Millions of people already withdrew more than R35 billion from their retirement savings under the two-pot retirement system.

It is that time of the year when everybody gets ready to go on holiday – everybody but you because you cannot afford it.

But you can withdraw from your retirement savings under the two-pot retirement system and fund your holiday that way. Is that a good idea?

This is definitely not a good idea, Therèse Havenga, head of business transformation at Momentum Savings, says.

“I usually sleep too late when it comes to booking a holiday. I am so task-oriented at work that holiday times seem to creep up on me.

“Last year I had to take my family to a farm close to the seaside because we could not get a dog-friendly place to stay in a coastal town at such a late stage.

“The worst was that there was no Wi-Fi, no signal and no electricity. How must teenagers plan their days, then? I was not popular.”

Havenga says this also meant that they had to travel more than anticipated and spend more time in restaurants to eat cooked food (where there was Wi-Fi). “So much for trying to save up and budget ahead of time.”

Now, she says, with so many changes in the financial landscape, she has been wondering what people do who do not save and plan for holiday expenses upfront. “Can they afford to take last-minute chances, like I do with booking a place?”

Havenga says she asked Momentum’s actuaries to do the sums and they illustrate how hard it will be to make up for the alluring thought of going on holiday with retirement money or on credit.

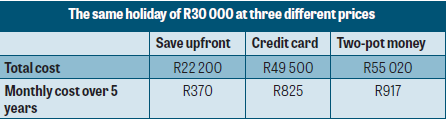

They drew up three scenarios for accessing about R30 000 using money from a withdrawal under the two-pot retirement system, using a credit card, or saving up first. This is the real cost of each option:

ALSO READ: Two-pot retirement system: survey shows what withdrawals will be used for

Using your two-pot retirement system money to pay for your holiday

The two-pot retirement system was introduced on 1 September 2024 to grant pension fund members access to a portion of their retirement savings for emergencies, but Havenga says some people seem to think it is available as spending money. Is this a feasible option?

Havenga says assuming you will retire in five years and you have R42 000 in the savings component of your retirement annuity where you contribute R3 000 per month and you earn R30 000 per month which means the tax rate you usually pay is 26%:

The transaction costs will be R200 for the withdrawal fee plus the 26% tax you pay on the withdrawal. You will then receive R30 880 when you withdraw the full amount in your savings component.

If you had left the money to grow in the retirement annuity, it would have grown to R74 370 at a 12% growth rate before fees (“opportunity” cost). This is how much it will cost you to pay back the actual cost and the opportunity cost over the next five years:�

- You will have to increase your monthly contribution by another R917 to restore the original maturity value.

- This results in a total repayment of R55 020 for the withdrawal.

ALSO READ: Two-pot retirement system: keep your hands out of this cookie jar!

Using your credit card to pay for your holiday

Havenga says your credit card rate is probably 21,75% (repo rate of 7,75% plus 14% as set by the National Credit Regulator). If you borrow R30 000 now, you will have to repay R825 per month over the next five years.

- This means to get R30 000 will cost you R49 500.

- This also means you could almost afford a second holiday with the R19 500 you waste on interest as R49 500 minus R30 000 equals R19 500.�

ALSO READ: Two-pot retirement system: how to resist the temptation of withdrawing

Saving up first for your holiday

If you were saving R370 per month for the last five years and your investment grew at a rate of 12% before fees, you would now have R30 000.

- Your total contributions would have been R22 200.

- This means if you save upfront, your R30 000 holiday will cost you only R22 200.

This table summarises how much your holiday would cost with each of the three choices:

Havenga says this means it costs the most to “borrow” from your long-term retirement savings under the two-pot retirement system.

The credit card option also bites you with interest to repay. However, by saving upfront, your holiday will cost you not only the least but less than the actual cost.�

“The sums show just how much one benefits by saving upfront for big expenses like holidays, especially fancy holidays.

“Now I must just do my homework in advance so that my last-minute bookings do not cost me more after I had diligently saved for a holiday.”