Bracket creep off the table – individual taxpayer burden effectively increased by R18bn.

Ordinary South Africans are walking away from the 2025 budget bruised and bloodied.

Government not only proposed an increase in the value-added tax (Vat) rate, but their income tax burden has increased by R18 billion.

The partial relief for bracket creep provided for in the original version of the 2025 budget has been wiped off the table. There will be no inflationary adjustment, not even for low-income households.

Nor is there any inflationary increase in medical credits.

But there will be above-inflation sin tax increases.

These tax proposals are designed to result in an increased tax collection of R28 billion for the 2025/26 tax year and a whopping R44.1 billion in the following year.

Despite massive resistance to any tax increases, Finance Minister Enoch Godongwana raised the Vat rate by 0.5%, effective 1 May this year, and another 0.5 percentage points in 2026.

ALSO READ: Budget 2025 VAT exemptions show Treasury’s disconnect with poor people

Tipping point

The expected collection from the Vat increase is R13.5 billion in 2025 and R15.5 billion in 2026.

Aneria Bouwer, senior consultant at Bowmans, says there is the possibility that these projections will not materialise because of the overall increased tax burden.

The South African Revenue Service (Sars) seems to recognise that there is a tipping point where increased tax rates do not equate to increased tax collections.

Bouwer also notes that the primary and secondary rebates have not been adjusted to provide for the impact of inflation.

Individuals also receive an annual exemption on all South African interest income they earn. It has remained the same for a few years.

The exemption threshold for interest has remained unchanged since 2013. The current threshold is set at R23 800 for individuals under 65 and R34 500 for individuals 65 and older.

“There is a general reluctance to increase certain thresholds, and because it is gradual it does have a substantial impact on taxpayers and their disposable income.”

Government thinking is that the higher income households will be bearing the brunt.

ALSO READ: Budget 2025 hitting consumers where it hurts: in their pockets

‘Low’ Vat rate

Gerhard Badenhorst, director in Cliffe Dekker Hofmeyr’s tax and exchange control practice, says Godongwana indicated in his 2025 Budget Review that 75% of the Vat collections come from high income households.

“That may be true but one needs to consider that these households can afford to pay the taxes.

“What is important is to consider that poor and low-income households spend a substantial proportion of their disposable income on Vat.”

They will feel the impact of the increase more than the richer households, he says.

Vat collections until 31 March are expected to come in at R460 billion, which is just under 25% of total tax collections. Time will tell if this percentage of total collections will increase because of the 0.5 percentage point increase in the rate, Badenhorst adds.

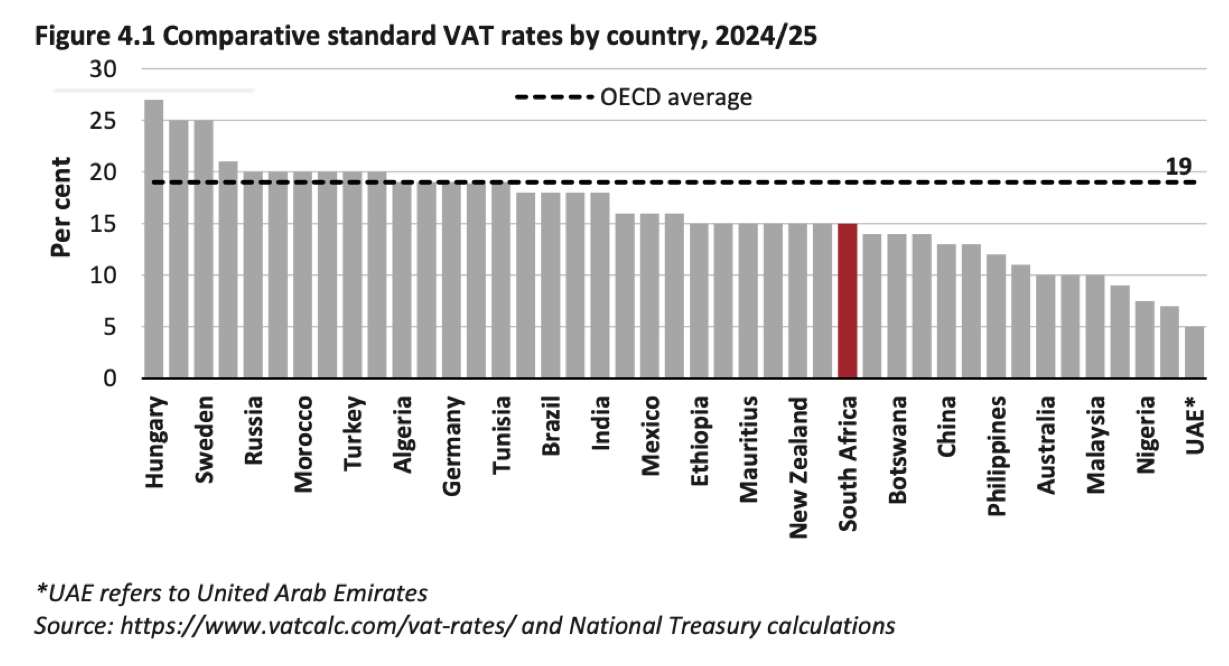

“The minister attempted to motivate the increase by referring to peer countries and comparing their Vat rates with that of South Africa. The average of the peer countries is 19% compared to our current rate of 15%.”

Source: National Treasury

Badenhorst warns against considering the Vat rate in isolation.

Botswana has a Vat rate of 14%, but its primary healthcare and education systems are exempt for Vat purposes. Our neighbour’s corporate tax rate is 22% compared to our 27% and their maximum marginal personal income tax rate is 25% compared to SA’s 45%.

Scandinavian countries have an average Vat rate of 25% but “virtually everything” in these countries is tax exempt.

“They have taken a policy decision to move away from direct taxes to consumption taxes. That is why their Vat rates are so high,” says Badenhorst.

“It is dangerous just to look at rates in isolation and then draw the conclusion that our Vat rate is low compared to other countries.”

ALSO READ: Budget speech hard on consumers with taxes

Smokes and drinks

South Africans will feel their tax burden further when they stock up on their smokes and drinks. Cigarettes and cigarette tobacco go up by 4.75% and alcohol products by 6.75%.

Tax Justice SA (TJSA) says these tax hikes will make life even harder for honest citizens while handing yet another victory to criminals.

“Instead of tackling the rampant illicit trade that is already robbing the fiscus of R100 billion every year, the government has chosen to punish law-abiding businesses and consumers, driving even more economic activity into the hands of criminals,” the organisation says in a statement.

“Minister Godongwana has ignored reality and chosen a path that will only worsen South Africa’s economic crisis,” says TJSA founder Yusuf Abramjee.

“Increasing Vat and sin taxes will not raise the revenue government hopes for. It will only boost illicit traders who operate with impunity while honest businesses struggle to survive.”

He says the budget fails to address the real problem – criminals who are looting the nation on an “industrial scale” in virtually every sector.

“Why is the government so quick to squeeze honest taxpayers but so slow to shut down the kingpins of illicit trade?”

This article was republished from Moneyweb. Read the original here.