How our mothers and grandmothers worked with money shows us the lessons we can teach our children in a different world today.

It is the time of year that we celebrate our mothers and grandmothers and the lessons they taught us that we still use today.

This is also true of the money tricks they taught us. Which we can, in turn, teach our children.

Therèse Havenga, head of business transformation at Momentum Savings, says this year Mother’s Day reminded her that the early money lessons she learnt did not come from textbooks or formal training but from the women in her family.

“They did not have flashy financial tools or expert advice, but they knew how to stretch a rand until it squeaked. Their approach was simple: save smart, live frugally and make the most of what you already have.

“Watching my mom in action made it real – her quiet everyday choices shaped a kind of financial wisdom that was practical, powerful and worth passing on.”

ALSO READ: Educate your children about money – here’s how

My grandmother’s money trick: preserving

Havenga says her grandmother was the queen of preserving.

“Canning was not just a hobby but a way to make sure nothing ever went to waste. She bottled anything she could lay her hands on.

“She taught me that having something set aside (especially something homemade) was a form of security, a quiet kind of wealth.”

On the other hand, her mother’s savings superpower was her sewing machine.

“Growing up, most of my clothes were homemade. Shop-bought outfits were rare, but I never felt I was missing out. If anything, it gave me a chance to stand out with one-of-a-kind pieces stitched with love.

“Beyond that, she was a budgeting wizard. She used the envelope system religiously, dividing the weekly cash into labelled envelopes for ‘fruit and vegs’, ‘milk and bread’, ‘church’ and ‘parking”, as well as for the occasional tuck shop treat.”

Havenga says her mother bought in bulk when it made sense, reused and repurposed literally everything and had a way of turning leftovers into new meals like magic.

“Nothing ever went to waste in our home. Not food, not fabric and not time.”

ALSO READ: Financial literacy at an early age is key for success later

Money advice that shaped a generation of women

She points out that financial advice does not always come wrapped in spreadsheets or seminars.

“Sometimes, it comes in the form of bottled peaches, hand-sewn dresses or the quiet pen-and-paper budgeting at the kitchen table. They shaped us as a new generation of women, teaching us the value of smart, mindful saving.

“Now that I manage my own home and raise a daughter of my own, I realise just how much I absorbed during those years. The biggest money lesson I hope to pass on in turn is what I learnt from our actuaries, that your money can work harder than you do.

“You do not have to hustle every hour or reinvent the chicken broth to save. With time on your side and a bit of discipline, your money can grow quietly in the background, doing the heavy lifting for you. But start early, as the more time your money has, the less effort you will need later.”

Havenga uses this example to illustrate what she means: If you start saving R1 000 per month when you are 23, increasing the savings amount by 10% per year and assuming growth of 10% per year, you can save a healthy R135 000 by the time you turn 30.

She says this can be a 10% deposit on a R1.35 million home, and in the end, your house will cost you R333,000 less, and the fees will cost you, say, R17,200. That is a lot of money to score.

“The best example of the influence of time is retirement savings. The earlier you start, the more time your money has to work for you. The longer you wait, the more you will have to put away to achieve the same growth.”

ALSO READ: South Africa’s retirement time bomb is ticking…

Example of saving money for your retirement

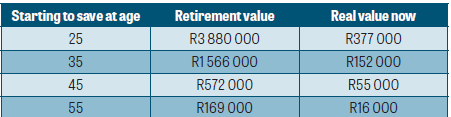

The table shows what happens if you start saving R1,000 per month at the ages below, up to the age of 65. (Assume that growth is 11% per year and inflation 6% to calculate the real value.)

She says the “real value” column is a big word to indicate what your retirement value would be worth today. It indicates that almost R4 million sounds like a lot of money, but 40 years from now, it will not buy you much.

“My story to my daughter is not as romantic as what I learnt from my mother and grandmother, but I believe it also shows the best gift from mother to daughter is a shared story on how to make every cent count.

“In turn, I hope that over time my daughter will show the quiet strength that comes from managing our money with intention.

“It is something she would have learnt not only from me, but also from my formidable mother and grandmother.

“To me, that would be the greatest Mother’s Day gift of all.”