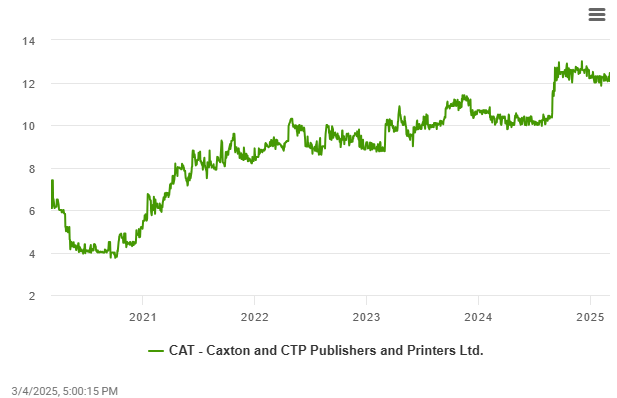

Delivers solid interim results despite limited growth prospects in the economy.

JSE-listed Caxton & CTP Publishers, Printers and Distributors delivered a solid financial result and grew earnings in the six months to end-December 2024 despite the economy showing limited prospects for growth.

Overall revenues declined marginally, with growth in the packaging segment offset by a decline in the publishing and printing segment of the group’s operations.

Caxton MD Tim Holden on Tuesday attributed the improvement in group profitability to optimal sourcing of raw materials and improved efficiencies in group operations, particularly where an investment in equipment has been made and there has been a focus on containing operating costs.

Revenues declined by 1.6% to R3.63 billion from R3.689 billion.

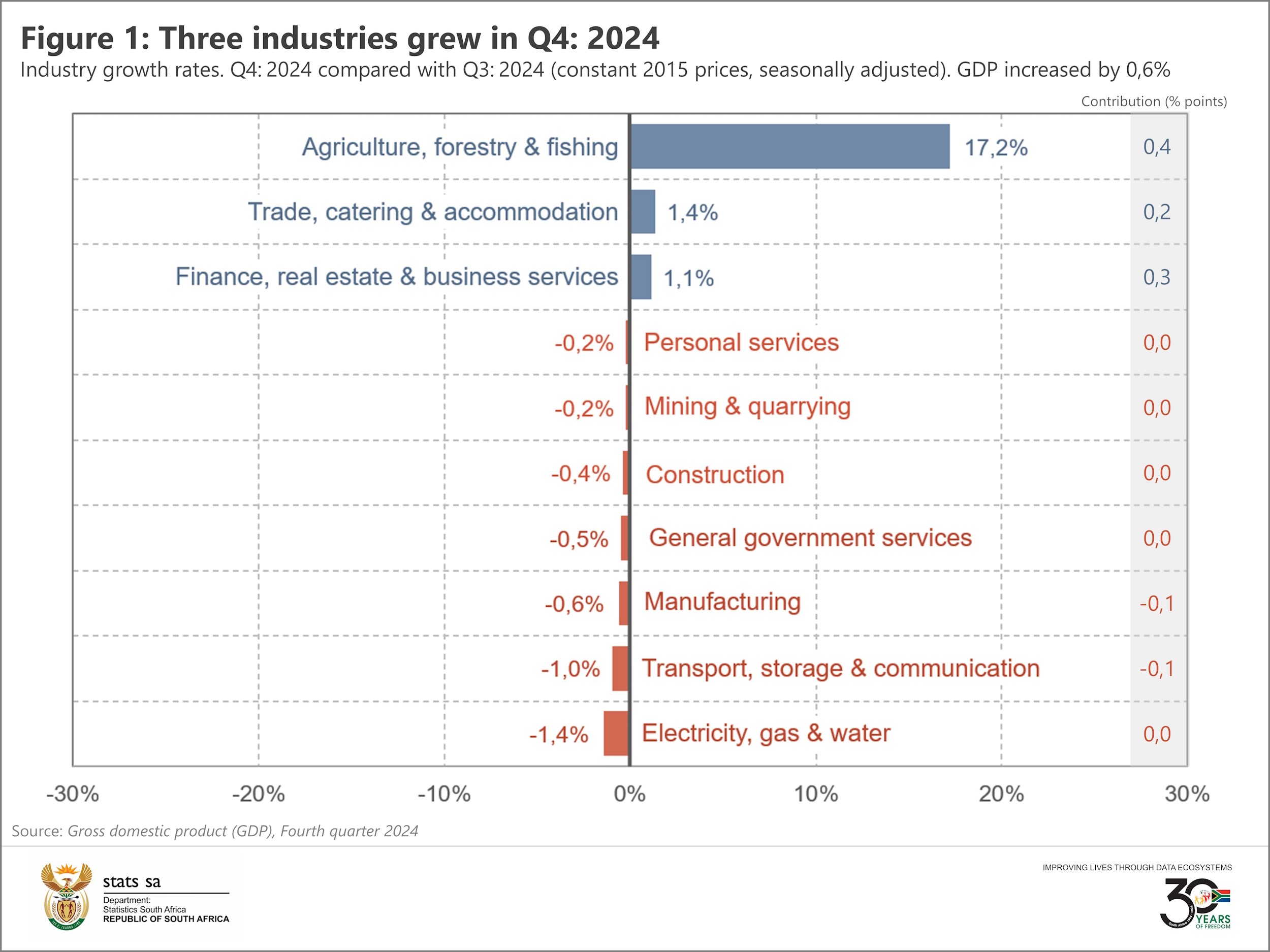

Holden said although some of the difficult trading conditions eased because of the reduction in interest rates, no load shedding and some reprieve in the fuel prices, this has yet to manifest itself in any significant improvement in consumer spending.

He said revenues in the group’s packaging division grew by 3.9% but this was more than offset by a 8.1% decline in advertising media and printing revenues.

“With no top line growth, it was extremely important to focus on sourcing of raw material inputs as well as managing operating expenses.

“Here the management team performed extremely well and managed to capitalise on pockets of well-priced raw materials and, with some improvement in the exchange rate, this positively impacted the operations performance,” he said.

Profit from operating activities after depreciation increased by 14.7% to R347.3 million from R302.8 million.

The group delivered an after-tax profit of R346 million, 23.5% higher than the R280.1 million achieved in the prior period.

Headline earnings per share improved by 12.3% to 95.5 cents from 85.1 cents.

Holden said Caxton does not expect any material changes to trading conditions in the run up to its June financial year-end.

“Our businesses are well poised for any uptick in consumer demand but the likelihood of that remains uncertain.

“The focus will continue to be to drive efficiencies, exploit pockets of market growth and look for the right acquisition opportunities.”

ALSO READ: Durban floods insurance claim gives Caxton a boost

Packaging and stationery

Holden said the stationery operations produced excellent results in the reporting period driven by the acquisition of the Tidy Files fixed assets effective 1 August 2024.

“The integration into our existing business is now complete and is exceeding our expectations.

“Operational costs have been well controlled and the focus is now on optimising ranges and stock levels.”

He said the packaging and stationery business improved performance despite limited growth in revenue at 3.9%.

He attributed this to excellent sourcing of raw material, improvement in production efficiencies and the continued focus on costs.

Holden said the quick service restaurant (QSR) market recorded overall declines in volumes, with certain customers performing better than others, adding it appears value meal offerings are a driver of volumes.

“It is encouraging to see continued growth in our new product offerings (cups, buckets and bowls) where we are looking at making further investments.”

He said the bag-in-box carton market experienced a shortage of white wine, which constrained volumes.

The company nonetheless managed to grow its share of the wine bladder market on the back of a long-term supply agreement with a major customer.

Holden said the beverage packaging offering progressed well during the period with the conclusion of a number of trials of new products and commencement of commercial production early in 2025, with volumes expected to grow over the calendar year.

“In line with this we have ordered further equipment to support this new business,” he said.

ALSO READ: Caxton acquires operations of Amcor Flexibles SA for R90 million

Newspapers and printing

The flagship asset of the newspaper and printing segment is The Citizen daily newspaper while the group also owns more than 120 free community newspapers countrywide.

Holden said The Citizen delivered a much-improved performance, with market growth in legal advertisements and cost reductions the main contributors.

He said national advertising revenues remained flat in the reporting period compared to the prior year despite good support from their traditional customer base, mainly grocery retailers.

Holden added that the newspaper and printing operations managed to gain support from non-traditional customers through innovative proposals and, encouragingly, they have seen an increased spend from financial institutions.

“While conditions remain tough, we are positive that the media proposals which include print, digital and activations will show some traction,” he said.

Holden said daily and weekly newspaper requirements continue to decline but this has been more than offset by growth in commercial printing where retail customers see the benefit of having access to a number of print plants around the country resulting in shorter lead times and reduced transport costs.

He said the revenues of the book and magazine printing operations remained flat but, following the restructure at the end of the previous financial year, the benefits meant profitability was maintained in line with the previous year.

Shares in Caxton closed unchanged on the JSE on Tuesday at R90.52 per share.

Disclosure: Caxton’s majority shareholders are also material shareholders in African Media Entertainment (AME), the owner of Moneyweb.

This article was republished from Moneyweb. Read the original here.