The finance minister will have another chance to present his budget speech on Wednesday. Will it be a budget of GNU consensus?

Will Finance Minister Enoch Godongwana be second time lucky on Wednesday when he presents his budget speech? South Africans are holding their breath to see if he has a new plan of where to find the extra money.

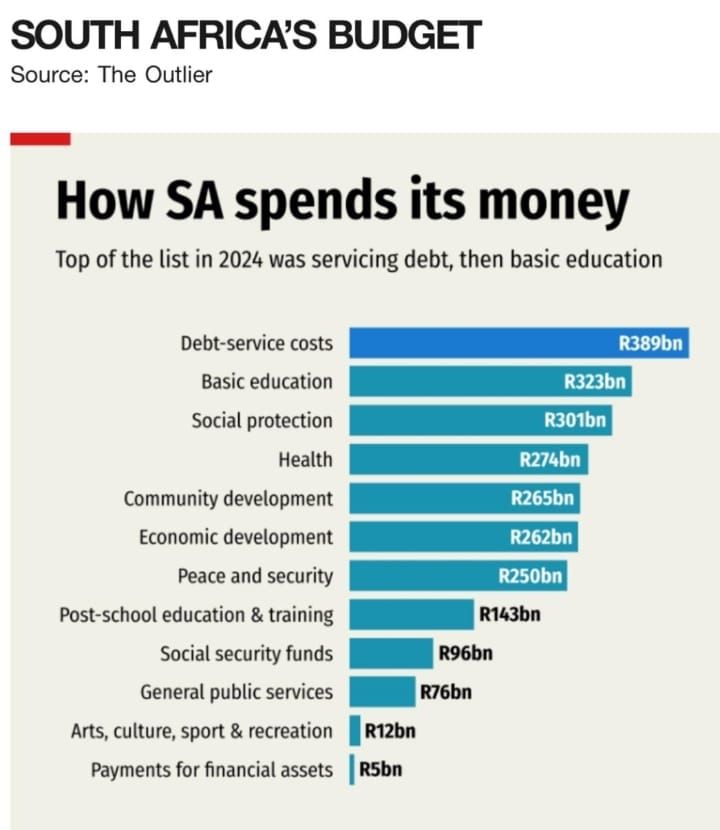

Prof. Bonke Dumisa, an independent economic analyst, says the financial reality of South Africa is that we have been in junk status since 2018. “As a country, we are living beyond our national means, spending over R1 billion a day just to service the costs of the country’s debt, before even beginning to pay off the principal loans.

“With a government debt already above R6 trillion, government cannot risk taking on more debt. We must all commit to national belt-tightening measures, starting with our highly over-bloated government at all three tiers and our over-bloated public service, although we are covertly intimidated from stating these truths.

“We should not be made to feel apologetic about the country implementing tough fiscal and monetary discipline, even when others deliberately use ‘austerity measures’ as swear words.”

ALSO READ: Budget 2025: Will Godongwana take, take, take or cut, cut, cut?

How South Africa spends its money

Dumisa uses this graph from The Outlier to illustrate the size of South Africa’s debt:

VAT compromise expected in budget speech

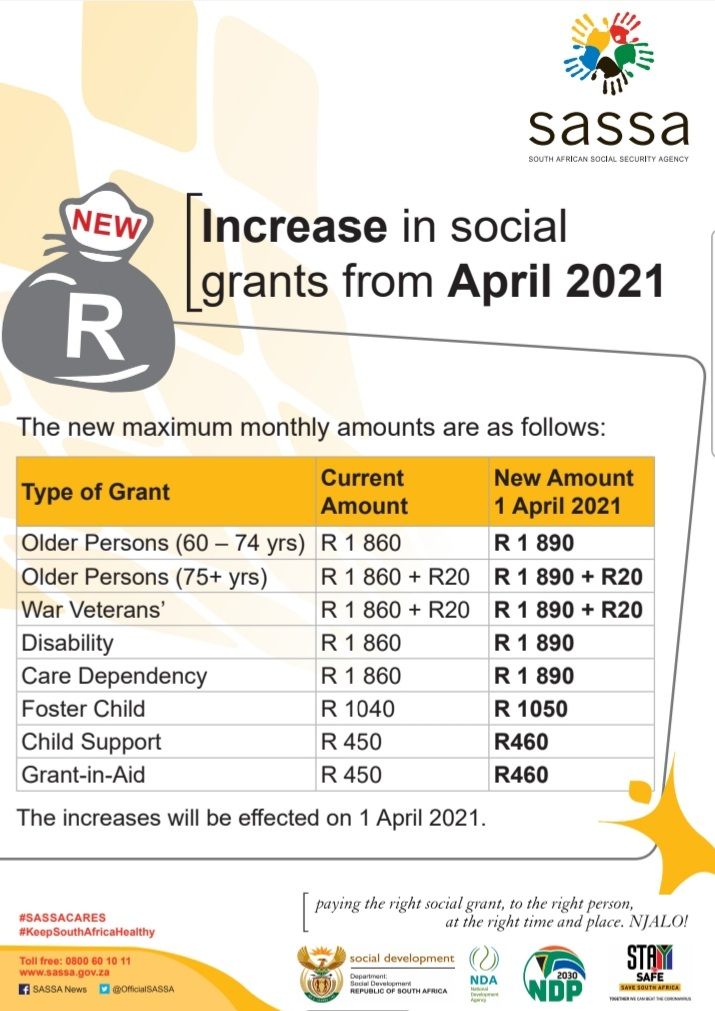

Isaac Matshego, Johannes Khosa and Nicky Weimar, economists at the Nedbank Group Economic Unit, say they expect a compromise on increasing VAT to between 15.5% and 16%. In addition, they expect that the upcoming local government elections could prompt the GNU to introduce the basic income grant in 2026, which would raise the social protection bill significantly.

They also warn that debt service costs will increase further as the country’s total debt increases and expect that the main challenge will be containing the public sector wage bill.

“The 2% VAT increase was projected to boost net VAT collections by R58 billion in the next financial year, by R61.5 billion in the next financial year and by R63.9 billion in the financial year after that. To somewhat compensate for the foregone revenue that would have come from the VAT hike to 17%, Treasury will scrap some tax adjustments and raise the low volume taxes by more than initially planned.”

ALSO READ: Budget 2025: What to watch out for

Matshego, Khosa and Weimar point out that in the original estimates, personal income tax brackets were adjusted by less than the inflation rate for all but the bottom two tax brackets to raise an additional R4.8 billion.

“In the revised Budget 2025, we could see the tax brackets left unchanged once again. Medical aid tax credits were left unchanged for the second consecutive year, at R364 per month for the first two beneficiaries and R246 per month for additional beneficiaries.

“We expect the revised budget to keep the numbers unchanged as government prepares to introduce the national health insurance (NHI) scheme.”

ALSO READ: What Budget 2025, although not delivered, shows – economist

Sin taxes expected to be increased more

In the initial budget speech, excise duties on alcohol were budgeted to increase by 6.8%, while those on tobacco products increased by between 4.8% and 6.8%, raising an average of R1.1 billion per year. The Nedbank economists expect that these tax increases will likely be revised higher.

They also expect that the fuel levy, which has not been adjusted since April 2022, is likely to be hiked by more than the inflation rate for this financial year, with high increases also likely in the subsequent years.

Matshego, Khosa and Weimar are also worried about fiscal consolidation. “Despite Treasury suggesting for some years that fiscal consolidation must be deepened by boosting revenue growth and restricting growth in aggregate expenditure, the government has been unable to contain the rapid increase of public debt as the sizeable budget deficit persisted.

“The persistence of the trend was visible in the budget numbers released on 19 February. Expenditure was budgeted to increase more than anticipated due to higher non-interest expenditure and some immediate spending needs, with priority given to social services and infrastructure investment.”

ALSO READ: Budget 2025: What business wants from the minister of finance

What about the SRD grant?

They also note that the initial budget speech made no full allocations for the SRD grant in the next financial years, with only R443 million and R463 million allocated for administrative purposes for the two years.

“We believe the SRD grant bill will increase to R40 billion in the subsequent two years after R35.3 billion was budgeted for the current financial year. Although Treasury remains committed to restricting new bailouts for the large state-owned enterprises (SOEs), we expect a comprehensive package for Transnet, which will also increase the non-interest expenditure.”

They also point out that the public sector wage bill is estimated to increase by 8%, absorbing 38% of revenue to accommodate the higher wage settlements reached in 2024 and enable the hiring of critical workers such as doctors, nurses, teachers and police officers.

“The revised budget will mark a significant departure from the figures presented in the original budget. The lower VAT increase and limited expenditure restraint will alter the trend of limited fiscal consolidation in recent years.

“The VAT increase, whatever it will be, will unlikely be the last. In the Budget Review released on 19 February, Treasury stressed that the local VAT rate is well below the average of 19% among South Africa’s peer economies.

“We believe government will lean towards more increases in the foreseeable future. The VAT increase should magnify the fiscal crisis that South Africa is headed for. For over a decade, expenditure outpaced revenue growth, resulting in wide budget deficits and an ever-rising public debt ratio. The time to tackle expenditure inefficiencies seriously is now.”

ALSO READ: Outa tells finance minister how to find an extra R500bn ahead of budget speech

Budget speech must show how government will build sound fiscal track record

Arthur Kamp, chief economist at Sanlam Investments, says this year National Treasury needed a plan to keep building a sound fiscal track record for South Africa, but ultimately, that plan, outlined in the initial Budget 2025, did not receive universal support.

He thinks that Treasury is likely to stick with the broad principles underpinning its initial budget speech for the amended budget. Kamp says it is important to remember that Treasury appears determined to make good on its “promise” of decreasing the debt ratio over the medium term to improve our sovereign debt rating and lower the risk of investing in South Africa.�

“At the same time, with deep expenditure cuts untenable in an environment where service delivery is ailing, Treasury is throwing its weight behind a strategy to grow the economy. Years of excessive consumption expenditure kept budget deficits large and the debt ratio on an upward path.

“This was accompanied by persistent sovereign debt rating downgrades, higher domestic real interest rates and weaker potential gross domestic product (GDP) growth. In response, Treasury is apportioning an increasing share of available resources to government capital expenditure, which is beginning to lift, relative to government consumption.”

Complementing this, he says, there has been a significant decrease in government wages (the largest component of consumption spending) compared to total spending over the past decade. “Legislation has also been enacted to allow for private sector participation in infrastructure development and spending, including the provision of basic service needs, with an emphasis on easing the regulatory burden and de-risking projects.”