The budget speech tried to sell the 2% VAT increase as a way to help poor people, although it will push up cost-of-living expenses.

The decision of National Treasury to increase VAT by 2% took many experts by surprise as this kind of increase is regarded as regressive as it would cause many other increases, such as higher inflation and following on that, a higher repo rate and interest rates.

According to the undelivered budget speech, Minister of Finance Enoch Godongwana was going to point out several new and persistent spending pressures in health, education, transport and security emerged since October. For this reason, government decided it is necessary to support these pressures to properly fulfil its service delivery mandate.

In his speech, Godongwana was going to say Treasury had three choices:

- continue to cut funding to essential services that people depend on;

- take on expensive debt that would burden future generations; or

- make strategic tax adjustments to secure the nation’s future.

He was also going to say government chose the most responsible path forward by proposing to increase the value-added tax (VAT) rate by 2% to 17%, “a necessary step” that would enable government to:

- Fund public sector wage increases for civil servants of 5.5%;

- Expand early childhood development opportunities for children;

- Retain teachers, doctors and essential frontline workers;

- Revitalise the commuter rail system; and

- Provide above-inflation increases for social grants.

ALSO READ: Budget speech: ANC ministers also opposed VAT hike, Godongwana slams DA’s ‘identity crisis’

Alternatives to increasing VAT

According to the budget speech, government “thoroughly examined alternatives to raising the VAT rate and the policy trade-offs involved, including increases to corporate and personal income taxes”, but these would generate substantially less revenue while potentially harming economic growth and job creation.

Godongwana would have pointed out that increasing corporate taxes, for instance, will discourage investment and job creation, ultimately yielding less revenue in the long run. “Opting to take on more debt, when our credit rating is currently at junk status, would lead to even higher interest payments, ultimately reducing our future spending capacity and raising the risk of further rating downgrades.”

He was also going to point out that more debt would also push up interest rates. “That would hurt households paying back loans and businesses looking to expand their operations, dampening investment across the economy. The VAT increase, by contrast, represents the most efficient and broad-based approach.”

The speech further explains that the VAT increase would keep the country competitive with international standards and secure the resources needed to fund social protections and long-term investments in infrastructure development that promise lasting, future economic returns.

ALSO READ: Budget speech postponement shows GNU is not a rubber stamp

Is government aware of cost-of-living pressures?

Godongwana also would have pointed out that government is painfully aware of the cost-of-living pressures households have to deal with, including high food prices, rising fuel and electricity costs and transport expenses, which is why government wants to take the following steps to protect vulnerable households:

- Expanding the basket of VAT zero-rated food items to include tinned vegetables, dairy liquid blends and a variety of meat products from sheep, poultry, goat and swine;

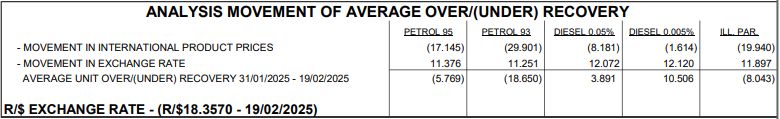

- Extending fuel levy relief for another year, saving consumers around R4 billion;

- Providing social grant increases that are significantly above inflation;

- Adjusting personal income tax brackets to protect lower-income earners.

Other tax proposals would have included partial adjustment of the remaining income tax brackets, with no changes to medical tax credits and above-inflation increases on alcohol and tobacco excise duties.

The tax measures announced in the speech would have generated R58 billion in additional revenue for 2025/26.

ALSO READ: Budget 2025: will it offer hope or any surprises?

VAT in South Africa

VAT was introduced in South Africa with effect from 30 September 1991 by way of the Value-Added Tax Act to replace sales tax. It started at 10%, with certain foods exempted from VAT and was increased to 14% in 1993. Paraffin was added to the list of exempted items in 2001. VAT was increased to 15% in April 2018.

According to Sars more than 160 countries have a VAT system.