Although Trump’s trade tariffs are causing major global policy uncertainty, the local impact will not be as bad as for countries like Canada and Mexico.

South Africa’s trade with the United States (US) is not big enough for Trump’s trade tariffs to tank the local economy, although it will hurt some sectors, such as citrus farmers and automotive manufacturers, as the country’s economy is stronger than it was when Trump levied his tariffs during his first stint in the White House.

And if the US wants to kick South Africa off the African Growth and Opportunity Act (Agoa) agreement, it will be cutting its nose to spite its face, says Professor Bonke Dumisa, an independent economic analyst.

He says in the same way that the US is weaponising the dollar against South Africa, the persistent noise about removing South Africa from Agoa is also meant to undermine the country’s economy, despite the fact that its membership was officially extended to the end of 2025 by the US federal government recently.

“My well-considered position is that the US will not remove South Africa from Agoa, unless they consciously embark on “cutting your nose to spite your face”. The Agoa legislation was deliberately well-crafted to be a win-win tool, and the US is not just a charity vehicle devised to do some African states a favour — far from it.

ALSO READ: Will Trump’s tariffs have major negative effect on South Africa’s economy?

Many US jobs will be at stake due to Trump’s tariffs on SA

“Over 120 000 US jobs are directly linked to Agoa. If the US emotionally removes South Africa, many of those 120 000 US jobs will be at stake. Agricultural products, especially our best South African wines, are well-liked by US consumers based on brand preference because they are good and not because they are ‘cheapies’.”

Therefore, Dumisa says, if the new US administration removes South Africa from Agoa, it will mostly negatively affect the US consumers by reducing their product choices, because South African agricultural products cannot be easily substituted by other products from other countries.

He also points out that the US automobile industry was effectively destroyed by US automobile industry stakeholders when they outpriced themselves from global competition. “If South Africa is emotionally removed from Agoa, this will not necessarily benefit the US automobile industry because the wide range of international car brands (including US, German and Japanese car brands) that South Africa sells to the US are cars US consumers like because they are high-quality cars at value-for-money prices.”

ALSO READ: South Africa will pay the price for Trump’s tariffs

Size of US/SA trade shows how Trump’s tariffs can affect SA

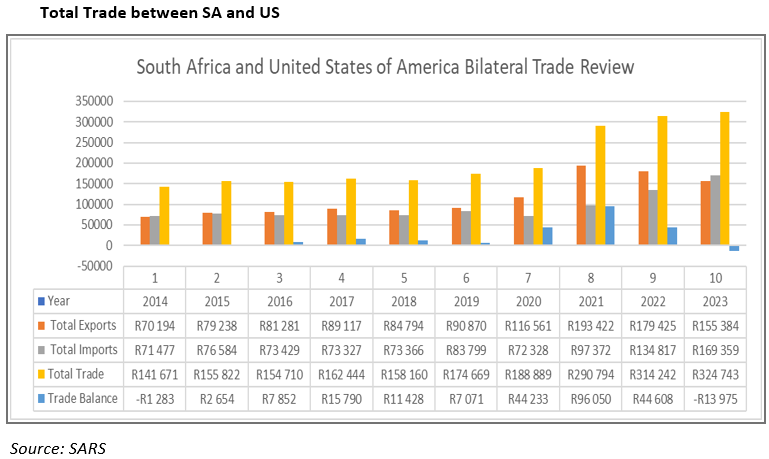

According to the Department of Trade, industry and Competition, bilateral trade between South Africa and the US amounted to $17.6 billion in 2023, down from $19.1 billion in 2022 and $19.7 billion in 2021.

South Africa’s exports to the US declined to $8.4 billion in 2023, from $10.9 billion in 2022 and $13.1 billion in 2021. This decline was seen in products such as platinum, ferroalloys, centrifuges and nickel.

Meanwhile, US exports to South Africa increased to $9.2 billion in 2023, from $8.2 billion in 2022 and $6.5 billion in 2021. The increase was driven by products such as petroleum oils and gas, helicopters and aeroplanes, automatic data-processing machines and tractors.

ALSO READ: Trump’s tariff threats will affect SA’s economy — experts

SA trade deficit with US for first time in decade

The department points out that for the first time in nearly a decade, South Africa experienced a trade deficit with the United States, amounting to $773 million.

South Africa’s key exports to the US include:

- Minerals and metals: precious metals, such as gold and platinum, industrial minerals, such as chromium and manganese and other metals form a substantial part of South Africa’s exports to the US.

- Automotive products: vehicles and automotive components, especially luxury vehicles, are significant exports under Agoa.

- Agricultural products: citrus fruit, wine, nuts and other agricultural products found a strong market in the US.

- Chemical products: organic chemicals and other related products.

Key imports from the US, on the other hand, are:

- Machinery and equipment: high-tech machinery, including agricultural and industrial equipment.

- Electrical machinery: components for telecommunications, computers and other electrical machinery.

- Pharmaceuticals and medical equipment: advanced medicines and medical devices.

- Aerospace products: aircraft parts and other aerospace-related components.

This graph shows the size of South African trade with the US over the years:

ALSO READ: South Africa can live without Trump

Trump’s tariffs will not be major blow to SA economy – economist

Johann Els, group chief economist at Old Mutual, also does not think Trump’s trade tariffs will be such a huge blow to the local economy. “The US has not yet imposed tariffs on us, and therefore, there is a risk that we might be pushed out of Agoa, but only about 2% of our exports go to the US under Agoa.

“If we are kicked off Agoa, the agricultural sector and the citrus farmers might be hurt, as well as the vehicle manufacturing sector. However, other than that, it will not have a huge negative impact on the economy.

“I think it will be more of an indirect effect through negative sentiment that will hurt us. Of course, if the US decides to institute direct tariffs and increases tariffs on goods from South Africa as they did with China, Canada and Mexico, it will also hurt us.”

ALSO READ: Trump picking on SA triggering spike in economic uncertainty – economists

Policy uncertainty due to Trump’s trade tariffs bigger threat

Els says the secondary story is that the policy uncertainty in the US, with Trump’s on-and-off way of doing things, creates lots of uncertainty in the US economy, as well as Musk cutting government employment.

“This creates uncertainty and could lead to the US private business sector holding back on investment plans. There is a lot of downside risk for the US economy and a US recession might affect the world.

“At least China is our biggest trading partner. China has a lot of potential to support the economy through tax cuts and extra government spending to protect the economy against the US recession or US trade tariffs.

“If China actually boosted our economy it will be a positive force. Our economy is also looking a little bit better than the previous time when Trump instituted tariffs on his trading partners in 2017 or 2018.

“The economy is looking a little bit better, and therefore, perhaps we are a little bit more insulated against these Trump policies this time around compared to the previous time.”