There was no repo rate cut to support economic recovery in South Africa, while the MPC waits to see what the effects will be of the global trade war.

The Reserve Bank opted to keep South Africa’s repo rate unchanged at 7.5% with only two of the six Monetary Policy Committee members voting for a 25 basis points cut, although the majority agreed with Governor Lesetja Kganyago that caution is needed due to an exceptionally uncertain external environment.

Jacques Nel, head of Africa Macro at Oxford Economics Africa, notes that Kganyago, who tends to be hawkish, sounded reluctant when he announced the 25 basis points repo rate cut in January. “His caution won the day at the latest meeting and showed not only in the decision but in his warnings that the global economy is not on a stable footing and that this calls for a careful approach.

“Two members voting for a cut suggest some within the committee think the Monetary Policy Committee (MPC) is overly cautious amid contained inflation and a dismal growth outlook. However, highlighting the negative impact of a sentiment shock – a scenario with an uncomfortably high probability given an erratic geopolitical environment – is an attempt to give this cautious stance more credence.”

Nel says inflation remains contained and therefore Oxford Economics Africa expects another policy rate cut in the third quarter of 2025.

ALSO READ: Reserve Bank keeps repo rate unchanged as expected

Sarb remains concerned about inflation risk

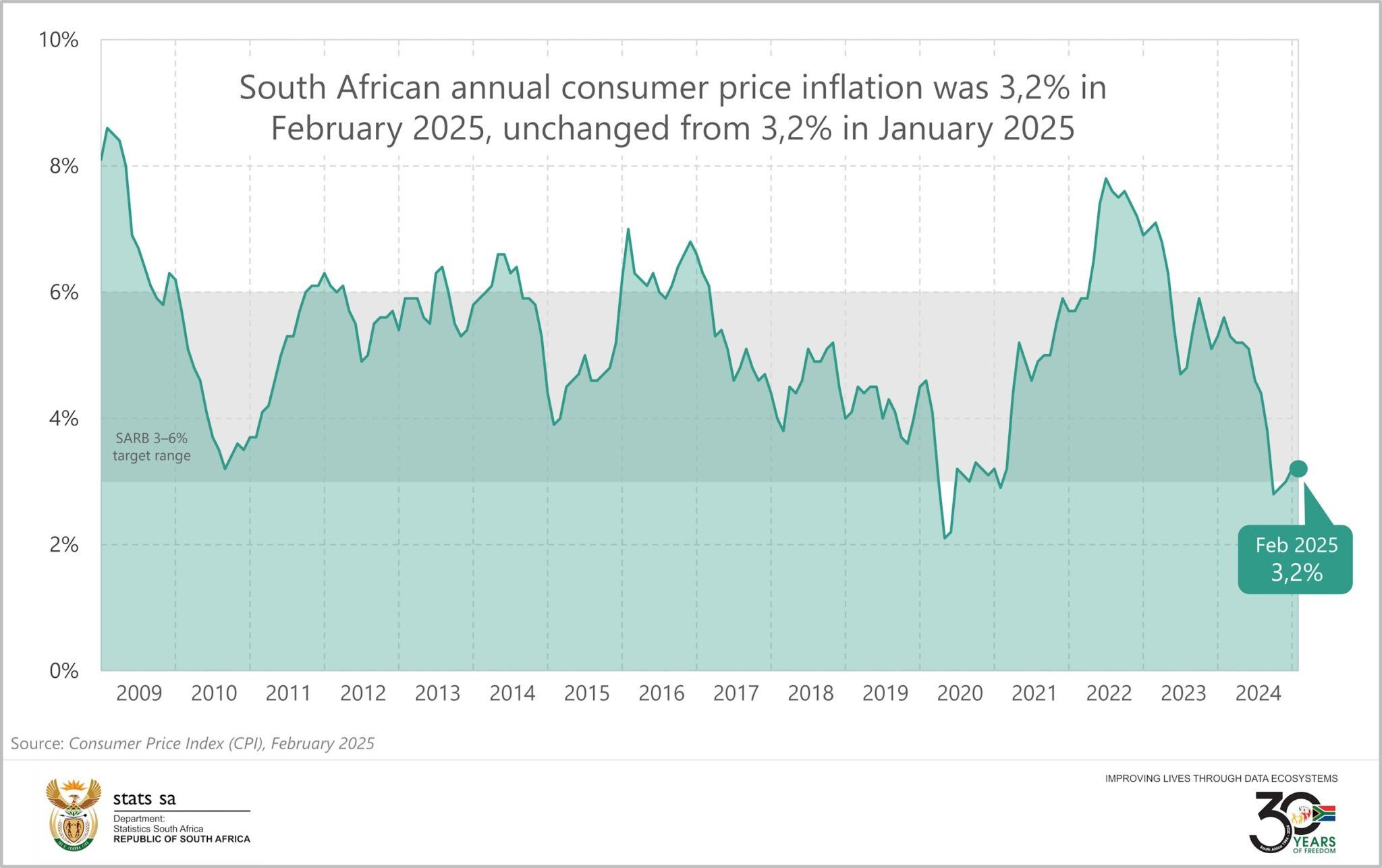

Lisette IJssel de Schepper, chief economist at the Bureau for Economic Research (BER), says while inflation expectations remain anchored and the inflation outlook is also relatively benign, the South African Reserve Bank (Sarb) remains concerned about potential upside risks to inflation and deemed it prudent to hold policy settings unchanged.

“For now, we suspect that should there be more certainty and continued favourable developments regarding the US Fed cuts, lower oil prices and a stronger rand, the Sarb may cut rates again later in the year.”

Prof Raymond Parsons, economist at the NWU Business School, points out that since the MPC’s previous meeting in January highly elevated levels of global and domestic policy uncertainty convinced a majority of MPC members to pause in its interest rate-easing cycle.

“The MPC now awaits greater clarity around these developments in the months ahead. The MPC decision again also highlights the role of non-model-based judgement in policy choices, especially in current uncertain circumstances.”

He says the MPC statement makes it clear that inflation trends in South Africa are now basically converging around the 4.5% midpoint of the inflation target range, yet monetary policy is nonetheless still in restrictive territory.

“Therefore, there is still scope for resumed cuts in borrowing costs for business and consumers later in the year. There also appears to be a minority view within the MPC that interest rates could still be further reduced to support economic recovery.”

ALSO READ: Inflation unchanged, but economists do not expect repo rate cut

Consumers to remain under pressure

Harry Kellan, CEO of FNB, says the bank expects consumers to remain under some pressure after the recent budget speech. “Household budgets will come under pressure with the increase in VAT and with no relief for personal income taxes, as the tax brackets remained unadjusted for inflation.

“Against this backdrop, we welcome the Sarb’s decision to leave rates unchanged as this creates a measure of stability to counteract growing uncertainty in global markets. Further rate reductions, while still expected, have become less clear with growing uncertainty in global markets and locally due to pressure on the National Treasury to fund government spending requirements.

“Under these conditions, consumers should manage their finances with caution when considering large expenses. We expect that the Sarb will continue to find a balance between managing inflation expectations while supporting the broader South African economy. For consumers, emergency savings and longer-term investments should be top of mind.”

Mamello Matikinca-Ngwenya, chief economist at FNB, says FNB also expected the MPC to leave interest rates unchanged, as the global environment remains precarious with adverse risk sentiment likely to weigh on emerging market assets.

“However, local inflation should remain anchored over the medium term and a VAT increase, while adding marginal upward pressure to prices, will likely weigh on consumer confidence and spending growth.

“This, alongside market expectations that the Fed will resume its cutting cycle at the turn of the year, will support the space for further monetary policy easing by the Sarb. Therefore, we should see another 50 basis points worth of interest rate cuts before the end of this year. At that stage, the impact of monetary policy on the economy will be more neutral.”

ALSO READ: Strong rand not reflection of SA’s economic health

Uncertainty of global dynamics and budget not passed

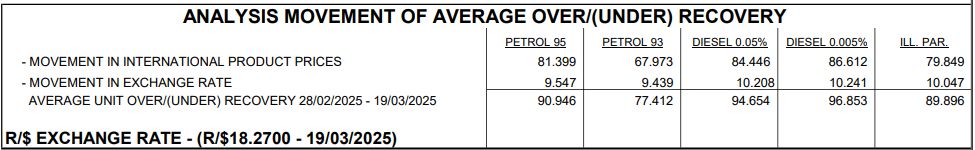

Tertia Jacobs, treasury economist and fixed income specialist at Investec, says the decision not to cut interest rates even as inflation has been revised to lower is based on the uncertainty of the global dynamics as well as the high country risk premium as the budget has not been passed.

“The market will remain biased towards a rate cut as inflation has been undershooting expectations but it is clear that the Sarb remains extremely cautious.”

Nicky Weimar, economist at the Nedbank Group Economic Unit, expects that the MPC will remain cautious and points out that the MPC again stressed that its decisions will be made on a “meeting-by-meeting basis”.

“This statement carries significant weight in the current unsettled environment. The US Fed left its policy rate unchanged for the second consecutive meeting, pointing to the upside risks to its inflation outlook posed by sharply higher tariffs and tighter immigration controls.

“Given the on-and-off nature of the global trade war and the unexpected pressure on the US dollar, it is difficult to see how the external environment will unfold over the next four years. In many ways, the world appears to be entering uncharted territory.

“If the greenback remains subdued because investors doubt the wisdom of the US’s economic policies, then the impact of the global trade war on inflation in South Africa and other emerging markets will likely be less damaging than initially feared.”

However, she says, the escalating trade war will hurt international trade volumes and undermine global growth. “If the US weathers the growth storm better than the rest of the world, US economic exceptionalism could be reaffirmed and the US dollar could rebound, placing pressure on the rand and other emerging market currencies.

“Given that the impact could be significant, the MPC will probably keep interest rates on hold until there are fewer moving parts to fret about.”

ALSO READ: Reserve Bank cuts repo rate but no promises for rest of 2025

Temporary pause in cutting repo rate

Casey Sprake, economist at Anchor Capital, says like in its January statement, the Sarb placed considerable emphasis on the ongoing volatility in the global economic environment.

“Looking ahead, the MPC continues to anticipate that interest rates will stabilise at a neutral level of approximately 7.25%. This implies the possibility of a further 25 basis points repo rate cut in 2025, followed by a prolonged period of stability through 2027.

“Consequently, the Sarb’s latest decision appears to be a temporary pause in the current shallow cutting cycle rather than a definitive end. However, the scope for substantial further easing remains limited.”