The key question to be decided by the Durban High Court is whether Transnet was right to allow winning bidder ICTSI to use a different measure of solvency than other bidders.

It seems like a rarefied academic debate – how to measure company solvency – but in this case, it could decide whether Philippines-based International Container Terminal Service Inc (ICTSI) gets to run Durban Container Terminal Pier 2 or whether that honour goes to the losing bidder Maersk.

In July 2023, ICTSI was anointed the preferred bidder for a 25-year joint venture with Transnet Port Terminals (TPT) to run the Durban container port, which handles about 72% of Durban’s port traffic and about half of SA’s imports and exports.

That decision by Transnet was challenged in court by Maersk, which argued that the winning bidder ICTSI had been allowed to “pervert” (in the words of the court) its solvency calculation.

It was allowed to use market capitalisation rather than book value, as was the case for all other bidders, in determining company solvency.

This, on its face, appeared to some as a ruse by Transnet to fudge the figures and push ICTSI over the finish line.

Not so fast, argued renowned academic Brian Kantor, who came out swinging for ICTSI, pointing out in Business Day that Maersk’s market value in September 2024 was 1.6 times its total debt, while ICTSI’s was 3.6 times.

“If the company is listed, its market value is clear and explicit and continuously available,” writes Kantor, who has since provided an affidavit for ICTSI.

ALSO READ: ‘Spurious’ legal battle over Durban port threatens SA economy

“The book value of a private company might be the best initial and readily available estimate of what the assets might realise, assuming the accountants for the firm have [been] following recommended good practice and have been consistently marking the books to market.”

Judge Robin Mossop of the Durban High Court last year interdicted Transnet from proceeding with the contested bid pending the hearing of Part B of Maersk’s application seeking to have the contract with ICTSI set aside.

That part of the case will be heard this month and will lean heavily on the opinions of expert testimony from both sides.

Professor Harvey Wainer weighs in on behalf of Maersk, arguing that the use of equity to assets in measuring solvency is nonsensical.

ALSO READ: Court decision delays revamp of Durban container port

Kantor’s view

Kantor has an entirely different view: “Book values are the sum of the capital invested in a company as recorded in its books. Market value is the value attached to the firm by investors,” he deposes in his affidavit.

The former measure is decided by accountants, the latter by market forces.

APM Terminals, owned by Maersk, argued in its court papers that ICTSI could only manage a solvency ratio of 0.24 against the minimum 0.4 demanded by Transnet when measured on the same basis as other bidders.

Transnet countered that the solvency was just one measure, and a non-critical one at that, in choosing the preferred bidder.

ALSO READ: Filipino ports giant ICTSI fights for its Durban port deal

There’s no single measure of solvency

It turns out that there are many different ways of measuring solvency.

Transnet turned to accounting experts for guidance and one of them, Professor Warren Maroun at Wits University’s School of Accounting, pointed out that there is no single way of calculating a solvency ratio, though he conceded that “it is common for financial ratios to be calculated using book values”.

“The issue is not whether there are different ways to calculate solvency. There probably are different ways. The issue is that Transnet required the solvency ratio to be calculated in a specified way,” declared Judge Mossop.

Maroun also added that market capitalisations “are not referred to explicitly in mainstream sources dealing with the solvency ratios”. A similar opinion was offered by Mettle Corporate Finance.

Kantor says he was astonished at the court action taken by Maersk on the basis of how solvency was calculated. A common tool for determining company default risk is the Bloomberg Model, which uses the market value of assets of a company as the basis of its assets-to-debt ratio.

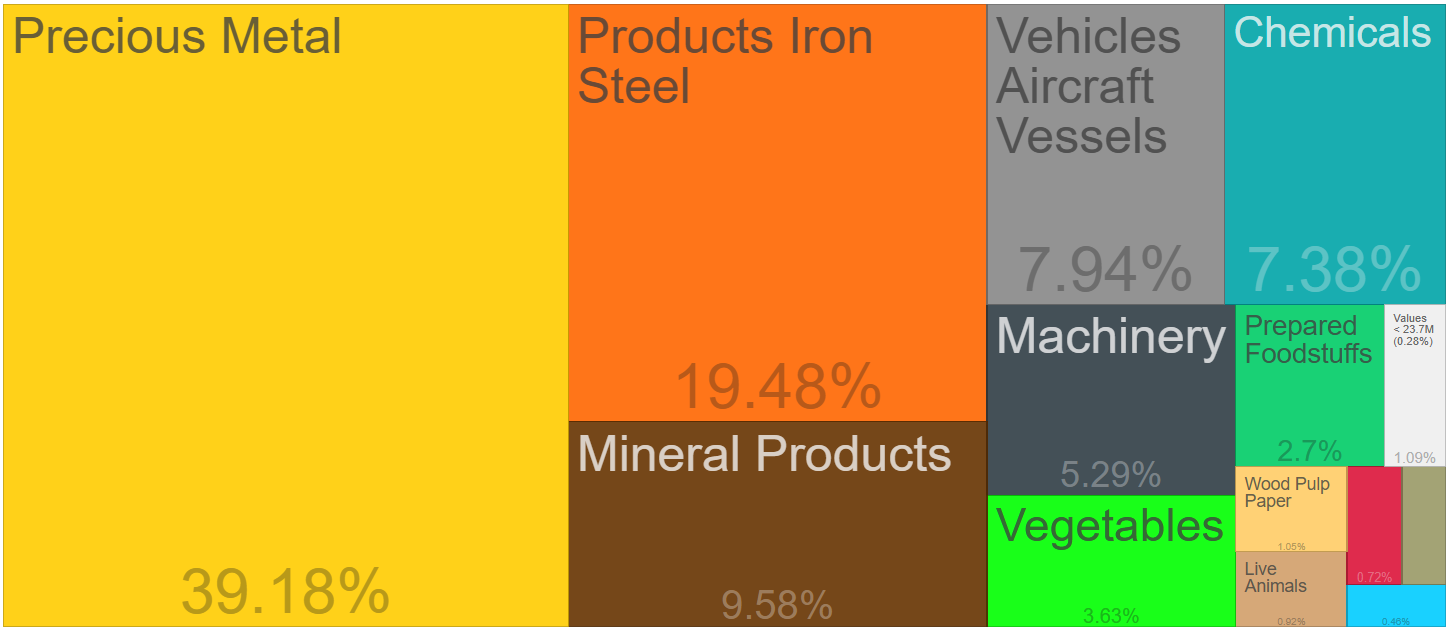

Using this measure, both ICTSI and Maersk have a very low risk of default – “almost equivalently so – though lower for ICTSI”, says Kantor, who then presents the following graph showing the probability of default of both companies.

Source: Brian Kantor affidavit

Kantor then presents a list of the JSE Top 40 companies to highlight the point that these two measures are often worlds apart, varying from 0.4 (price-to-book) for Sasol to 15.07 for Clicks.

The range of price-to-book values for the S&P 500 is even wider, varying from 63 for Apple to 1.34 for Bank of America.

ALSO READ: Transnet’s privatisation of Durban container port needs a do-over

Using other accounting measures, both companies again come out roughly equal:

- Earnings before interest to interest expense comes to 4.2 for ICTSI and 4.5 for Maersk;

- Return on assets (9% for ICTSI and 4.3% for Maersk); and

- Market value-to-debt (1.57 for ICTSI and 2.9 for Maersk).

The only metric where Maersk scores significantly better than ICTSI is debt-equity (2.4 times for ICTSI and 29.5 for Maersk).

The market value of a company can be considered to be the present value of a flow of operating profits, after costs, to which the owners are entitled. Kantor concludes that a company’s market value should be treated with respect since this is the price rational investors have placed upon it. “It reveals a temporary consensus about the worth of a company,” says Kantor.

Transnet points out that ICTSI agreed to inject R11 billion in port upgrades to revive the Durban port, which is rated one of the worst in the world by the World Bank.

Its bid was about R2 billion higher than Maersk, a far more important consideration in determining the winning bidder.

This article was republished from Moneyweb. Read the original here.