Personal loans and credit cards have a maximum allowable interest rate in South Africa.

Although we all watch the increases and decreases in the repo rate with eagle eyes, few consumers know that the rate of interest on their personal loans must be within legal limits.

Despite the relief of no VAT increase and an inflation rate below the South African Reserve Bank’s target range, many South African consumers still rely on credit to get through the month.

Unfortunately, the South African Reserve Bank (Sarb) expects inflation to tick up to an average of 3.6% in 2025 and continue increasing to 4.5% in 2026. This, combined with global uncertainty, means the Sarb is unlikely to make any further rate cuts, Benay Sager, chairman of the National Debt Counsellors’ Association, says.

“Add increased electricity costs, personal income tax bracket creep and ever-increasing service delivery costs to the mix of diminishing spending power and it is understandable why so many consumers will continue to depend on credit,” Sager says.

ALSO READ: What you need to know about personal loans

Important to understand how much interest you pay

In this context, he says it is important for consumers to understand how much interest they pay on credit-related products such as personal loans and credit cards. “It is even more important to compare this to the maximum allowable interest rate to make sure you are charged fairly.

“Unlike other countries, in South Africa the maximum allowable interest rate is regulated by the National Credit Act and the maximum allowable interest rate depends on the type of credit agreement and the date the credit agreement was signed.”

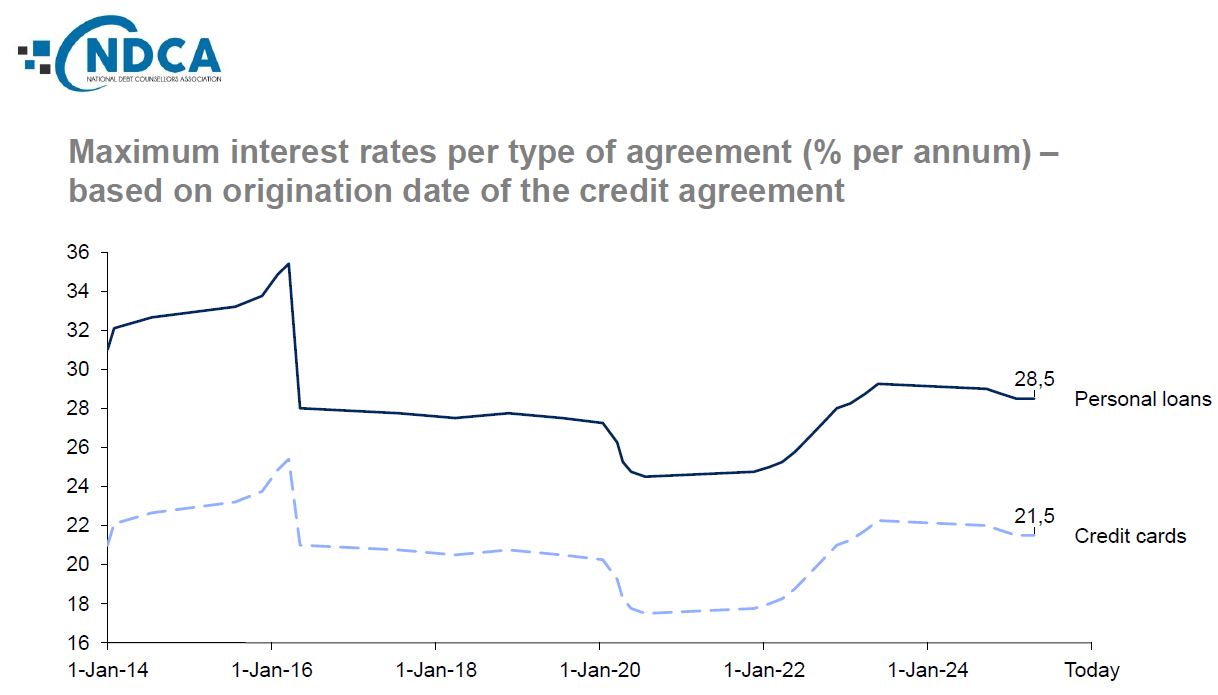

For South Africans, the two most important types of credit agreements are personal loans and credit cards. This table indicates the maximum interest rates allowable for each and how these have varied since January 2014”

Sager points out that there was a significant change in November 2015, when the regulatory calculations for maximum interest rates were changed.

“This change lowered maximum allowable interest rates and has generally been positive for consumers. Since both personal loan and credit card maximum allowable interest rates depend on the Sarb’s repo rate, they both benefited from rate cuts during Covid.

“On the other hand, the repo rate steadily increased since 2022, resulting in corresponding maximum allowable interest rates for personal loans as well as credit cards.”

ALSO READ: What you should know about loans

Examples of interest on personal loans

In 2024, the average personal loan amounted to just more than R30 000. Assuming the loan term, the time a consumer has to repay the loan, is one year at a rate of 28.5%, they would pay R8 550 in interest. In South Africa loan terms can range from three to 84 months.

Average credit card balances are R24 000 per month, attracting approximately R430 in interest per month, depending on how the credit card provider calculates the interest and assuming the consumer pays off the full balance every month. This amounts to R5 160 in interest per year.

“While these are illustrative calculations, they indicate that the amount of interest you pay for these forms of credit is significant. It is why it is important to compare interest rates before signing a credit agreement and be aware of the maximum allowable interest rates.

“Although there’s a global trend towards this, many people still accept the first approved loan without considering they may be able to get a better deal,” Sager says.

ALSO READ: FSCA fines African Bank R700 000 for misleading advertising [VIDEO]

Check how much interest you should pay

He says consumers who are unsure whether they are paying too much interest or what the maximum rate is should check with an NDCA member. A list of members and their contact details can be found here.

Members of the association can also help people who are struggling to repay debt.

“Renegotiating interest rates on debt is one of the most powerful tools in a debt counsellor’s arsenal. Under debt counselling, rates for unsecured debt can be reduced to near 0% if necessary to allow consumers to pay back expensive debt faster.”

Interest on vehicle debt and balloon payments can also be renegotiated and the period extended, Sager says.