‘A thorough financial audit can now identify areas of strength to leverage and weaknesses to address, ensuring businesses are optimally positioned to thrive.’

It is essential for businesses, particularly small and medium-sized enterprises (SMEs), to conduct a comprehensive financial health check as the year reaches its midpoint.

This financial health check is important for navigating the current economic climate and ensuring sustained growth in the second half of the year.

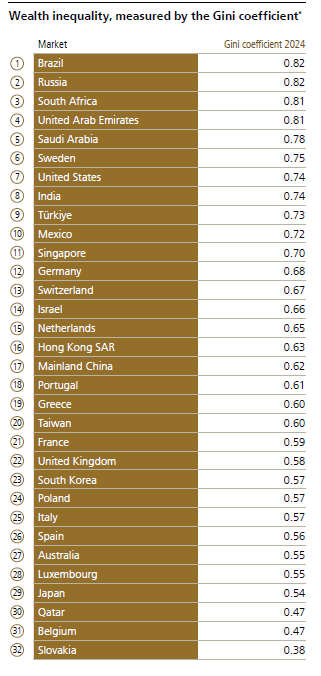

Garth Rossiter, Chief Risk Officer at Lula, said the economic landscape continues to present a mix of challenges and opportunities for small to medium-sized enterprises (SMEs).

ALSO READ: Political events happening in June expected to affect South African SMEs

Macroeconomic outlook for SMEs

Rossiter said that the macroeconomic outlook in which SMEs operate is improving.

“The RMB/BER Business Confidence Index hit a five-year high in Q4 2024, while consumer confidence rebounded to pre-pandemic levels. Annual inflation has dipped below 3%, and the consensus appears to be that inflation will remain at lower levels for 2025; this will support the argument for lower interest rates,” he added.

He highlights that the power supply is more stable than it was in the previous year, and consumer spending is showing signs of recovery. “Despite lingering higher operating costs for businesses, the significant drop in inflation and declining interest rates make the future look brighter than it’s been in recent times.”

Access to finance for SMEs

Rossiter notes that access to finance remains a significant hurdle for many SMEs, as traditional lending models often fail to meet the needs of smaller and early-stage enterprises.

The global geopolitical events and domestic logistical challenges continue to impact supply chains and overall confidence.

“The agility and resilience of South African SMEs are consistently put to the test,” he added.

Tips to check if your business is ready

“The halfway mark of the year is not just a calendar event; it is a critical juncture for self-assessment. A thorough financial audit can now identify areas of strength to leverage and weaknesses to address, ensuring businesses are optimally positioned to thrive,” said Rossiter.

ALSO READ: Challenges and opportunities for SMEs in 2025

To measure SMEs’ financial health and strategies for the second half of 2025, Rossiter recommends the following:

1. Revisit budget vs actuals: Compare your year-to-date income and expenses against your initial budget. Identify significant variances. Are revenues lower than projected? Are costs, particularly those influenced by inflation like fuel and utilities, higher than anticipated? “Adjust your budget to reflect current realities and future projections.”

2. Assess cash flow: Analyse your cash inflow and outflow patterns. Are customer payments timely? Are you managing supplier payments efficiently? Calculate your cash flow runway – how many months can your business operate with its current cash reserves?

“In South Africa’s environment, where payment delays can be common, robust debtor management is crucial. Consider offering early payment discounts or implementing digital invoicing to accelerate receivables.”

3. Review key financial statements:

A. Income statement: Examine your gross and net profit margins. Are they shrinking? This could indicate rising input costs or ineffective pricing strategies.

B. Balance sheet:Understand your assets versus liabilities. Are your debt levels manageable, especially with current interest rates?

C. Cash flow statement: Provides a clear picture of how cash is generated and used within your business. Look for trends and potential bottlenecks.

4. Evaluate debtor days and working capital:

A. Debtor days: How long does it take for your customers to settle their accounts? High debtor days can severely impact liquidity.

B. Working capital ratio: Do you have enough short-term assets to cover short-term liabilities? This ratio is vital for operational liquidity. Adjust for any seasonality in your business.

5. External conditions:

A. Interest rates: With current prime lending rates, assess the impact on existing loans and any plans for new credit. Explore fixed-rate options if suitable.

B. Load shedding contingencies: Although greatly improved, consider any residual costs associated with power backup solutions (e.g., generators, UPS maintenance) and potential productivity losses that still impact your operational expenses and break-even point.

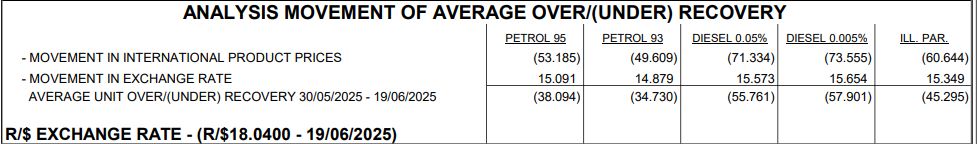

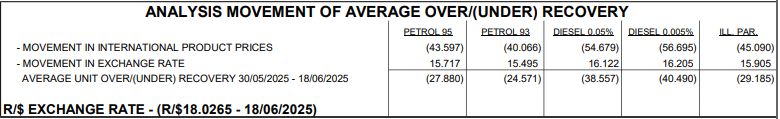

C. Inflation and rand volatility: How are these impacting your procurement costs, pricing, and profitability?

6. Re-evaluate goals and forecast: Based on your financial review, are your initial business goals for the year still realistic? “Adjust your targets and create a rolling forecast for the next six months, incorporating anticipated revenue, expenses, and capital needs. This foresight allows for proactive decision-making.”

NOW READ: Entrepreneurship a solution to youth unemployment – but there are challenges