More trust needed to improve tax compliance.

Taxpayers’ trust in the South African Revenue Service (Sars) has stagnated over the past 12 months, although the overall taxpayer experience when dealing with the government agency has improved.

Participants in the latest PwC Taxing Times survey note that the lack of knowledge by Sars staff has a massive impact on the trust they have in Sars. Some even feel “targeted” since they are audited every time they submit a return or assessment.

PwC director of tax controversy and dispute resolution Elle-Sarah Rossato says improved taxpayer trust is important. “It will eventually translate into restored public confidence, increased tax morality and ultimately the payment of tax.”

PwC has been conducting the survey since 2018. This year the report reflects the impressions of 206 corporate taxpayers across 17 industries. The survey was conducted from May to July 2024 and posed questions about the verification and audit processes, disputes, and Sars’s service delivery.

ALSO READ: Sars and taxpayers grapple with ‘bona fide inadvertent error’ clause

Getting better, but …

While there have been improvements in certain areas such as the finalisation of audits within shorter timeframes, there are still significant challenges. These include prolonged verification and audit processes, inconsistent service delivery, and a need to rebuild taxpayer trust.

“The survey highlights the importance of continuous improvement in Sars’s systems and processes to meet its strategic objectives and enhance the overall taxpayer experience,” says Rossato.

Jadyne Devnarain, PwC associate director, says the survey is a critical lens through which they assess whether Sars is living up to its promise of efficiency, transparency and trustworthiness.

“The feedback serves as a vital barometer of Sars’s performance, particularly in its efforts to modernise its systems, engage stakeholders and build public trust in the tax administration system,” she says.

ALSO READ: Sars releases 90% of reversed refunds following screening process

Verifications

There has been a sharp decline in the number of taxpayers believing it is “extremely likely” that they will be selected for corporate income tax verifications. It appears that Sars has narrowed its scope of selection criteria.

Almost half of the participants indicated that the verifications took between one and three months to complete. Another 27% of the corporate participants indicated that the verification process took between three and six months to finalise. This is an improvement from last year’s 34%.

Around 8% experienced turnaround times of 12 months and longer compared to 17% in 2021. While there has been improvement from 2021 to 2024, the increase in prolonged verifications shows a decline in Sars’s efficiency when dealing with verifications in 2024 compared to 2023. In 2023, only 3% of the participants waited a year or longer.

“Considering that a verification is a broad level review of a return, verifications should be concluded swiftly. We remain hopeful that the time periods in this regard are shortened even more in the year to come,” says Rossato.

ALSO READ: Was your tax refund reversed? Here is why

Vat and refunds

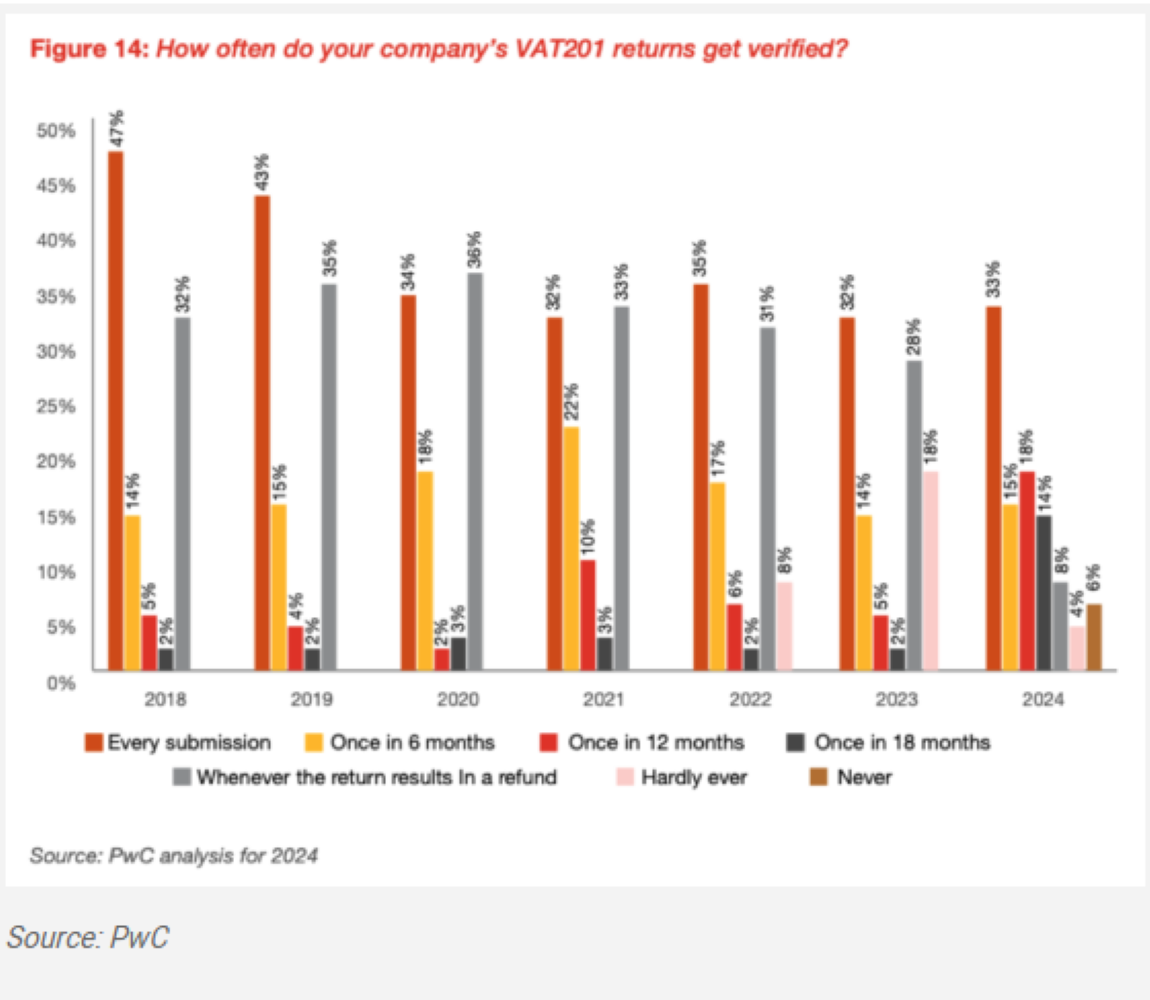

The risk around value-added tax (Vat) returns and fraudulently claimed refunds remains a sticky point between Sars and taxpayers, particularly the honest ones.

Advanced data analytics are employed to detect anomalies or patterns that deviate from the norm. For example, if a taxpayer’s Vat claim is significantly higher or lower than usual, or if it deviates from the industry average, the return might be flagged.

It does appear as if Sars is improving on the time it takes to verify a Vat return.

This year, 42%, compared to 40% last year, said their verifications were completed within 21 days. Only 2% of participants indicated that their verifications took more than 12 months to complete, compared to last year’s 4%.

There also appears to be improvement in terms of Vat refund payments. “We trust it will continue,” says Rossato.

ALSO READ: Waiting for Sars to answer? Taxman apologises for hours-long call centre delays

Complexity and compliance

Transfer pricing disputes have been gathering momentum over the past few years as tax authorities, including Sars, have built their audit capabilities in this area.

However, there has been a migration away from the courts towards settlement processes.

This may point to an improved climate for settlements and parties’ reluctance to go to court over transfer pricing disputes.

These matters are highly technical, complex and expensive. There has been an increase in the number of unresolved transfer pricing audits from 7% in 2023 to 18% in 2024.

Although there has been an increase in the number of participants who found it easier to comply with their tax, 46% of participants “disagree” and “strongly disagree” that it has become easier. “This may imply that taxpayers find Sars’s systems or processes too difficult to understand or to navigate.”

Participants note that while the eFiling system is making compliance easier, tax returns are becoming more complicated. They also remark on the number of audits and requests for information that make it difficult to comply.

ALSO READ: Are you making money with crypto assets? Sars is looking for you

Penalties

This results in penalties due to incorrect interpretation of questions.

More than 40% of respondents perceived Sars to be aggressive when raising understatement penalties (USPs).

Sars is evidently hammering down on non-compliance, and as it increases its scrutiny of tax advisors, the consequences of non-compliance are becoming more severe, says Rossato.

This article was republished from Moneyweb. Read the original here.