The Road Freight Association disputes claims that Transnet has improved performance at the Durban container port.

The Road Freight Association has slammed Transnet’s application for tariff increases of between 4.57% and 6.69% and disputes claims of a performance turnaround at the Durban Container Terminal Pier 2, the country’s largest container terminal.

“Transnet increases tariffs for doing, well, nothing really. Never mind an increase in performance or efficiency,” says Gavin Kelly, CEO of the Road Freight Association.

Earlier this month, Transnet said introducing a new truck booking system had improved truck turnaround time by 24% at the terminal. It also claimed that truck booking slots were available 60 hours in advance, compared with the previous 24 hours.

The Road Freight Association disputes this, saying the claimed improvement in truck turnaround times does not include ‘staging time’ at the terminal check-in gate. The claimed improvement is measured only once the truck leaves the check area.

“In addition, transporters still struggle with the booking system, as booking slots remain ‘not available’ and many hours are wasted waiting for slots to become available,” says the association.

The statistics quoted by Transnet are distorted where trucks are not allocated slots and are subject to delays while waiting outside the terminal working area.

ALSO READ: Transnet’s privatisation of Durban container port needs a do-over

“Less available slots means fewer vehicles entering the port precinct, which means fewer vehicles have to be serviced within a shift, which shows ‘improved productivity within the terminal’ – whilst, in reality, it is not the case. [Fewer] trucks against the terminal equipment availability show productivity improvement, but fewer movements are being done in totality. Less cargo is moved.”

Transnet’s ambitions of improving port efficiency by appointing Philippines-based International Container Terminal Services Incorporated (ICTSI) as its preferred bidder are currently being challenged in court by the losing bidder, APM Terminals, owned by Danish shipping company AP Moller-Maersk. Earlier this month, the Durban High Court issued an interim interdict preventing Transnet from proceeding with the planned contract to hand over port management to ICTSI.

Kelly says he hopes Transnet’s application for tariff increases for the 2025/26 financial year receives scrutiny from the newly created National Transport Regulator.

ALSO READ: Has Transnet botched the ‘privatisation’ of the Durban container terminal?

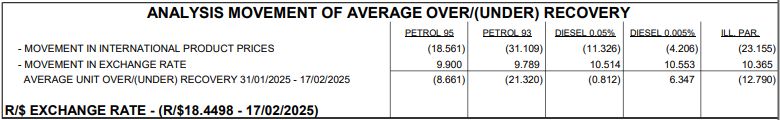

These tariff increases include:

- 67% increase on Deepsea Container Empties;

- 57% on Coastwise Containers and Transhipments;

- 69% increase on Container Empty Transhipments;

- 57% on Break Bulk Imports and Exports;

- 57% on Dry Bulk Imports and 7.90% on Dry Bulk Exports;

- 57% increase on Liquid Bulk Import and Export, and

- 57% increase on Automotive Imports and Exports.

“From the perspective of the Road Freight Association membership, which battles on a daily basis to get containers into and out of our ports, more so the port of Durban, these increases are uncalled for and will further hurt our already collapsing port.

“Where did Durban Container Terminal (DCT) develop the perception that there is a successful truck booking solution?

“What are the increases for? Equipment and infrastructure upgrade, repair and maintenance or just operational matters like administration, salaries and the like?” asks the Road Freight Association, adding that it has received numerous complaints from its members relating to the new truck booking system.

The claims of a 24% improvement in truck turnaround times must be measured against the full picture of truck and vessel waiting times, slot availability, and terminal volumes during the identified period.

ALSO READ: ‘We’re on the right track’ – Transnet boss Michelle Phillips

“While it sounds fantastic that slots are made available 60 hours in advance as opposed to the previous 24-hour advance release period, the reality is that the number of slots available in these 60 hours is not enough to accommodate the volumes of exports and imports that need to access the facility during the same 60 hours.

Says one transport expert who asked not to be named: “Transnet’s mandate is to reduce the country’s logistics cost. Being a monopoly allows you to be uncompetitive without any checks and balances.”

Transnet also claimed that transporters with at least 50 containers per vessel are not required to make any bookings for their release. However, this does not mean that a transporter has 50 trucks to evacuate a “group import release”. This still poses operational challenges for transporters trying to access the terminal.

“Simply put, those trucking companies using the Port of Durban on a daily basis have not seen any progress in respect of operational efficiencies at the terminal,” says Kelly.

“This brings us back to the query around the application for higher tariffs in the coming year – when little to no progress for the better has been coming from Transnet and its subsidiaries.”

This article was republished from Moneyweb. Read the original here.