South Africans are becoming good at finding ways to deal with the cost-of-living crisis by cutting costs.

Everything is getting more expensive while our salaries do not keep up. This means the consumer class needs to cut costs to make ends meet. Some find a second income stream while others cut their entertainment costs.

When Finance Minister Enoch Godongwana eventually delivered his budget speech in March, the nation wondered if the government of national unity (GNU) was really grabbing the country’s cost of living crisis by the horns and wrestling it to the ground.

“Concerns about the impact of value-added tax (VAT) increases over the next two years, increasing costs of debt servicing and the lack of decisive strategies to tackle rising consumer costs suddenly appeared,” Brandon de Kock, director of storytelling at BrandMapp, says.

“By the fourth quarter of last year, South Africa’s consumer confidence index was at -6 points. It is not the worst ever of -36 points in 1985 and far from the best at 26 points in 2018. But it is a notable recovery from the recent pandemic lows which fell to -33 points in 2020.

“Take a step back and it is a clear indication of the resilience of South Africa’s consumer class who have quite a few tools at their disposal to deal with the rollercoaster of life.” (Consumer confidence plunged to -20 again in the first quarter due to the proposed VAT increase.)

ALSO READ: Running out of money? Here are tips to cut your living costs

Insights into how consumers are cutting costs

The latest BrandMapp survey, that tracks the behaviour and sentiments of South Africans living in households with disposable incomes, from R10 000 per month to the millionaire class, provides insights into how the consumer class tackle the financial management of their households.

The consumer class is defined as adults who can freely buy goods and services above their basic survival needs.

Despite the sluggish economy and the cost-of-living crisis, De Kock says, according to the latest National Treasury data, the consumer class in South Africa grew at about 7.5% last year, which means it outpaced inflation.

However, he points out, the growth of the consumer class is not spread evenly across the different income brackets. “If you divide the personal income earners of South Africa into the core consumer class earning between R10 000 and R30 000 per month, the top enders earning between R30 000 and R80 000 and the millionaires earning more than R80 000 or more per month, you start to see some interesting shifts.

“The core represented 56% of all taxpayers back in 2020, but now it only represents 46%. This means there is a significant increase in the top end with more than half of the consumer class, with 54% now sitting in the R30 000 to millionaire income brackets.

“While this is obviously not great for the country’s gini coefficient, it appears that while the rich are getting richer, the number of people earning relatively high incomes, living aspirational lives and driving potential growth seems to be increasing at an equally rapid rate.”

ALSO READ: SA consumers cutting electricity and food to survive cost-of-living crisis

What costs are the consumer class cutting?

The survey also considered what costs the consumer class is cutting. De Kock says when it comes to strategies to deal with the rising cost of living, BrandMapp’s survey shows that there is not much difference between mid-income and top-end earners, although middle-income earners are 50% more likely to consider getting a second job.

“Around a fifth of the consumer class are thinking of cancelling Dstv and spending less on alcohol and their mobile data packages, while less than 10% are thinking about cancelling some insurance and downgrading their medical aid.”

De Kock says it is interesting to see that some of the habits we learned during the Covid pandemic are hanging around, with 35% of the consumer class considering cutting back on clothing budgets and 31% saying they are likely to go out less to the movies and restaurants.

“All-in-all, with home grocery delivery, meals-on-wheels and streaming services, a mid-to top-income South African home is a comfortable place to be and we have learnt that staying home more in our trackie pants is a relevant cost-saving strategy.”

ALSO READ: Need extra money? Here’s how to reduce your living costs for the rest of the year

Cutting costs in different provinces

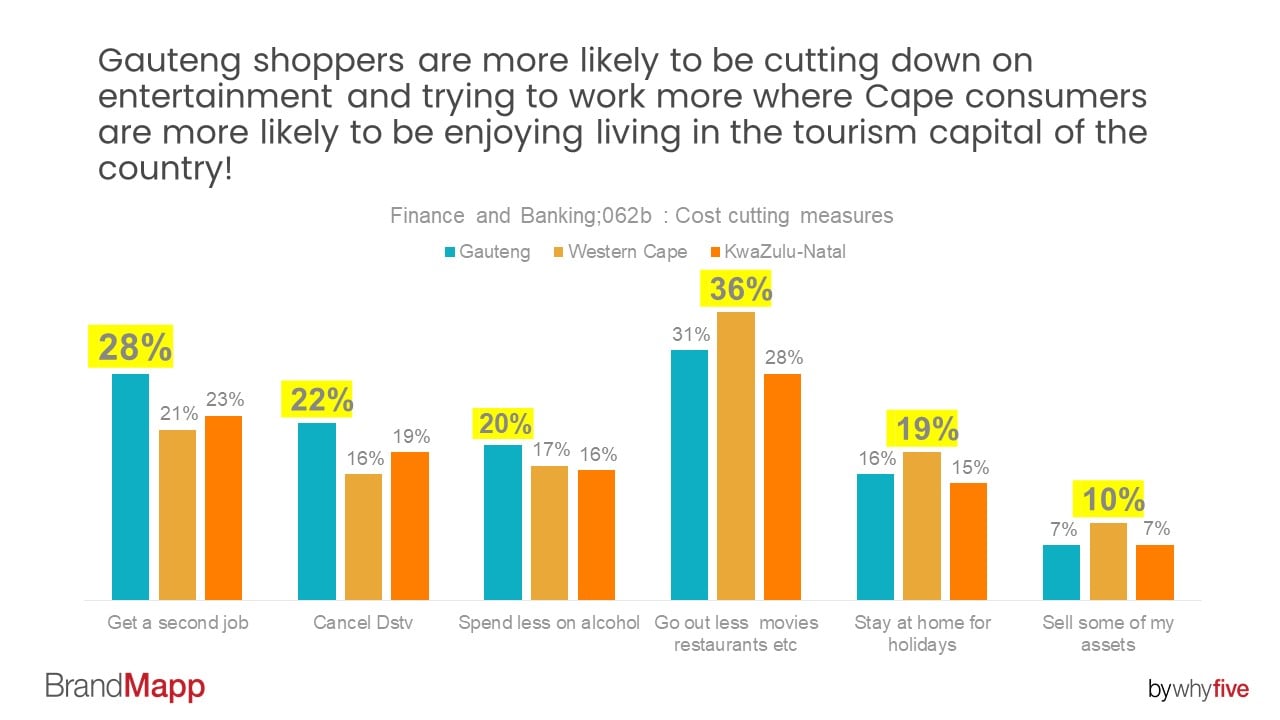

The survey also found that the province you live in shapes your cost-saving strategies. The top cost-saving strategies that Gauteng residents use include abstinence, working harder and cancelling legacy entertainment services, with 28% of the consumer class in the province saying they are open to taking on a second job, which outstrips their counterparts in the Western Cape (21%) and KwaZulu-Natal (23%).

Gautengers are also ahead of these two provinces with a whopping 36% of consumers saying they think about cutting back on alcohol and 22% consider living without Dstv. And while 31% of Gauteng respondents say they are likely to go out less to movies and restaurants, this is still less than the 36% of Western Cape residents who consider being more of a homebody as their top cost-saving strategy.

However, staying home for the holidays is a bridge too far for most Gauteng consumers, with only 16% prepared to entertain this idea, while 19% of Western Cape consumers are content to make the most of living in the country’s top tourism region.

ALSO READ: Take control and secure your right to financial security

How different generations are cutting costs

How the consumer class stretches their budgets also depend on the different generations. De Kock says not surprisingly, South Africa’s well-heeled boomers are the least likely to think about any cost-saving measures, while at the other end of the scale, Gen Z and Millennials are the most open to a wide range of ways to cut their expenses.

“What we see is that going out less to movies and restaurants, staying home more and cutting back on clothing budgets are major strategies across all generations, mirroring our Covid cost cutting habits.”

Millennials are the most likely to cut back on alcohol (24%), get a second job (30%) and spend less on clothing (38%), while Gen Xers are mostly likely to withdraw from their pensions (11%) and cancel Dstv (24%).

In addition, 36% of Gen Z hope that going out less to movies and restaurants will help get them through the month, while 29% consider staying home more and 28% think about changing where they shop to find the best prices.”

ALSO READ: ‘Under pressure’: South Africans struggling to keep up with debt repayments

Are men and women cutting different costs?

The survey also shows that there is a gender divide in cost-cutting, especially when it comes to clothes and alcohol. De Kock says there is an interesting story in the differences between the ways that women and men approach the cost-of-living crisis.

Women are 50% more likely than men to consider cutting their clothing budgets and changing where they shop for groceries. Men, on the other hand, are 50% more likely than women to think of cutting back on alcohol and withdrawing funds from their home loans. Women are also more likely to look for a second job than men and more willing to do their own house work.

However, across the board, lower prices win the day, according to the BrandMapp survey. When asked about their general shopping habits, 58% of South Africa’s consumer class say that they always look out for sales and discounts, De Kock, says.

“A total of 34% say that the lowest prices is the top factor when choosing where they shop, surpassing convenience, quality and value. The youngest consumers are most hooked on looking for the lowest price, with 39% choosing a store on this basis.”