Many people buy offal to eat because they cannot afford better cuts of meat. Budget 2025 just emphasises the inequality in South Africa.

The food items added to the VAT exemption basket in Budget 2025 shows just how disconnected Treasury is from poor people in South Africa, by only adding offal meat instead of items such as frozen chicken.

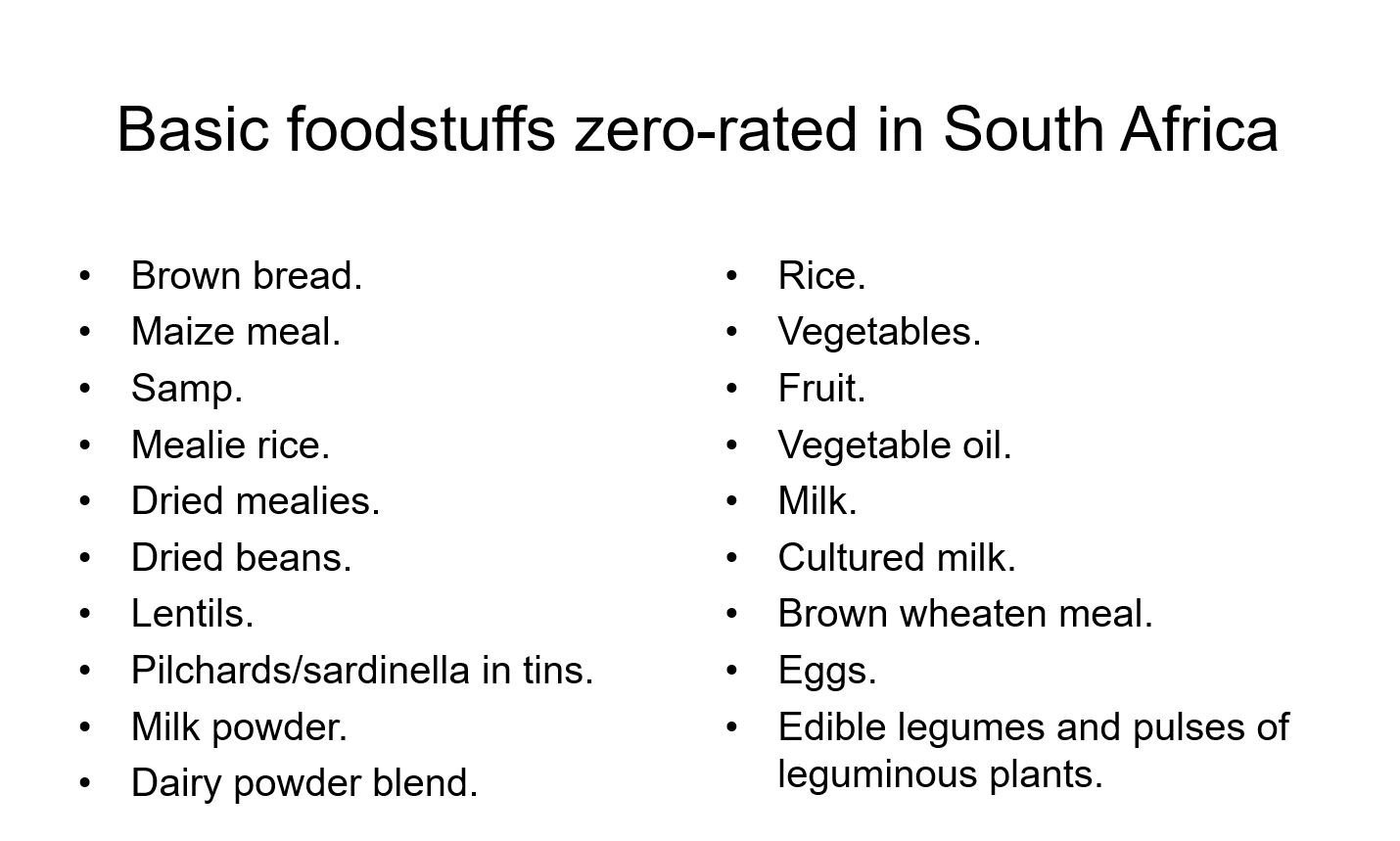

Finance Minister Enoch Godongwana only added edible offal of sheep, poultry, goats, swine and bovine animals, specific cuts of meat such as heads, feet, bones and tongues, dairy liquid blends and tinned or canned vegetables to the list of zero-rated foods.

Mervyn Abrahams, programme coordinator at the Pietermaritzburg Economic Justice and Dignity group says only zero-rating offal as a source of protein shows what Treasury thinks of the most vulnerable people in our society.

The Pietermaritzburg Economic Justice and Dignity group works with women who live in low-income communities to track the prices of 44 basic food items in the household food basket from 47 supermarkets and 32 butcheries where they live and shop.

ALSO READ: Budget speech: VAT increase decision not made by someone who knows hunger

How Budget 2025 changes the household food basket

Asked about the effect of Budget 2025 on vulnerable and poor consumers, Abrahams says the exemption now adds four items on the group’s list, chicken feet, gizzards, beef liver and canned beans to the list of VAT-exempt items.

According to the February data for the household food basket for February, the zero-rating of these four items will save low-income consumers R67.43 on VAT, almost enough for 2kg of chicken feet. However, the 0.5% increase in VAT will add R10.80 to the household food basket.

While the zero-rating of more food items in the household food basket will help low-income consumers, Abrahams says this help will not go very far, as they will still have to buy 0.5% more VAT on the electricity they buy, which will become even more when Eskom tariffs are hiked in July when they will pay R158.42 more for 350 kW of electricity.

“When you consider the overall impact of Budget 2025, it gives to poor consumers and takes away from them again. The saving on VAT will also only help poor consumers if the VAT saving is passed on to them. It is very difficult to tell if the value chain gobbles up the VAT savings because we have no access to the data.”

He says this is the same as when the fuel price decreases but food prices do not decrease as well.

ALSO READ: Budget speech hard on consumers with taxes

Social grant hopes dashed

Abrahams says while they welcome the increases in social grants above inflation as an attempt to bring value to recipients, the Child Care Grant is only increasing by R30, which is still 30% below the food poverty line of R796. The group was hoping for an increase that would be pegged at the food poverty line as child grants are usually used to buy food.

“This increase will have no impact on the stunting rate among South African children. Stunting has an adverse effect on educational outcomes and what we spent on health as well as the child’s productivity when they enter the workforce as adults due to cognitive difficulties.

“Government must realise that the future of South Africa depends on what we feed our children today. I think it was overall a missed opportunity.”

ALSO READ: Budget 2025: A game of give a little and take a lot?

Budget 2025 will not stimulate economic growth

While Abrahams says he agrees with what Godongwana said in the opening of Budget 2025 that the most important part of the budget is to grow the economy, he points out that an increase in VAT will not grow the economy but rather stifle it.

“Consumers will buy less and less consumer spending means that the economy will not grow. Budget 2025 does not look like a growth agenda.”

Abrahams says Godongwana and Treasury had other measures they could have used to increase revenue that would not have stifled economic growth, such as a payment holiday for public service employees’ pensions for a year as it is over-funded by 110% that could have saved government R59 billion, while the increase in VAT will only increase revenue by R28 billion.

“We would have liked the minister to consider zero-rating 350 kW of electricity for poor consumers as they use electricity to cook food and preserve it. There seems to be no political will to look after the interest of vulnerable consumers.”

ALSO READ: Budget speech too optimistic about the economy?

No mention of hunger, food security or malnutrition

The Union Against Hunger (UAH) that aims to abnormalise hunger in South Africa and realise the constitutional rights of every individual to sufficient food and water and of every child to basic nutrition, was disappointed that the minister did not even mention hunger, food security or malnutrition in his one-hour speech that brought little comfort for millions of hungry, food insecure and malnourished South Africans.

“The most contentious issue that caused the postponement of Budget 2025 was a proposed 2% increase in VAT from 15% to 17%, which was opposed by the ANC’s GNU partners and opposition parties.

“In a wholly inadequate compromise, VAT will still be increased by 0.5% this year and 0.5% next year. Increasing VAT by 1% over the next two years will increase hunger and increase the cost of living for everybody, but especially for the poor and hungry who can least afford it.”

UAH says although social grants were increased to offset the VAT increase, the VAT increase will in itself fuel inflation and reduce gross domestic product (GDP) growth, virtually cancelling out the social grant increases.

ALSO READ: Outa tells finance minister how to find an extra R500bn ahead of budget speech

Basket of zero-rated food expanded in Budget

About the minister adding to the basket of zero-rated foods, the UAH says while this is welcome, there is mixed evidence on whether making certain commodities exempt from VAT benefits the poor more than the non-poor or even benefits the poor at all.

“Nobody disputes that money must be raised to pay for increased pro-hunger spending, but not by taxing the hungry. The UAH will hold those in power accountable to hungry people by monitoring government policies and programmes to ensure they are anti-hunger and accelerating progress towards Sustainable Development Goal 2 of zero hunger by 2030.”

The UAH says Budget 2025 is not anti-hunger and it does not put South Africa on a track to achieve zero hunger. The organisation says instead government could have:

- Rejected the VAT increase and replaced it with wealth taxes;

- Increased social grants to the level of the food poverty line; and

- Delivered adequate nutrition to all children in early learning programmes.