The minister had to plug a staggering R75 billion hole in Budget 3.0 without further borrowing or triggering political backlash.

Even before the first version of Budget 2025, there were calls for finance minister Enoch Godongwana not to punish taxpayers, but in Budget 3.0 he did in any way. Budget 3.0 coincided with grim economic indicators that include unemployment at 32.9%, global instability and a trade war that continue to affect South Africa’s growth prospects.

The nation has been on tenterhooks since the shock news was announced on 19 February that Godongwana planned to increase the Vat rate from 15% to 17% in Budget 2025 to generate an additional R58 billion in revenue, resulting in serious backlash from the parties in the government of national unity (GNU) and other opposition parties.

However, he failed to allay the fears of citizens and investors with his plans to tackle the escalating fiscal deficit, manage the country’s debt and spend without burdening taxpayers, Neil Roets, CEO of Debt Rescue, says.

ALSO READ: Budget 3.0 was not a chainsaw budget, economists say

Only vague measures for stimulating job creation in Budget 3.0

“Measures to stimulate job creation were vague, and the absence of any real focus on combatting corruption was evident. Especially concerning were the tax measures figured in at this time and those projected for 2026, at a time when South Africans need urgent financial relief.

“I understand that the minister faces numerous challenges, including a turbulent economic landscape, crumbling infrastructure, currency volatility, global trade tensions and an astronomical government budget deficit.

“He is tasked with striking a delicate balance between expenditure cuts and avoiding further financial strain on households, but taxing the workforce to death is not the answer. The reality is that his decision to impose new tax measures will hurt consumers who are already struggling.”

Investec chief economist Annabel Bishop agrees, saying that increasing taxes is not a favoured route to plug the gap of the budget deficit, as this has a negative impact on growth and employment.

ALSO READ: Budget 3.0: not austerity budget, but a redistributive budget

Infrastructure investment and structural reforms in Budget 3.0

Godongwana laid out the government’s plans to spur economic growth potential to boost revenue and reduce funding shortfalls with an emphasis in Budget 3.0 on infrastructure investment and structural reforms.

Roets says this is commendable, with over R1 trillion allocated over three years to infrastructure projects across transport, energy and water, which are critical for long-term growth. “However, delivery remains the key concern.

“Budget 3.0 confirms that debt service costs will exceed R1.3 trillion over the next three years, which means R1.2 billion per day, which is more than the combined allocations for health, education and policing.

“What we need is a concrete plan of action to tackle the fiscal deficit through disciplined budgeting, efficient tax collection, responsible spending and a laser focus on stimulating economic growth. Without economic growth we are looking at a mounting socio-economic crisis,” he warns.

ALSO READ: Sensible or underwhelming? Economists react to Godongwana’s Budget 3.0

Will Sars come to the rescue as Budget 3.0 envisages?

The government allocated an additional R7.5 billion to Sars to increase its revenue collection capabilities. If this is successful, it could bring in R20 to R50 billion per year which will potentially cancel the need for further tax increases, he says.

“The news ahead of Budget 2025 of a historic public servants’ salary increase, accompanied by substantial enhancements to various allowances, does not inspire confidence in the GNU due to the dire predicament of much of the country’s workforce.”

There was, Roets points out, of course, no mention of cutting down the size of the cabinet, regarded by many as an unnecessary burden on taxpayers and an obstacle to effective governance, a point that has been hotly debated in the media leading up to Budget 2025.

Political analyst Joe Mhlanga notes that the cabinet’s size and perks drain our economy, while ActionSA recently revealed that the current cabinet configuration is costing taxpayers an additional R239 million per year, amounting to over R1 billion for the current term.

ALSO READ: Budget 3.0: Fuel levy replaced VAT hike but is it the better option?

Dropping the Vat increase, minister imposed other taxes in Budget 3.0

Roets says the minister’s reiteration that Vat will not be increased was widely welcomed, but imposing alternative tax penalties on taxpayers, such as raising sin taxes even more and hiking the fuel levy for the first time since 2022, delivers a heavy blow to the hard-working citizens who are the backbone of the economy.

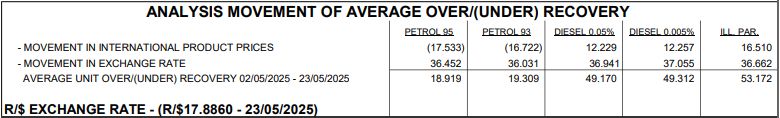

From 4 June the general fuel levy will increase by 16 cents per litre for petrol and 15 cents per litre for diesel. Roets says this alone will increase the cost of living for every South African.

“Notably, the minister also confirmed that the planned expansion of the zero-rated Vat basket that was originally proposed to cushion poorer households from a Vat hike, will now fall away since the Vat increase itself was dropped. This removes what could have been a vital buffer for low-income households.

“How can this possibly alleviate the burden on the country’s workforce? Does this mean that taxpayers are having to pay for the inefficient management and high levels of corruption that have led to the country’s poor service delivery?

ALSO READ: Godongwana cuts zero-rated food basket in Budget 3.0

Consumers need more aggressive support strategies

“It is essential that government considers much more aggressive support strategies for consumers facing financial distress.”

Roets says with 32.9% of the nation without income, according to the Q1 2025 Quarterly Labour Force Survey data released by Statistics SA, it is not difficult to understand how government grants are indeed the only lifeline for many people.

However, job creation is a top priority – or it should be, he says. “With a third of the population currently unemployed and youth unemployment at an astronomical 46%, among the highest in the world, the country stands at the tipping point of becoming a state-funded nation and everything that comes with that.

“Government’s growth path focuses on extending and increasing the social wage support grant. This points to a lack of confidence in economic recovery powered by a flourishing business sector that drives job creation and entrepreneurship, without which there will be no recovery.”