the Nation Address.”

She points out that significant unfunded expenditure risks therefore remained. “It is important to highlight that compared to Budget 2024, which Treasury described as ‘striking a balance’ between R15 billion worth of tax measures and R80.6 billion in expenditure cuts over the medium term, the aborted 2025 Budget would have imposed R182.4 billion of net new tax measures over the medium term but no new expenditure cuts.”

The additional revenue will allow Treasury to ease the spending brakes: the non-budget has consolidated non-interest spending growing by 0.9% on average annually in real terms over the medium term, whereas previously, the plan was for it to contract by 0.5% a year on average, IJssel de Schepper says.

ALSO READ: Budget 2025: Was the decision to increase VAT by 2% such a bad idea?

Budget 2025: a shift in burden of adjustment

“This represents a looser fiscal stance and while this is being achieved without a meaningful deterioration in the country’s debt metrics, a shift in the burden of adjustment. Whereas previously, the brunt of austerity was felt in frontline government education and health services, it has now moved onto all taxpayers through a higher VAT rate, but especially onto higher-income earners through the failure to provide fully for bracket creep for the second year in a row or adjust medical tax credits.”

Where would all the new money have gone? IJssel de Schepper says the attempted Budget 2025 added a net R173.3 billion in new money to the 2024 budget baseline over the next three years. “Most of it (R75.6 billion) would have gone towards bolstering frontline services in education and healthcare.”

“The second largest share (R58.5 billion) would have allowed for above-inflation increases in social grants to help offset the impact of the VAT hike on the poor and extend the SRD grant for another year.”

ALSO READ: Budget speech: VAT increase decision not made by someone who knows hunger

Implications of Budget 2025’s R35.2 billion for SRD grant

However, she points out that the allocation of R35.2 billion to the SRD grant would have meant keeping the number of grant beneficiaries down to about 10 million, despite over 18 million beneficiaries being eligible and the benefit pegged at only R370 a month. These two features were rejected by the courts and are currently subject to an appeal by government.

IJssel de Schepper says infrastructure would have received the third-largest share (R46.7 billion) of the new money, driven mostly by higher allocations to large water and transport projects, including funding for passenger rail and disaster reconstruction.

“Finally, the new three-year public sector wage agreement, which grants an above-budget 5.5% increase in the first year and holds increases to inflation in the other two years, would have also absorbed a sizeable R23.4 billion chunk of the new money.”

“The rest of the new money would have been used to fund the SA National Roads Agency (R16.6 billion), the early retirement plan (R11 billion), troop deployment in the Democratic Republic of the Congo (R5 billion) and public employment programmes (R4.6 billion).”

ALSO READ: Budget speech: Why Godongwana wanted a VAT increase of 2%

Discussions on Budget 2025 will be one of trade-offs

She expects that from a practical perspective, the discussion among GNU parties and Treasury will therefore likely turn into one about trade-offs. “If they are adamant about not increasing VAT, there is no money for the ‘new’ expenditures.”

“What will they then be willing to forfeit, or where else could the money be found? It is also important to highlight that Treasury’s assumptions about the revenue that the VAT hike could bring in are, in our view, optimistic.”

ALSO READ: Budget speech: ANC ministers also opposed VAT hike, Godongwana slams DA’s ‘identity crisis’

Eskom getting a smaller piece of the pie in Budget 2025

Roy Havemann, senior economist at the Impumelelo Economic Growth Lab at the BER, also looked at how Eskom’s debt would be restricted in Budget 2025 and if there would have been a bailout for Transnet.

He points out that Treasury announced significant debt relief for Eskom in Budget 2023 to strengthen its balance sheet, restructure the business and invest in necessary maintenance and indicated that over the next three years, government would provide Eskom with debt relief amounting to R254 billion in three tranches.

At the time, he says, the amounts represented what Treasury estimated was Eskom’s full debt settlement requirement over the next three years. Treasury decided to simplify the agreement in consultation with Eskom, but this was before the lower-than-expected Nersa tariff decision, which implies a risk.

“By 31 March, government will have advanced R14 billion in debt relief to Eskom. This is a reduction of R4 billion from the original amount projected up to this point, owing to the utility’s failure to meet the deadline for disposing of the Eskom Finance Company.”

ALSO READ: Budget 2025: What business wants from the minister of finance

No further support for Eskom?

“Under the terms of the arrangement, the remaining elements are a R40 billion advance and a R70 billion debt takeover scheduled for 2025/26. The final R70 billion debt takeovers will now be replaced with two advances totalling R50 billion: R40 billion in 2025/26 to redeem debt maturing in April 2026 and R10 billion in 2028/29 for debt maturing in May 2028.”

He points out that over the five-year period government will have provided Eskom with loans to the value of R230 billion to assist the utility in repaying its debt, about R24 billion less than projected at the outset, reducing the gross borrowing requirement.

“In accordance with the original agreement, the debt relief provided to Eskom will be converted into government equity over time and Treasury officials signalled in the question-and-answer session that they do not anticipate further support.”

ALSO READ: Transnet needs R51 billion to restore rail and infrastructure network

No pie for Transnet, although it needs R46 billion?

Haveman says in contrast with what the Lab expected, no direct support in terms of debt relief or balance sheet support was provided for Transnet, with Treasury rather opting to support the entity by helping with critical infrastructure projects, such as the expansion of the land‐side container terminal in Cape Town.

However, he says, the R2 billion Budget Facility for Infrastructure is not new. “Improved rail volumes are attributed to the support of Operation Vulindlela in the Budget document, with the entity making ‘some progress in implementing its recovery plan’.

“This is, indeed, yet another risk for the March budget. Our estimate is that Transnet needs around R46 billion in this fiscal year.”