‘We need incentives encouraging entrepreneurship, supporting business growth, and attracting international investment.’

While South Africans are unhappy about the 0.5% Value-Added Tax (VAT) increase for 2025 and the additional 0.5% added in 2026, FNB believes that not increasing fuel levy and sugar tax will provide some relief for farmers.

Finance Minister Enoch Godongwana announced that the fuel levy and sugar tax will not be increased in his 2025 budget speech.

ALSO READ: Budget speech: VAT increases by 0.5%, with another 0.5% hike next year

What no increases mean for farmers

Paul Makube, Senior Agricultural Economist at FNB Commercial said fuel accounts for almost 13% of production costs in the grain sector and is critical for distributing all types of produce and inputs to and from markets across the country.

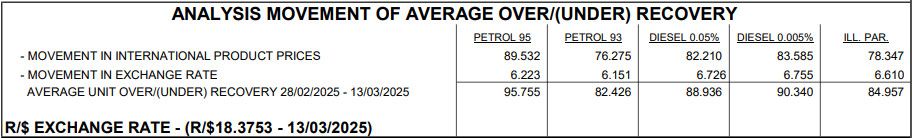

The General Fuel Levy amounts to 18% of the retail price, while the Road Accident Fund (RAF) levy is about 10%.

The general fuel levy has remained unchanged since 2022 to mitigate the effects of higher inflation resulting from fuel price increases.

With the recent fuel price hike, the fuel levy is R3.96 per litre, and the RAF levy is R2.18 per litre of 95 petrol.

R6.14 in taxes is included in every R22.41 spent per litre of 95 petrol.

No mention of sugar tax increase

Makube said that farmers will also be relieved that the Health Promotion Levy (HPL) was not increased.

HPL, also called the sugar tax, was implemented in 2018. It is a tax on sugar-sweetened beverages aimed at reducing consumption and promoting healthier choices

“There was no mention of changes to the HPL after the industry was given a two-year breather on levy increases to afford it time to diversify and restructure.”

ALSO READ: State’s R1.3trn infrastructure plans unaffected by budget dispute

Infrastructure investment

He added that the government’s commitment to infrastructure investment through payments for capital assets, projected to account for 5.1% of total spending and grow by 8.1% annually over the next three years, boosts confidence in the sector.

“Agriculture growth remains constrained by the deteriorating logistics infrastructure, such as the dilapidated roads, that increases operational costs.

“Further investments in both rail and road facilities and services will help unlock expansion as envisaged in the country’s Agriculture and AgroProcessing Master Plan (AAMP), a product of a collaborative effort by government, agribusiness, labour, and civil society to revitalise and grow the sector.”

Farmers disappointed

Roelie van Reenen, supply chain executive at Beefmaster Group, said the 2025 budget was disappointing because it failed to stimulate the country’s economic growth.

“Taxing the nation is not a sustainable solution.

“We need incentives encouraging entrepreneurship, supporting business growth, and attracting international investment. Economic growth is driven by incentivisation, not taxation.”

He notes that the budget does little to address the country’s tax system imbalance, where 7.9 million personal income taxpayers support 28 million grant recipients — “a model that is simply not viable in the long term.”

ALSO READ: Budget 2025 hitting consumers where it hurts: in their pockets

Does the expansion of the food basket really work?

He added that expanding the list of VAT zero-rated food items is not a broad economic incentive for the whole country but a plaster for the poorest poor.

“Additionally, while we support red meat products being put on the zero-rated VAT list, specifying organ meats creates enforcement challenges. We look forward to further clarity on its implementation.”

However, Van Reenen says there is one significant optimistic takeout from the proposed budget: it must still be approved by the members of the government of national unity (GNU) before becoming law.

“For the first time in years, there is no unilateral decision-making in government. All participating parties have a say in what is best for the country.

“This is democracy in action, ensuring that the interests of all South Africans are represented.”

NOW READ: Budget will leave South Africans bruised and bloodied