picture: x

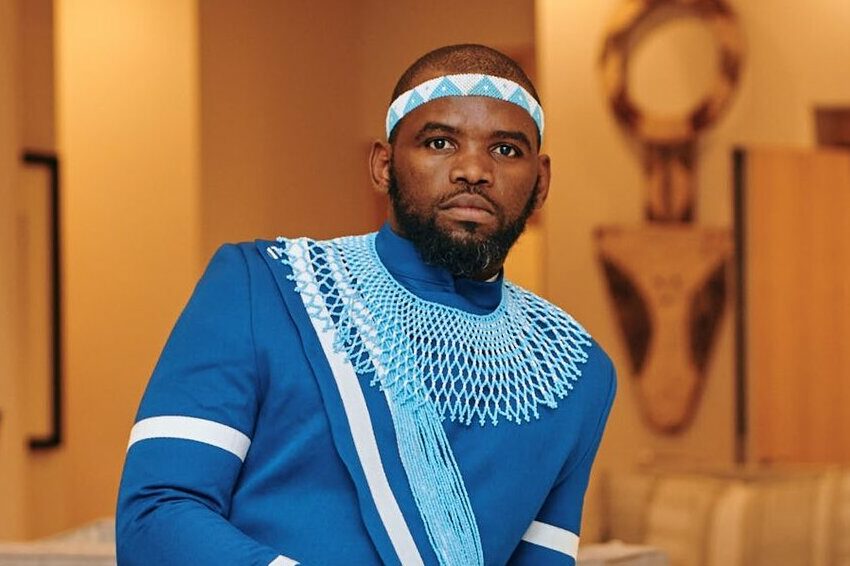

The 2025 Budget Speech was delivered by Minister of Finance Enoch Godongwana, March 12, 2025, at the National Assembly in Cape Town.

According to the speech, the budget remains committed to a balanced fiscal strategy, with a projected budget primary surplus of 0.5% of GDP in 2024/25, growing to 0.9% in 2025/26.

The budget speech was postponed in February due to disagreements within the Government of National Unity (GNU) over proposed budget measures, particularly a contentious 2% increase in Value-Added Tax (VAT).

Additionally, the government cited “funding challenges” as a reason for the postponement, requiring further deliberations to take place on the budget.

President Ramaphosa acknowledged the concerns raised by the postponement, emphasizing the importance of addressing the concerns of various stakeholders and ensuring transparency and accountability in the budget process.

The speech outlined the government’s priorities, including allocating financial resources to support economic growth, job creation, and social development.

However, the speech also acknowledged the challenges facing the South African economy, including lower commodity prices and structural constraints, which have impacted growth.

The proposed 0.9% VAT increase, which will be implemented in two stages – 0.5% in 2025 and another 0.4% in 2026, is expected to generate an additional R75 billion in revenue for the government over the medium term.

This increase aims to help reduce the country’s budget deficit and stabilize public debt.

However, there are concerns that this increase could have a negative impact on the economy, particularly on low- and middle-income households, who spend a larger portion of their income on VAT-inclusive goods and services.

The increased cost of living could lead to reduced consumer spending, potentially slowing economic growth.

Key impacts on the economy:

– Increased Revenue: The VAT increase is expected to generate significant revenue for the government.

– Reduced Consumer Spending: Higher prices due to the VAT increase could lead to reduced consumer spending.

– Impact on Low-Income Households: The increase could disproportionately affect low- and middle-income households.

– Economic Growth: The VAT increase could potentially slow economic growth.

South Africans took to X(previously known as Twitter) to share their views.

One user said South Africans are not angry enough, they should be like Kenya and take it to the streets to show they reject this increase.

We South Africans needs to take to the streets and demand for President Cyril Ramaphosa to Resign like the people of Kenya 🇰🇪 they rejected the Budget Bill that could effect cost of living and demanded for Ruto to go, We not angry enough and it’s disturbing #BudgetSpeech2025 pic.twitter.com/fhPdd1WD3z

— IG:Joy-Zelda (@joy_zelda) March 12, 2025

Another one mentioned that we are too relaxed as a country, we need to protest.�

Nah guys we need to protest, we are too relaxed as a country. 💔#BudgetSpeech2025 pic.twitter.com/S7hLYPTgB6

— ……. (@Peaches8Just) March 12, 2025

Also see: ‘2% VAT increase proposition is too much’ – Mzansi on SA government