It is enough to make you weep when you read how much better off South Africa could have been with economic growth of 4.5%.

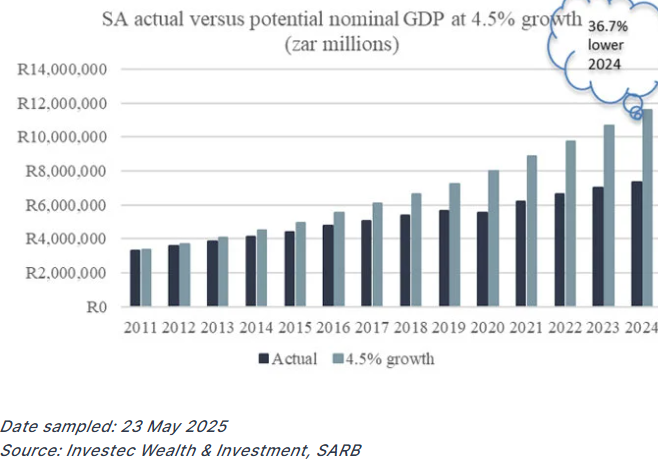

If South Africa had sustained an economic growth rate of 4.5% per year, in line with its emerging market peers, its GDP would have been just under R12 trillion in 2024 instead of the actual R7.5 trillion.

Government revenue could also have been around R800 billion higher than it is.

Investment strategist at Investec Wealth and Investment International, Osagyefo Mazwai, notes that although South Africa has grown over the last 15 years, averaging economic growth around 1% a year, the population has grown at a higher rate of around 1.3%.

He points out that there has been a structural break in South Africa’s economic performance compared to the rest of the world, with a stark dislocation in gross domestic product (GDP) per capita.

“In essence, people are worse off than they were in 2010, suggesting that economic policy has been ineffectual in addressing poverty, unemployment and inequality.

“On a per capita basis, the rest of the world is 50% richer than the average South African. Growth of 1% will not lead to the envisaged goals of lifting people out of poverty and meaningfully addressing the problems of unemployment and inequality.”

This chart compares nominal GDP over the period with what it would have been if the South African economy grew at 4.5% a year to illustrate the point on the opportunity cost of foregone growth in policy formation and execution:

ALSO READ: Experts say no way SA can achieve economic growth of 3% this year

How does economic growth of R12 trillion sound?

Mazwai says if the economy grew at 4.5%, South Africa’s nominal GDP would have been just below R12 trillion in 2024, a significant number, especially considering the benefits that could have been derived from a vastly larger GDP.

He points out that South Africa’s economic growth rates similarly had an effect on government revenue.

“Government revenue in 2024 alone could have been around R800 billion higher, while just a few weeks ago, South Africa faced a budget impasse due to a shortfall in funding, needing to raise R75 billion in the medium term to cover the shortfall.

“That shortfall is insignificant considering how much more could have been raised had the economy grown more in line with emerging market peers.

“The cumulative figure of revenue foregone is scary, at around R5 trillion over the last 15 years.

“That is material, considering the fiscal constraints facing South Africa and demonstrates the need to ensure economic growth to boost the fiscal war chest and further enable the capacity of the state to deliver services.”

ALSO READ: IMF’s bad news about economic growth for SA, thanks to Trump tariffs

What economic growth of 4.5% could have meant

Mazwai says these statistics put this into perspective:

- The R5 trillion lost would be enough to clear almost 90% of South Africa’s gross national debt and bring the debt-to-GDP ratio down to just below 10%, compared to the currently expected 77% ratio this year.

- Eskom needs R390 billion over the next decade for transmission lines, a fundamental pillar of creating greater capacity in the energy sector. Electricity is the backbone of any structural improvement, especially considering the government’s goals to build domestic manufacturing capacity and create meaningful employment opportunities. The R390 billion would be a drop in the ocean had growth been 4.5% over the last 15 years.

- Transnet needs R160 billion to upgrade rail and port infrastructure. Our logistics networks are key in connecting the economy across its internal nodes, but also key in building additional capacity to meet the demands of external markets. Again, R160 billion would have been a drop in the ocean had growth been in line with our peers.

- Eskom has debt of R400 billion. With economic growth at 4.5%, the government could have bailed Eskom out 12 times.

- Transnet has a debt of R140 billion, and the government could have bailed out Transnet many times, too.

- Social grants will cost the fiscus around R266 billion this year. With economic growth of 4.5%, these would have been more than affordable and potentially materially higher than what marginalised citizens receive now, also considering that many more people would have been absorbed into the labour market.

ALSO READ: Fourth quarter GDP improved but economists say its still not great – here’s why

With higher economic growth, South Africa would have functioned better

Mazwai says these statistics are significant because they show how South Africa could have been in a better position to address the prevailing needs of the state. “Granted, if the economy was growing at 4.5% the assumption is that Transnet and Eskom and some of the other structural enablers of the economy would have been functioning properly.

“The numbers indicate the potential for vastly greater capacity to invest in the productive elements of the South African economy, such as in infrastructure, education, healthcare and the salaries of teachers, nurses and doctors.”

He also notes that business confidence has been unusually correlated with the performance of state-owned enterprises (SOEs) in the post-pandemic environment, and therefore, SOE reform momentum must be sustained or increased.

“Business confidence is the key leading indicator of economic growth and employment creation. The unemployment rate would be closer to around 20% compared to the current 32.9% had the economy been growing at 4.5%.

“In other words, a third of those presently unemployed, according to the narrow definition of unemployment, would have jobs.”

ALSO READ: Absa foresees economic growth of 2.1%, but Trump and budget can disrupt it

But there have been some victories so far for the economy

However, Mazwai says none of this should detract from some of the victories seen of late, such as:

- The formation of the government of national unity (GNU) and subsequent political stability and increased policy certainty, although the recent budget impasse showed that these are nonetheless fragile.

- The increased momentum of Operation Vulindlela in addressing the various structural impediments in the economy. The next steps are critical for addressing water infrastructure and local government inefficiencies.

- Improvements in the electricity supply and logistics network.

Mazwai says there has been some stagnation in the recovery of SOEs, which may be cause for concern, although the worst of SOE performance appears to be behind us. However, he says a reacceleration in trend improvement is important for business confidence to grow.

ALSO READ: Economic activity still moving sideways but optimism increases

Recovery in PMI could mean higher economic growth

“We recently saw a modest recovery in the S&P Global Purchasing Managers Index (PMI), to a neutral level of 50. There must be a trend improvement in PMIs, which are typically linked to economic outcomes.

“Should PMIs continue to improve, the economy should continue on its path of recovery. This will likely be driven by the continued success of Operation Vulindlela.”

Looking at GDP projections, Mazwai says data released so far suggest that while growth was likely weak in the first quarter, a persistent upward trend in PMIs can result in a marked acceleration in growth outcomes.

“PMI improvement will largely be a function of continued improvement in SOE performance. At present, the economy, by our estimates, is tracking at 1.3% for the year, which is well above the 0.6% seen in 2024 and 0.8% in 2023.

“This can then lead to more meaningful employment creation and a trend reversal in GDP per capita from the pattern of decline since 2011.”

ALSO READ: World Bank has simple answer to improve South Africa’s economic growth

What SA can do to keep momentum going to grow

He suggests that South Africa follow these steps to keep the momentum going and put South Africa on a firmer growth trajectory:

- There must be a focus on economic growth, premised on “growing the pie”. “There is no scarcity problem in South Africa, and we must rather adopt an abundance mindset, which says there are enough resources to drive transformation through economic growth. These should be in conjunction with policies that support the constitutional obligation of redress and equality, but premised on growth enhancement.”

- Liberalisation of the economy should be a key focus area to enable the structural elements of the economy. “Deregulation is an essential pillar of the process.”

- Operation Vulindlela must remain at the centre of driving economic reform to achieve the objective of inclusive economic growth.

- Policies must prioritise an investor-friendly environment in South Africa as a mechanism for increased foreign investment and improved employment outcomes.

- Public-private partnerships are another area that can catalyse the economy. The private sector has sufficient capital, while a conducive operating environment that is supportive of strong returns can drive meaningful economic growth.

- Education must be at the centre of societal development to ensure that the next generation of entrepreneurs is upskilled and enabled for longer-term economic success.

- A re-industrialisation policy must take advantage of the advantages embedded in the economy in a business-friendly environment. “Building domestic capacity is at the core of the job creation agenda.”