If the transaction is approved, Ninety One will get access to Sanlam’s distribution network, while Sanlam will benefit from Ninety One’s strong investment culture.

London Stock Exchange and JSE dual-listed global asset manager Ninety One is set to acquire all the issued shares in Sanlam Investment Management (SIM), while Sanlam Group will, in turn, receive a 12.3% stake in Ninety One, the group said in a joint statement issued on Sens on Wednesday.

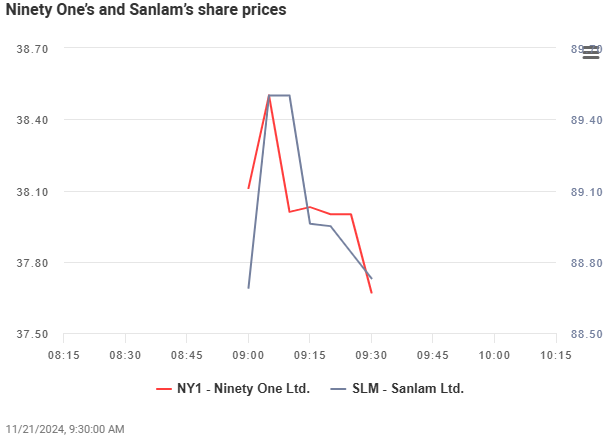

Ninety One’s share price initially strengthened almost 3% on the news, but by midday traded around 1% up. Sanlam’s share price also firmed around 1%.

In the joint statement, the two financial services giants announced a “long-term relationship” which will also include the following:

- Ninety One will be appointed as the primary active investment manager for Sanlam’s single-managed local and global products;

- Sanlam will appoint Ninety One as the permanent investment manager to manage assets for Sanlam Investments UK Limited, a wholly-owned subsidiary of the Sanlam Group; and

- Sanlam will serve as an anchor investor in Ninety One’s international private and specialist credit strategies that meet its investment requirements

SIM is currently wholly owned by Sanlam Investment Holdings (SIH) in which the Sanlam Group has an effective 65%.

Sanlam’s proposed 12.3% equity stake in Ninety One will be through a combination of Ninety One Limited and Ninety One plc shares, “thereby establishing the Sanlam Group as a long-term shareholder of Ninety One”.

The proposed transaction is subject to approval from shareholders and the regulatory authorities in South Africa, the United Kingdom, and any other applicable jurisdiction.

ALSO READ: Consumers bounce back as insurance policies increase

Rationale for the transaction

According to Ninety One, the proposed transaction could mean that it will gain preferred access to Sanlam’s distribution network, expanding its market reach through Sanlam’s established channels and into savings pools outside the normal reach of its brand.

The anchor investment will also enable Ninety One to accelerate the expansion of its international private credit offerings.

Hendrik du Toit, Ninety One founder and CEO, says Sanlam is a business with a powerful brand and significant scale in South Africa. “Our experience and expertise are complementary.”

Sanlam notes that its active asset management capability will be strengthened by the relationship with Ninety One.

“Over time, Sanlam anticipates that Ninety One’s investment culture and research processes will further enhance the competence of the current Sanlam teams … Sanlam purposefully selected Ninety One after identifying them as the pre-eminent South African active asset manager,” it adds.

Meanwhile, Denker Capital CEO Shane Tremeer, clarified that the boutique asset manager is not affected by the proposed deal between Ninety One and Sanlam.

“SIH separately holds an equity stake in Denker Capital. This holding falls outside of the Sanlam–Ninety One agreement, and as such we are unaffected by it. Our business remains unchanged, and we will continue to serve our clients and investors as we have in the past,” he notes.

ALSO READ: Report reveals SA’s loss of confidence in financial institutions

Ninety One’s interim results

Meanwhile, Ninety One announced in its interim results released on Tuesday that it recorded a 1% increase in closing assets under management to £127.4 billion for the six months ended 30 September 2024.

The group will pay an interim dividend of 5.4 pence per share.

In the period under review, basic and headline earnings per share decreased by 12% to 7.8 pence. Net outflows were £5.3 billion (2023: £4.3 billion).

Du Toit says the group benefited from positive performance in equity and bond markets. However, the demand for risk-on strategies, especially in emerging markets, remained muted.

“This affected our ability to produce new business at historic rates. It is encouraging to note that we have experienced a significant improvement in inflows and business opportunities since September,” he notes.

Since September, there has been an improvement in flows and pipeline. “[This] gives us confidence that the worst is behind us.”

Ninety One is encouraged by an environment of lower interest rates, broadening markets and an improving new, but cautions that optimism should be tempered by elevated levels of global political risk.

This article was republished from Moneyweb. Read the original here.