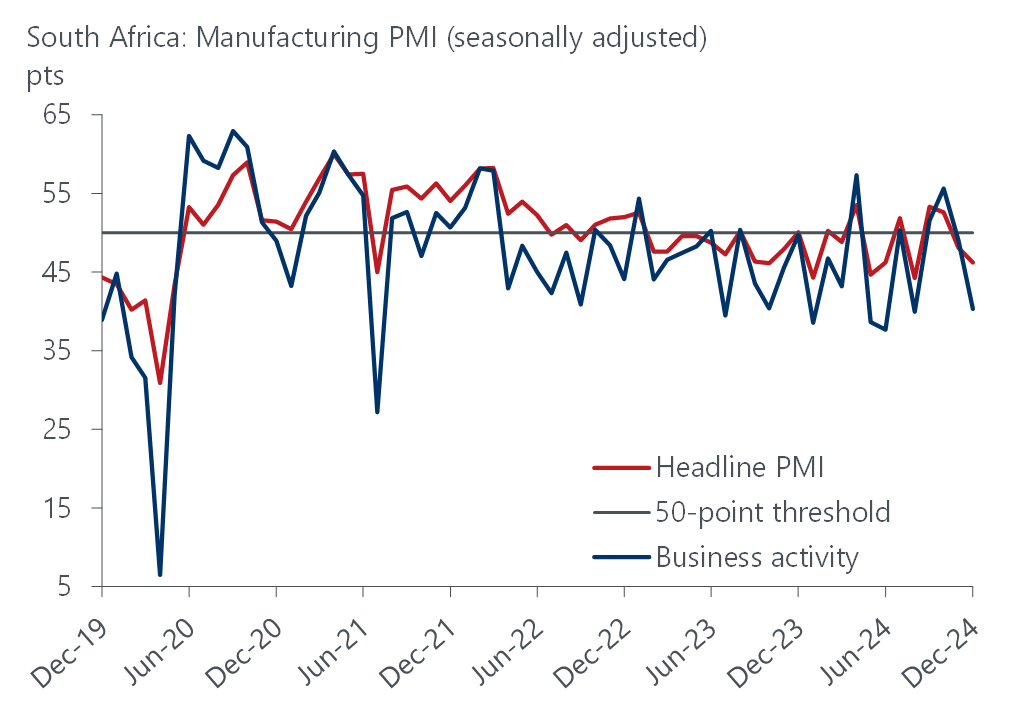

Although business activity declined in December, South African businesses are optimistic that conditions will improve in six months.

Business activity in South Africa ran out of steam at the end of 2024 as measured by the Absa PMI as well as the S&P PMI, but it is not all bad, economists say.

There is optimism that business conditions will improve, while the PMI for the fourth quarter was the best in two years.

The Absa Purchasing Managers’ Index (PMI) is an economic activity index based on a survey conducted by the Bureau for Economic Research (BER) and sponsored by Absa. S&P compiles the S&P Global South Africa PMI from about 400 private sector purchasing managers’ responses to a questionnaire.

The seasonally adjusted Absa PMI declined by 1.9 points to 46.2 points in December 2024, remaining in contractionary territory. This puts the average PMI for the fourth quarter at 49 points, not significantly different from the 49.8 points for the third quarter, but above the 47.8 of the first quarter and the 48.1 of the second quarter.

The BER points out that the manufacturing sector experienced a volatile 2024, with this second consecutive monthly decline in December, reversing the upward momentum from September and October.

The business activity index decreased by 8.7 points to 40.3 in December, and the BER says the pullback in production came on the back of a sharp fall in demand. The new sales orders index fell to 37.4 points from 45.9 in November. Worryingly, the BER says, some respondents noted that conditions in December 2024 were worse than usually seen in December.

ALSO READ: Absa PMI drops to 48.1 in November, manufacturing suffers

Business activity shows exports dropped sharply

Export sales also dropped sharply and fell back to levels last seen in the first half of 2024. The supplier deliveries index increased by 7.7 points to 56 points, moving above 50 points for the first time in three months.

The BER says with production and orders significantly weaker, higher demand for supplies is unlikely to be the cause of the delays (this index increases when deliveries are slower as this is normally seen as a positive sign with manufacturers competing for supplies).

Logistical issues remain locally and in the global markets, which likely caused the slowdown in delivery times. The employment index decreased by 0.4 points to 46.5 and remained in contractionary territory for the ninth consecutive month.

The BER points out that due to volatility and largely depressed activity, the employment index has been below the neutral 50-point mark for eleven of the twelve months.

The purchasing price index fell by 1.3 points to 60.4 in December and the BER says this was surprising given that the rand exchange rate was relatively weaker in December, while the prices of fuel and LP gas increased at the beginning of the month.

ALSO READ: Did PMI turn the corner back to positive territory in September?

Optimism most positive outcome of PMI

The BER says the most positive outcome of the PMI was that the index measuring expected business conditions in six months increased by 5.2 points to 67.6 in December, indicating that manufacturers remain optimistic about business conditions in the future.

Jacques Nel, head of Africa Macro at Oxford Economics Africa, says the notable loss of momentum towards the end of 2024 is disappointing given the estimated pick-up in demand in the fourth quarter. “However, the latest figures are considered a mere lull, and we expect improvement in 2025.”

He says the latest PMI reading is disappointing as it represents the second consecutive monthly decline during a period when activity usually sees a boost and indicates a reversal of the upward momentum seen in September and October.

“Nonetheless, manufacturers remain optimistic – expectations of an uptick in broader economic activity this year should translate into a healthier manufacturing sector.”

ALSO READ: Policy Uncertainty Index falls, confirming uneven economic recovery

S&P PMI shows similar trends

The S&P Global South Africa PMI released on Monday also showed that business activity levels declined in December for the first time since August and ended the year on a dull note, as private sector firms registered the first decline in business activity in four months.

According to the latest survey data, muted demand conditions led to a stalling of sales growth and a pull-back in hiring. The sector was also influenced by an increase in inflationary pressures, as quickening cost burdens drove a solid uptick in selling prices.

David Owen, senior economist at S&P Global Market Intelligence, says the drop-off in growth appeared to soften the outlook for 2025 among surveyed businesses, with confidence easing further from its recent multi-year highs.

But on a positive note, supply chain pressures showed signs of easing, which encouraged firms to purchase additional inputs.

After signalling growth in each of the previous four months, the S&P Global South Africa Purchasing Managers’ Index dropped below the 50.0 neutral threshold at the end of 2024. At 49.9, from 50.9 in November, the reading signalled a fractional decline in private sector business conditions.

ALSO READ: Positive sentiment after election: A positive turn for economy?

Business activity quieter in December, stalling sales growth

In line with the headline PMI, the seasonally adjusted new orders sub-index indicated a stalling of sales growth in December. Owen says anecdotal reports suggested that quiet market conditions dampened order book intakes, alongside a further contraction in new export business.

The drop in sales ended a four-month sequence of expansion, which had been the longest observed by the survey in over two years. In response, South African businesses curtailed their output levels in the final month of 2024.

Owen says the reduction was the first seen since August, although it was marginal. “Concurrently, after the first increase in six months in November, job numbers were held largely stable.”

Sector data showed that weakness in the private sector was broad, with construction firms seeing the fastest contractions in output and sales. However, there was some positivity in services, where a slight uptick in new work was noted.

Supply chains also appeared to be in better health in December. While delivery times lengthened, it was softer and some panellists indicated that delays at domestic ports were less severe. Owen says this encouraged firms to increase their purchases of inputs for the third month in a row, which led to a slight expansion in inventories.

Meanwhile, the survey data signalled a faster rise in input costs at the end of the year, with the rate of inflation the highest in four months, with staff pay and purchase price inflation both quickening from November.

However, after running at historically muted levels in recent months, the degree to which costs rose was still much weaker than the survey’s trend pace, Owen points out.

ALSO READ: Economic activity still moving sideways but optimism increases

SA businesses optimistic about future business activity

South African companies also remained positive overall about future business activity in December in the S&P survey, with just over a third of panellists expecting an expansion in output over 2025. However, Owen says after reaching a 30-month-high last August, the degree of confidence fell for the third time in four months amid some hesitancy from surveyed businesses regarding future sales volumes.

“December’s PMI data suggest that the South African economy may have lost a little bit of steam at the end of 2024. New orders failed to grow after going on an impressive run in the latter stages of the year, as firms highlighted a more muted demand environment. They also faced accelerated cost pressures, as wage inflation quickened, and material and transport prices rose.

“Nevertheless, the final quarter of 2024 was an encouraging one for businesses on the whole. The fourth quarter PMI average of 50.5 is the strongest recorded since the third quarter of 2022, which gives some confidence that gross domestic product (GDP) growth will improve after a contraction in the last quarter.”