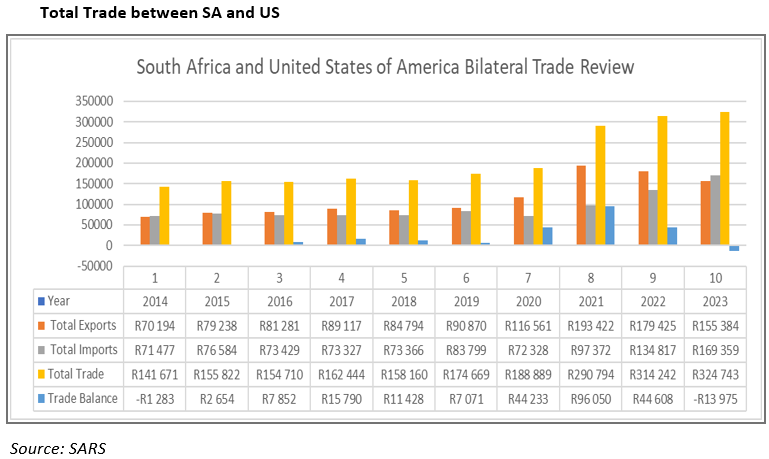

If the state needs to generate revenue, VAT might be a highly effective tool to achieve that goal.

The finance minister, Enoch Godongwana, was initially set to table the 2025 budget speech on 19 February; however, it was postponed due to disagreements over increasing value-added tax (VAT).

Godongwana proposed increasing VAT by 2%, which led to disagreements among parties in the government of national unity (GNU).

However, South Africans need to brace themselves for a VAT increase, although it might not be a 2% increase.

ALSO READ: Budget speech: Why Godongwana wanted a VAT increase of 2%

Why increase VAT

The last time the government increased VAT was in 2018 by 1% from 14%.

Des Kruger, consultant at Webber Wentzel says that if the state needs to generate revenue, VAT is a highly effective tool to achieve that goal.

“If one considers the efficacy of the other revenue tools, it becomes immediately apparent that VAT is the most effective manner in raising revenue immediately.

“While the improvements to Sars [South African Revenue Service] may generate additional revenue, the reality is that this will take time.”

Will increased VAT foster economic growth?

He states that how additional funds are allocated and used is more significant.

“Suppose the revenue from a VAT increase is used effectively to foster economic growth.

“In that case, its drawbacks can be mitigated through improved infrastructure investment, job creation, and a more supportive economic environment.”

“While the political dynamics will only come to light after the re-tabled budget speech, and with the government needing to raise an additional R60 billion to meet its expenditure goals for the coming year, a VAT increase of some nature still remains likely.”

Kruger adds that the only factor that can stop the government from increasing VAT is if it decides to cut expenditures.

“This decision requires significant political capital, given the vested interests that budget cuts may adversely affect.

“Increasing VAT is likely the most palpable economic and political choice given these costs.”

ALSO READ: Budget 2025: Was the decision to increase VAT by 2% such a bad idea?

A double-edged sword

Chetan Vanmali, Partner at Webber Wentzel says increasing VAT may represent a zero-sum game from a government perspective.

It is reportedly framed as “the best of the worst options”, but increasing VAT again in any form may create unintended consequences.

“These include the VAT increase, not realising the desired revenue, increasing inflation, which may see the Reserve Bank hold interest rates at higher levels for longer, and cause taxpayers to change behaviour.

“This behaviour change may reduce spending in South Africa’s small and under-pressure tax base, harming economic activity and placing businesses under cash flow pressure.

“As recent history illustrates, if the business sector faces cash flow challenges, headcount is one area leveraged to reduce costs.”

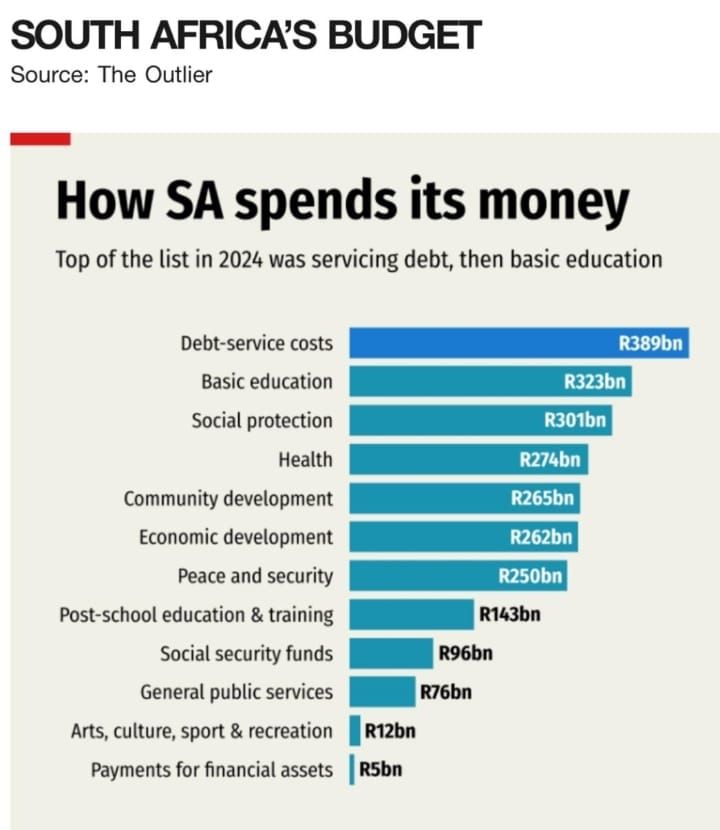

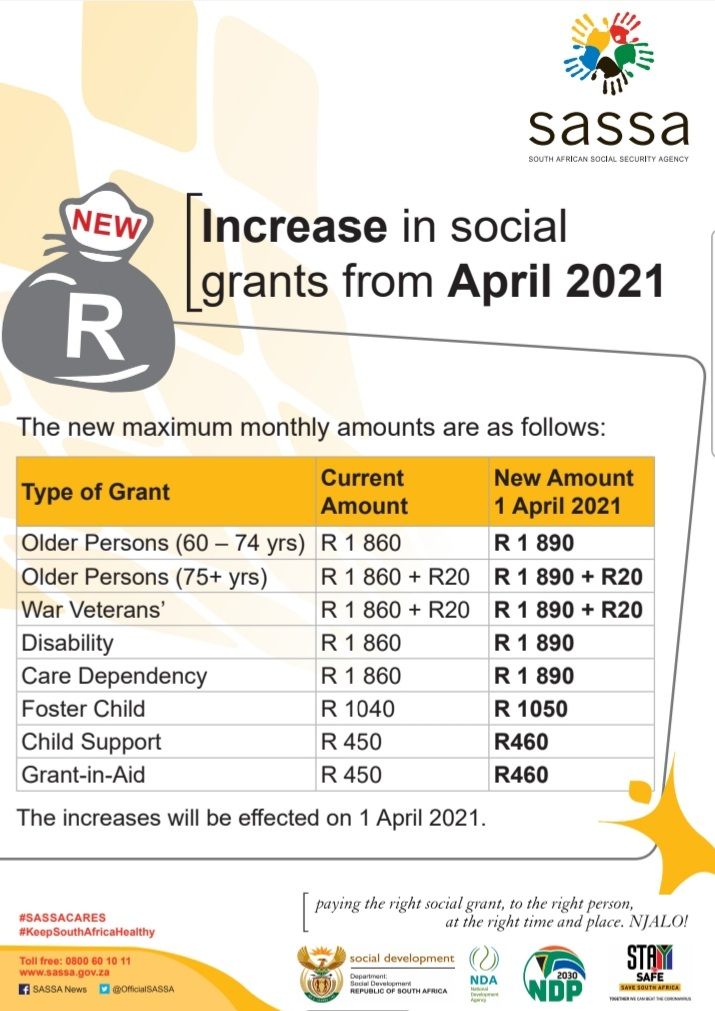

Government has previously stated that increased VAT will support more health, education, and social grant spending, a laudable goal.

He adds that it is not inconceivable that increasing VAT may result in a hollow victory, with the state finding itself in a similar situation 12 to 24 months from now.

Zero-rating and government positioning to signal future policy direction

Vanmali says to soften the impact of a VAT increase on people with low incomes, the government has reportedly proposed expanding the list of zero-rated items for VAT.

“The findings of several tax commissions have suggested that zero-rated items are not an adequate way to reduce the impact of a higher VAT rate.

“Low-income earners only benefit from a small proportion of tax revenue forfeited on zero-rated items, and low-income earners also purchase standard zero-rated items, exposing them to a higher VAT rate.”

He adds that the most long-lasting effect of the re-tabled budget may be how it sets the tone for future state spending.

ALSO READ: Budget 2025: Will Godongwana take, take, take or cut, cut, cut?

Cut state spending

While it is unlikely that the current administration will cut spending and implement policies that harm influential constituencies, influential persons across the political and business spectrum are increasingly advocating for reduced expenditure.

“These ideas may not hold sway, but the national government level’s political gravity is likely to evolve further in the coming years.

“Coalition governments will likely rule South Africa for the foreseeable future, meaning that the diversity of views within government is only likely to widen.”

Consequently, voices supporting state reform and reduced spending will always have a seat at the table in some form and possibly represent a majority in the future.

“As we await the budget speech, the government can set a course for sustainable growth and economic resilience.

“A well-balanced approach—combining revenue generation with prudent spending—could pave the way for a more stable fiscal future.

“The decisions made now will not only shape the immediate economic landscape but also lay the foundation for long-term prosperity.”