Consumers spend R87.5 billion on retail sales since the beginning of 2025 and mostly paid for their shopping with credit.

South African consumers spent a whopping R19.6 billion in May on clothes and furniture, although momentum in the retail sector seems to be slowing.

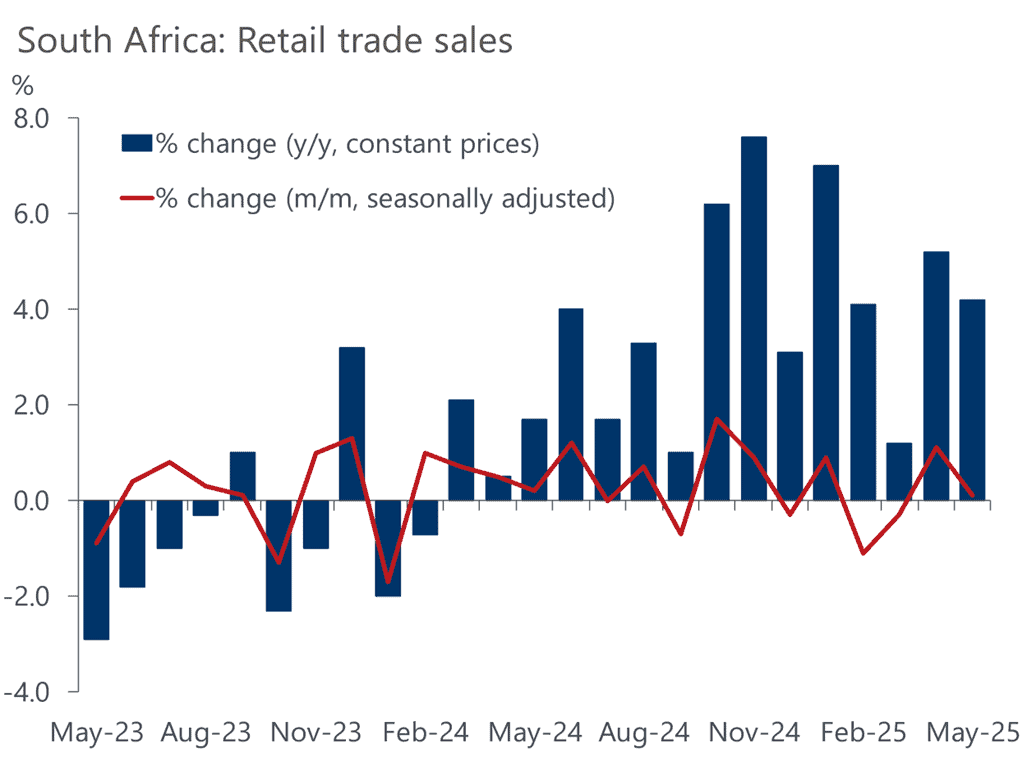

According to the retail trade sales numbers issued by Statistics SA today, retail trade sales, measured in real terms (constant 2019 prices), increased by 4.2% in May compared to May 2024.

The largest positive contributors to this increase were retailers in textiles, clothing, footwear and leather goods (12.5%) and general dealers (3.6%).

Seasonally adjusted retail trade sales increased by 0.1% in May compared to April after month-on-month changes of 1.1% in April and -0.3% in March. Retail trade sales increased by 3.5% in the three months ended May 2025 compared to the three months ended May 2024.

ALSO READ: How Shoprite made R20 million profit per day

But retail sales were flat for past three months

The largest positive contributors to this increase were again retailers in textiles, clothing, footwear and leather goods (9.5%) and general dealers (2.8%). Seasonally adjusted retail trade sales were flat in the three months ended May 2025 compared to the previous three months.

The largest negative contributors were retailers in food, beverages and tobacco in specialised stores (-2.2%) and textiles, clothing, footwear and leather goods (-0.4%). The largest positive contributors were all ‘other’ retailers (1.4%), retailers in hardware, paint and glass (0.7%) and general dealers (0.2%).

This chart shows that consumer demand has strengthened since early 2024, thanks to lower interest rates and favourable inflation:

ALSO READ: Index reveals consumers are willing to spend money, but not too much

No surprises in retail sales for May

Jee-A van der Linde, senior economist at Oxford Economics Africa, says there were no surprises in the retail sales numbers for May. “South Africa’s retail trade sales growth moderated in May in line with our expectations.

“We predict private consumption growth to remain a key driver of overall economic growth this year, underpinned by easier monetary policy and low inflation.”

Van der Linde points out that momentum in the retail sector seems to be slowing, with sales of 4.2% in May compared to a year ago after the 7.0% recorded at the start of 2025.

“Although we expect consumption growth to moderate over the coming quarters, households will remain a key driver of overall economic growth this year, underpinned by easier monetary policy and low inflation.

“We forecast a 25 basis points interest rate cut in the third quarter, followed by another incremental cut in the first quarter of 2026. Meanwhile, consumer confidence recovered during the second quarter, with middle- and high-income households – the most sensitive to interest rate changes – posting the strongest quarterly improvements.

“This latest data release aligns with our view of subdued economic activity in the second quarter, and we continue to forecast real GDP growth of 0.8% this year.”