Mzukisi Ndara bought a used car but was charged for a new one, as well as extras he did not want. He’s written a book about it, and vows to fight on – arguing that under common law, ‘fraud unravels all agreements’.

In November 2004, former Department of Health communications executive Mzukisi Ndara bought a used 2004 Nissan X-Trail but was charged for a new one – as well as extras he didn’t request.

He asked WesBank to cancel the sale as it was based on what he says were fraudulent misrepresentations, but the bank refused.

He’s been fighting the case for 20 years – at an astonishing personal cost.

He was blacklisted, had his credit facilities revoked, lost two houses as a result, and was forced to resign from his government job. He also lost his wife, which he says was largely due to the depression she suffered from the family’s deteriorating financial position.

ALSO READ: Have a complaint about your bank? This is what can go wrong and how you can resolve it

Lengthy legal battle

The case that has likely cost millions of rands for both sides has wound itself from the Eastern Cape High Court – which ruled in 2015 that his claim had prescribed (run out of time) – to the Supreme Court of Appeal and then to the ConCourt, all of them agreeing with the high court decision.

The Prescription Act sets a time limit of three years to bring an action of this nature, to which Ndara responds he only became fully aware of all the facts in 2013 – in which case his claim against bank had not prescribed.

In August this year, the Constitutional Court dismissed Ndara’s appeal against this judgment, ruling in favour of WesBank and Weir Investments, the motor dealer.

Now Ndara has applied once again to the ConCourt to have the earlier high court decision rescinded.

It hasn’t all been one-way traffic in WesBank’s favour in the courts.

In 2014, the Eastern Cape High Court dismissed WesBank’s application to have the matter dismissed.

Then in 2018, Judge Buyiswa Majiki set aside an earlier ruling by the same court that had dismissed Ndara’s leave to appeal, which had been obtained in Ndara’s absence.

What is perhaps most astonishing about this case is that it has dragged on for close to 20 years and could not be resolved by other means.

Asked to comment, WesBank head of marketing and communication Lebogang Gaoaketse, says: “WesBank welcomes the ruling by the Constitutional Court, which affirms the bank’s position, denying the allegations made by Mr. Ndara. The matter was tested in various courts, including the apex court in the land, and all have dismissed his claims.

“We will continue to oppose or defend any action or application brought by Mr Ndara.

ALSO READ: Here’s what you can learn from the most common banking complaints

Banks don’t like losing

Every bank has disgruntled customers who litigate their gripes online.

There is little dispute that banks generally win against customers who take them to court.

Even where the merits of the case would seem to favour the customer, the banks win by running up legal costs that force their clients to abandon the fight.

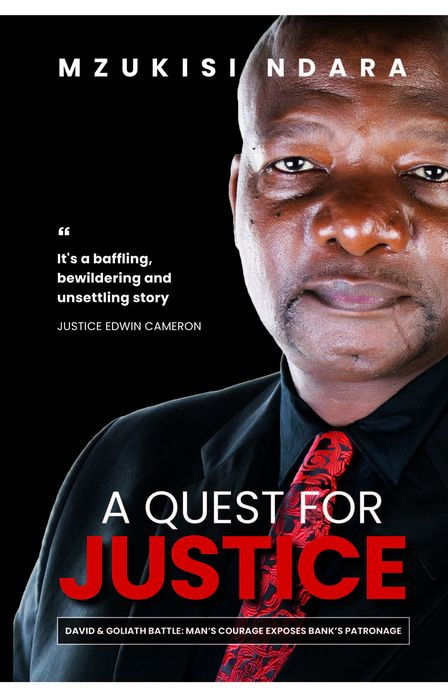

But Ndara isn’t done yet. He self-published a 400-page book, A Quest for Justice, in which he details the calamitous consequences of this bungled car purchase.

What is startling about this book is the endorsements Ndara has received from some heavyweight legal minds.

A Quest for Justice by Mzukisi Ndara. Image: Ndara’s Facebook page

“Your account is truly a Dickensian tale of the law’s delays and obscurities, of lawyers and journalists’ evasions, with very occasional light points of courage, loyalty and competence,” writes retired ConCourt Judge Edwin Cameron, adding that the story is “baffling, bewildering and unsettling”.

And former public protector Thuli Madonsela: “Your story needs to be told for business and government to understand they can’t keep turning a blind eye to their people who believe the end justifies the means regarding profit making.”

ALSO READ: Banking Ombudsman puts R25 million back in consumers’ pockets

Merits of the case ‘yet to be argued’

Throughout his ordeal, Ndara placed his trust in the constitutional right to have his case heard before a competent court.

He has been defeated on technical points (such as prescription), but argues that the merits of his case have yet to be argued.

Unless someone stands up and fights for the rights of consumers, he says the abuses he alleges he suffered will continue as a matter of routine.

“I may have been induced into a vehicle sale contract tainted with fraudulent misrepresentations, but how that affected every facet of my life is a legitimate question to ponder,” he writes in A Quest for Justice. “After all, I was complicit in this whole episode, having signed documents without applying my mind.”

He may not have applied his mind, but that, he argues, does not exonerate the bank or the dealership.

At the time, they were bound by the Credit Agreements Act – which preceded the National Credit Act of 2007 – and which held credit grantors liable for “any act, omission or representation”.

The car sale was strewn with misrepresentations, he argues in his court papers.

ALSO READ: New ombud scheme will handle complaints about insurance, banking and credit

The sale

He was sold a “new” 2004 Nissan X-Trail for R297 990, which included extras valued at R35 340, and was charged interest at 15.25% – which was prime plus 4.5% instead of the prime less 2% he was entitled to as a senior government executive.

The Nissan was actually a demonstration model with several thousand kilometres on the clock, and should have been discounted to R270 000.

The offer to purchase agreement contained only one signature, that of the dealer representative.

This was no oversight, Ndara alleges, but rather part of “fraudulent connivance”.

He was later told by the dealer the R35 340 extras he was charged were a mandatory requirement from WesBank, but later found out this was untrue.

There were several offers to “reload” the contract at a lower interest rate, but Ndara insisted on the instalment sale agreement being cancelled on the grounds of fraudulent misrepresentation.

In 2007 he was sent a restructured instalment sale agreement and told if he didn’t sign it, the car would be repossessed and he would be liable for the full outstanding balance.

Under threat of repossession, he signed the restructured agreement.

He further alleges that his trade-in vehicle, a Nissan Almera, had an outstanding balance of about R141 000 that was paid over to Absa, yet he continued to be charged by WesBank for both vehicles.

He then discovered he had been blacklisted by WesBank in 2007, a fateful event that cut off access to credit from all banks.

He was then forced to sell two houses he owned with his late wife in East London.

ALSO READ: Banking scams are increasing – here’s how to protect yourself

‘Fraud unravels all agreements’

Despite his losses in court over the years, Ndara vows to fight on.

He argues that under common law, fraud unravels all agreements.

“Very few people in my circumstances have fought their cases all the way to the ConCourt as I have done, but I believe I must do it, and I must win, for the rights of ordinary South Africans suffering abuses from the banks,” Ndara told Moneyweb.

This article was republished from Moneyweb. Read the original here.