This week saw the release of the latest employment figures, as well as the consumer confidence index and producer price inflation.

The most worrying economic data released this week was undoubtedly the consumer confidence index that dropped by 14 points to -20 during the first quarter of 2025. On the other hand, gold reached a new high thanks to investors looking for safety.

With continuing geopolitical tension gold was in the spotlight again, with the metal surging to a record high on Thursday as investors sought safety. Brent crude oil also gained, rising 2.6% for the week, supported by US tariff threats, particularly secondary sanctions targeting buyers of Venezuelan oil.

Tracey-Lee Solomon, economist at the Bureau for Economic Research (BER), says tariffs are affecting short-term prices and unsettling long-term investment and that despite US president Trump’s pledge to increase output and lower prices, his trade policies may have the opposite effect.

Bianca Botes, director at Citadel Global, says gold extended its gains to reach a fresh high of $3,059.63/ounce on Thursday, following an equally impressive previous week. The precious metal has climbed over 16% over the past year, amid market volatility and geopolitical tensions, rewarding investors seeking alternative asset protection.

“Gold reached new highs as Trump’s recent announcement of a 25% tariff on imported cars sustained trade concerns.”

She also notes that Brent crude oil climbed to $74.02/barrel on Thursday, holding near Wednesday’s four-week high of $74/barrel, driven by persistent concerns over tightening global supply.

ALSO READ: Absa foresees economic growth of 2.1%, but Trump and budget can disrupt it

Rand weakens due to US dollar strength

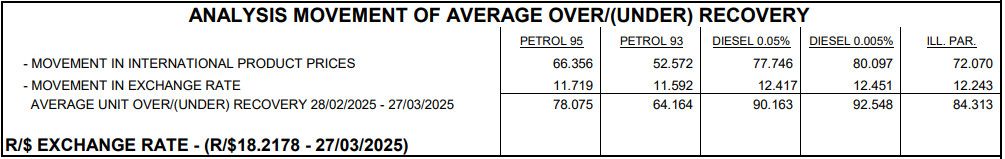

Solomon says the rand weakened by 0.6%, primarily due to broad US dollar strength and also slipped 0.1% against the euro and 0.5% against the pound sterling.

According to Botes, the rand traded between R18.10/$ and R18.33/$ this week, closing at R18.33/$ on Friday. She also points out that Reserve Bank Governor Lesetja Kganyago said last week the repo rate was left unchanged due to “extreme uncertainty”, which includes the rand exchange rate.

Isaac Matshego and Busisiwe Nkonki, economists at the Nedbank Group Economic Unit, say the uncertainty over the impact of the evolving trade war on US and world trade remained the dominant theme in foreign exchange markets over the past week.

“The US dollar stabilised somewhat over the past two weeks after coming under considerable pressure from its highs in mid-January. Despite the dollar’s mild pullback, the rand strengthened slightly, trading around R18.15 on Friday morning.

“The local unit benefitted from a wait-and-see attitude within the markets ahead of the US’s anticipated introduction of reciprocal tariffs next week. It also drew support from the firm gold price.”

ALSO READ: This is what proposed 2% VAT hike did to consumer confidence

Huge drop in consumer confidence

The FNB/BER Consumer Confidence Index plunged from -6 to -20 index points in the first quarter of 2025. The 14-point decline matches the sharp drop seen in the first quarter of 2023 when South Africa entered stage 6 load shedding for the first time.

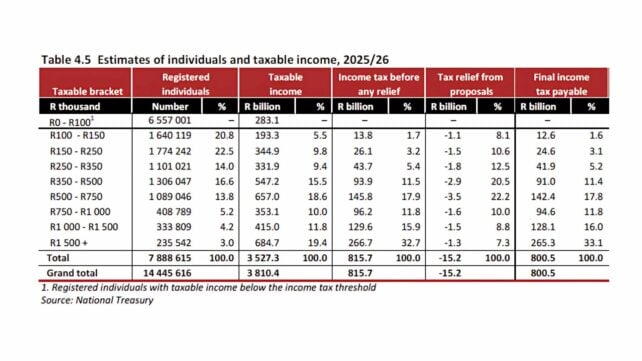

Katrien Smuts, economist at the BER, points out that the fieldwork for the survey began shortly after the postponement of the February budget speech, when news broke of the finance minister’s (ultimately aborted) proposal to increase VAT by 2%. “The prospect of higher taxes, whether through a VAT hike or further personal income tax bracket creep, likely rattled consumers.”

Mamello Matikinca-Ngwenya, Siphamandla Mkhwanazi, Thanda Sithole and Koketso Mano, economists at FNB, say the reduced VAT increase and broadening of zero-rated food items as well as above-inflation social grant increases, could provide support for improved sentiment in lower-income households.

“However, higher-income groups still face bracket-creep, as well as worsened relations between South Africa and the United States. Since higher-income households are more sensitive to policy issues, these developments may continue to weigh on their sentiment.

“Understandably, a higher tax burden and trade distortions should weigh on economic activity and household finances. In line with this, households have become more pessimistic on the outlook and still do not consider the current time as appropriate for buying durable goods.”

ALSO READ: Civil contractor sentiment declines further

Producer price inflation eased

Producer Price Index (PPI) inflation for final manufactured goods came in below expectations in February, easing to 1% from 1.1% in January. PPI inflation remained subdued in recent months, supporting a favourable near-term outlook for inflation.

Matikinca-Ngwenya, Mkhwanazi, Sithole and Mano say lower petrol and diesel prices have been a key factor holding down annual PPI inflation. “However, a point of concern is the PPI for electricity and water, which accelerated to 10.8% in February from 10% in January.

“Given the importance of these inputs in manufacturing, sustained increases could likely place upward pressure on producer and consumer prices this year.”

Matshego and Nkonki say smaller contractions in petrol and diesel prices and an acceleration in the increase of chemical products were offset by a larger contraction in the other category and a moderation in the prices of rubber and plastic products.

“A gradual uptick in producer inflation is likely in 2025, driven by the normalisation in the base, with food and fuel prices taking the lead. Food prices will be affected by fading global disinflation, with further upside from the unfolding trade war, which threatens global food prices and the rand. We forecast PPI to average around 3.3% in 2025, slightly up from 3% in 2024.”

ALSO READ: SA economic outlook positive, but key risks threaten economic growth

Leading business cycle indicator rises in January

The composite leading business cycle indicator rose by 0.9% in January 2025, with four of the 10 available component time series improving, while five declined and one remained unchanged. The largest positive contributions came from an acceleration in the six-month smoothed growth rate in new passenger vehicle sales and an increase in the number of residential building plans approved.

The most notable negative contributors were a decline in the average hours worked per factory worker in the manufacturing sector and a slowdown in the six-month smoothed growth rate of job advertisements, signalling continued caution in hiring.

Matikinca-Ngwenya, Mkhwanazi, Sithole and Mano say the continued weakness in manufacturing is a concern, although not unexpected as it aligns with the persistently downbeat sentiment reported in the Absa Manufacturing Survey. “Overall, while the January uptick is welcome, it does not yet point to a broad-based strengthening of the business cycle.”

ALSO READ: Quarterly Employment Statistics: Fourth quarter adds only 12 000 jobs

Quarterly employment statistics not that great

Employment data for the fourth quarter was not that great, although it showed a modest increase in job creation. The net increase in employment, lower interest rates, income growth and the boost from the two-pot retirement fund withdrawals supported consumer spending, which accelerated by 1% in the fourth quarter from 0.4% in the third quarter, Matshego and Nkonki say.

Mamello Matikinca-Ngwenya, Siphamandla Mkhwanazi, Thanda Sithole and Koketso Mano noted that earnings were 30% higher than in the fourth quarter of 2019, beating inflation of 26.9%. “We anticipate that growth could approach 2% over the next couple of years, highlighting gradual improvements in the operating environment.

“The emphasis on infrastructure and improved service delivery in the budget is encouraging, but implementation risks must be reduced. This would not only support cyclical growth, but embed higher longer-term growth by raising productivity, encouraging capacity investment and employment creation.”