Climate change is causing more natural disasters, making insurance for your property and belongings a must-have.

With natural disasters becoming part of our daily lives, it is hardly necessary to explain why you need insurance to cover the damage left behind after a flood or big storm.

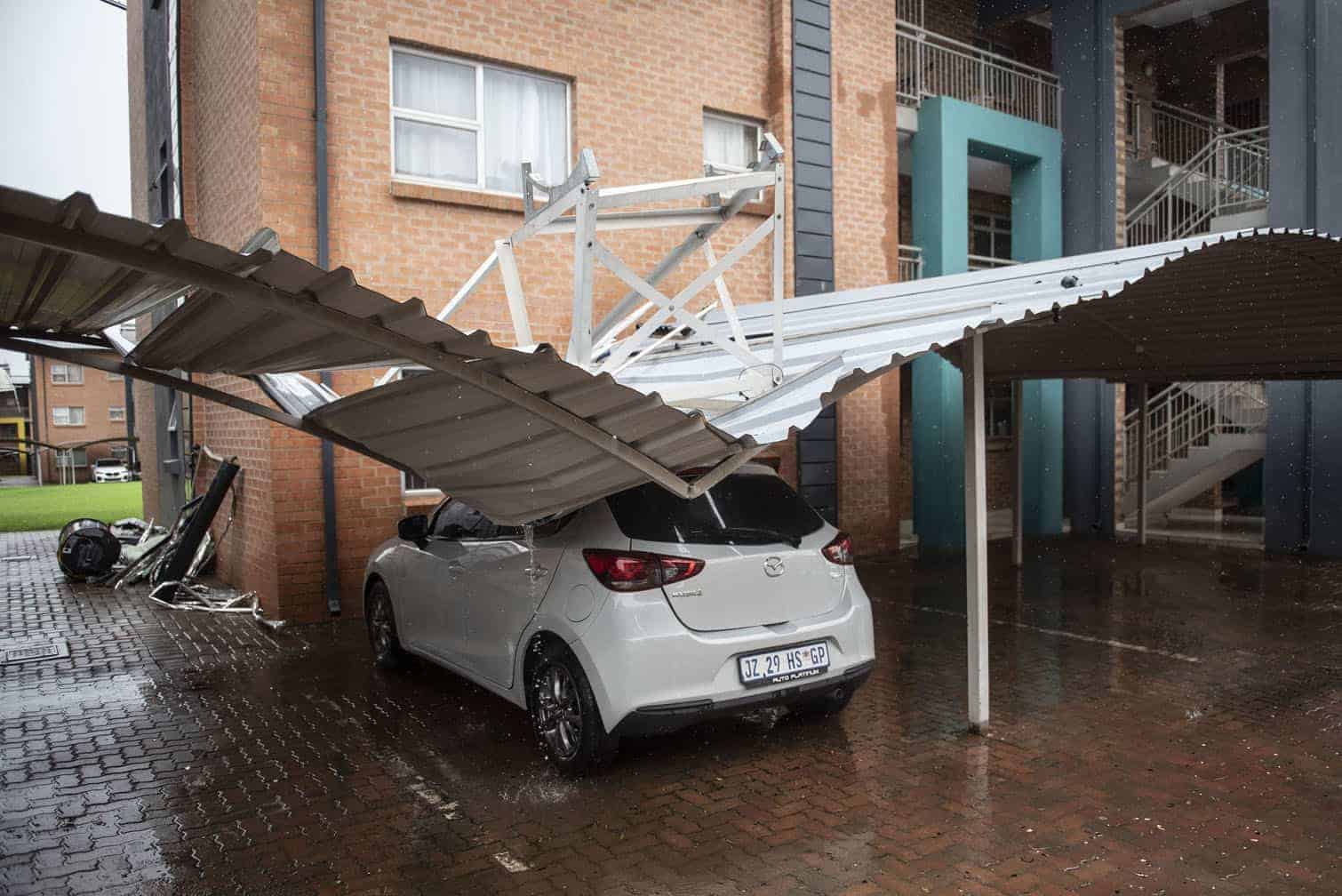

Just more than a week ago what appears to have been a tornado swept through Montana, in northern Pretoria, causing widespread damage to cars, buildings, the contents of these buildings, external geysers, and more.

Trees were uprooted, roofs were blown away, whole areas and roads were flooded, while many residents had to be evacuated.

While there was some debate whether SA Weather could classify this extreme weather event as a tornado or a landspout, some people point out that South Africa is not historically known as a tornado hotspot.

However, this was the second weather incident of this kind within the space of a year, Wynand van Vuuren, client experience partner at King Price Insurance, says. “The country’s most common natural disasters, such as floods, droughts, fires and large storms are on the increase and lighting strikes, hail damage, wind storms and sea level rises are also happening more often.”

ALSO READ: Do you need building insurance as well as home contents insurance?

Not having insurance makes you more vulnerable

He says consumers who do not insure their cars, buildings and home contents are becoming increasingly vulnerable. “The cost of fixing the damage caused by natural disasters is increasing every year and South Africans who do not have adequate insurance are having to pay these costs out of their own pockets.”

Having to fix damage caused by a natural disaster can be a devastating blow to your finances, Van Vuuren says. “Only around 30-40% of cars on South African roads are insured. When it comes to their buildings and home contents, most South Africans focus on cover for robberies and break-ins, but they do not pay enough attention to protecting their homes and possessions against the effects of natural disasters.

“And if they do, many are under-insured and often only realise this when it is time to claim.”

Van Vuuren explains that under-insurance happens when your buildings and home contents are covered for an amount that is less than the replacement value at today’s prices. In these cases, valid claims are paid out proportionately.

ALSO READ: This is how to boost your chances of a successful short-term insurance claim

Beware of under-insurance

For example, if the value of your building is R400 000 and you only insure it for R200 000, you will likely only be compensated for 50% of your loss if the building is damaged in a flood.

In 2024, natural disasters across the world caused losses estimated at $320 billion and only around half of it was insured. Munich Re, one of the largest reinsurers in the world (and also one of King Price’s reinsurers) surveyed homeowners and asked them whether they considered expanding their insurance in response to increasing weather disaster risks.

The responses were not great, with 57% indicating that they want to but cannot afford it.

“One of the main reasons that people give for not insuring their property is that they are unable to afford it. I always ask these clients what they would do if they lost their house. Can they afford not to insure their buildings?”

ALSO READ: More storms mean more insurance claims, but they’re not always paid out – here’s why

Insurance companies have enough to pay out claims

Van Vuuren points out that many consumers also doubt the ability of insurers to pay massive claims caused by natural catastrophes, which can run into hundreds of millions of rands per event. However, Van Vuuren says there is no need for concern.

“In South Africa the industry regulator requires all insurers to maintain adequate surplus funds for potential claims. If you lose your house and you ensured that you dotted the Is and crossed the Ts on your insurance policy and your claim is valid, your claim will be paid out.”