United African Stokvel and Darren and Shirley Langbein will now be investigated for operating as a financial services provider while not authorised to do so.

The FSCA finalised its investigation into United African Stokvel and found that it never invested the funds it solicited from consumers despite promising high and unrealistic returns.

The FSCA has now referred the matter to the police, Prudential Authority and the National Consumer Commission.

United African Stokvel claimed on its social media pages that it is a digital stokvel that invests clients’ funds in property and telecommunications and that the returns from these investments are used to pay investors’ returns.

However, according to the Financial Sector Conduct Authority (FSCA), there were various complaints from clients stating that although they were promised returns, they did not receive them.

This led to the FSCA warning consumers in July last year to be cautious when conducting any financial services-related business with United African Stokvel.

The FSCA then said that it suspected United African Stokvel of conducting unauthorised business and breaching certain financial sector laws.

It also emphasised that United African Stokvel is not authorised to provide any financial products or financial services.

ALSO READ: ‘You want to die?’: Members open up about nightmare of investing in United African Stokvel

Did United African Stokvel apply for a licence?

In addition, the FSCA pointed out that although United African Stokvel claimed on social media that it applied for a financial services provider license, the authority did not receive any application.

The FSCA said anybody providing investment products and other financial services requires the FSCA’s authorisation.

The FSCA successfully conducted a search and seizure operation at the premises of United African in Fourways in terms of the Financial Sector Regulation Act in June last year as part of an ongoing investigation into the business activities of United African.

The investigation was initiated after the FSCA received a whistle-blower’s report.

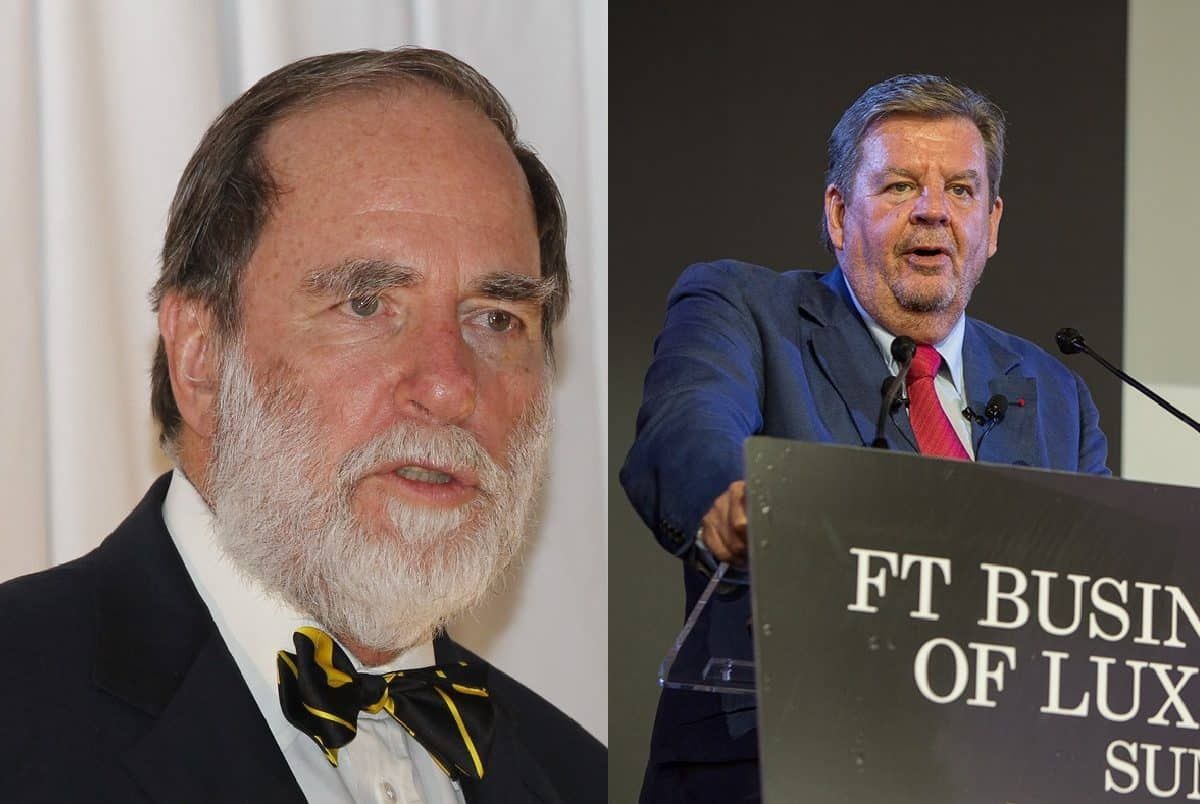

Today the FSCA said in a statement that it has finalised its investigation into United African Stokvel, Darren Langbein and Shirley Langbein.

“The FSCA found that they solicited and collected funds from members of the public with a promise of unrealistic returns and that they did not invest any of the funds.

They misappropriated a substantial amount of the funds collected for their personal benefit and the rest of the funds were used to pay some of the investors as “returns”,” the FSCA says.

“Due to the nature of the findings made during the investigation, the FSCA shared its investigation report with the South African Police Services, Prudential Authority and the National Consumer Commission.

ALSO READ: How pyramid schemes scam you out of your money

Langbein said United African Stokvel is safe and reliable…

According to an interview conducted with Darren Langbein in Spot-On magazine published in December 2022, he founded United African Stokvel and launched three new start-ups in the telecommunications, investment and non-profit sectors since 2017.

Langbein told Spot-On that United African Stokvel is a safe and reliable, community-based savings stokvel where they help individuals save for their future together.

He said United Africa Stokvels offer various affordable saving plans that help people earn highly competitive compound interest rewards.

He sold the scheme as digitising stokvels, although the business was never operated as a stokvel would be run.

“I am very attracted to the concept of people trusting each other, especially in this day and age,” he reportedly said to Spot-On.

“When we first started, it was exceptionally difficult to get people to trust us. Now that we are approaching our fourth birthday and have so many successful savers having been paid out, we are in a position where we have grown our members’ trust and are growing exponentially,” he said.

ALSO READ: If it’s too good to be true… How to identify a pyramid or Ponzi scheme

‘A safer option as no cash changes hands’

He went on to say that stokvels are a safer option as no cash changes hands, while there is a digital trail of all savings deposits and pay-outs.

“Digitising stokvels is the only way forward in terms of security.”

Langbein told the magazine that United African Stokvel has more than 15 000 members. United African Stokvel offered three options:

- Monthly Fixed Term from R500 to R50 000 per month at a fixed term of six to 12 months compounded at a rate of 4% per month.

- Followers Special that offered people who save between R1 000 and R50 000 once-off double their money in 12 months.

- Upside-Down Special that offered 7% returns per month if you save between R5 000 and R100 000 once-off for 12 months.