The MPC did not even consider a cut of 50 basis points. The decision to cut the repo rate by 25 basis points was unanimous.

The Monetary Policy Committee of the South African Reserve Bank decided at its meeting today to cut the repo rate by only 25 basis points, despite economists calling for a cut of 50 basis points.

After Statistics SA announced this week that the inflation rate for October decreased by a full 1% in October from September, economists said there were no inflation expectations to justify not cutting the repo rate by 50 basis points.

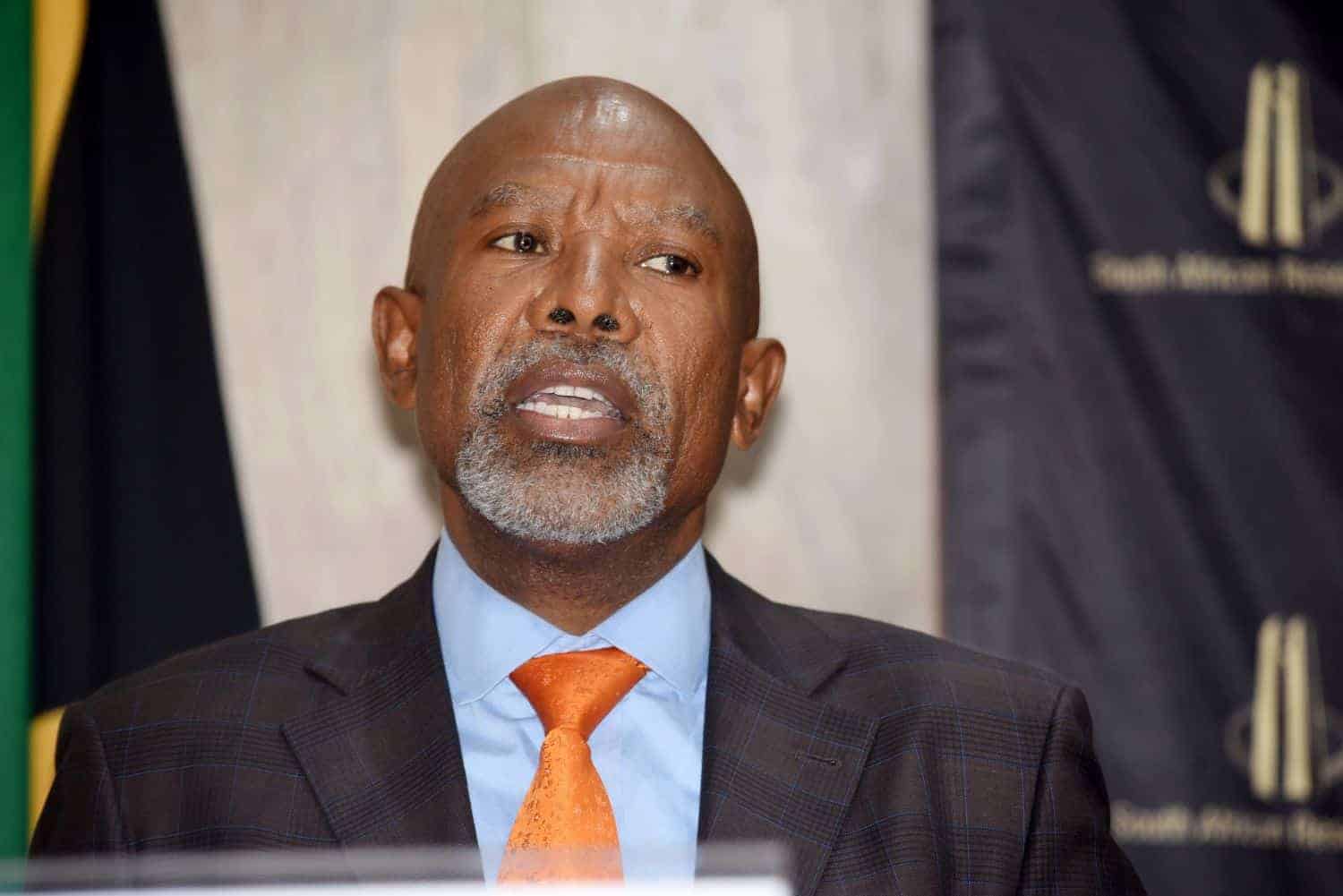

Lesetja Kganyago, governor of the South African Reserve Bank (Sarb) and the Monetary Policy Committee (MPC) didn’t seem to agree.

He said the global macroeconomic context has become more challenging since the previous MPC meeting in September, when the repo rate was also cut by 25 basis points.

“The dollar has appreciated against most currencies, including the Rand. Longer-term interest rates have increased in the US and across the globe. Short-term rate expectations have likewise shifted up.”

He added that, in general, monetary policy in major economies remains restrictive and headline inflation has slowed.

“While this has provided some room for major central banks to ease rates further over the past two months, new inflation pressures and heightened uncertainty suggest diminished policy space.

“With underlying inflation still above target in several economies, there are risks of policy reversals.”

ALSO READ: Repo rate expected to be cut again on Thursday, despite Trump’s win