Including tax rebates or subsidies for consumers to accelerate the uptake of electric and new energy vehicles.

The government is planning some major changes to its industrial policy for the automotive industry by providing incentives and support to other new energy vehicle (NEV) technologies, and not just electric vehicles (EVs).

This includes introducing tax rebates or subsidies for consumers to accelerate the uptake of these vehicles in South Africa.

President Cyril Ramaphosa told the SA Auto Week conference in Cape Town last week that consideration must be given to incentives for manufacturers as well as tax rebates or subsidies for consumers to accelerate the uptake of EVs as well as hybrid vehicles.

Ramaphosa did not provide any time scale for implementation of these incentives or indicate how they would be funded, but more detail could be revealed by Finance Minister Enoch Godongwana in the Mid-Term Budget speech on 30 October.

Billy Tom, president of automotive business council Naamsa and CEO of Isuzu Motors South Africa, said on Friday Naamsa recently had a meeting with Minister of Trade, Industry and Competition Parks Tau and has set up a follow-up session where he believes the issue will be unpacked and the industry will get more clarity around how the incentives will be funded.

“We are going to keep away from speculating where the money is going to come from, but we appreciate the big and bold move the government made,” said Tom.

He said Naamsa sees the content of Ramaphosa’s announcement as “a crucial step towards the widespread adoption of cleaner, more sustainable vehicles”.

“These measures will ensure that South Africa remains part of the global supply chain as major trading partners shift towards EVs,” said Tom.

He added that the industry looks forward to working with Tau and his two deputy ministers and other government departments on implementing these policies to ensure the industry remains future-focused and globally competitive.

ALSO READ: Government’s pledge to support the car industry

Upping competitiveness

Ramaphosa told the conference the incentives and support are not just about creating a greener future but also about ensuring South Africa remains competitive in the global market.

“As many of our major trading partners rapidly shift towards EVs, it is imperative that we remain part of this global supply chain. This is a major industrialisation opportunity for South Africa and the region, particularly within the context of the African Continental Free Trade Area,” he said.

“This will position South Africa as a forward-thinking, green economy. It will advance our aspirations to be a global automotive hub,” added Ramaphosa.

Godongwana said in his Budget Speech in February the government proposed introducing an investment allowance commencing on 1 March 2026 on new investments to encourage the production of EVs in SA.

He pointed out that government had also reprioritised R964 million over the medium term to support the transition to EVs.

Former Department of Trade, Industry and Competition (dtic) minister Ebrahim Patel said in December 2023 at a briefing that coincided with the release of the government’s Electric Vehicle White Paper that South Africa’s electricity challenges had contributed to the government focusing on a two-phased policy approach to the transition to EVs, with the focus firstly on the production and export of EVs rather than on stimulating domestic demand and sales.

Patel anticipated the phasing between the production and export focus and the consumption and market development phase will be over a period of seven to eight years.

ALSO READ: SA motor sector must reap opportunities from electric car demand, says Ramaphosa [VIDEO]

Risk of being ‘left behind’

Peter van Binsbergen, Naamsa vice president manufacturing OEMs (original equipment manufacturers) and CEO of BMW Group South Africa said on Friday there is a very real risk that if South Africa’s automotive industry “does not transform its local production industry to NEVs, it will be left behind”.

“We need to make sure that our manufacturing base is technologically open … so that we can produce on the same production line ICE (internal combustion engine) vehicle, hybrids, plug-in hybrid electric vehicles (PHEVs) and ultimately EVs because the jury is still out on where the future is going.

“We need to keep that technology open focused, so that we can ensure we get the maximum production allocation to our South African plants and serve the world.

“That is what is really important and what I really embrace about the president’s announcement is that the government will work with us and support any NEVs on a broad scale, not just battery electric vehicles [BEVs],” he said.

Van Binsbergen said the automotive industry together with the dtic is looking “to future-proof the industry in South Africa and thereby also the jobs we create”.

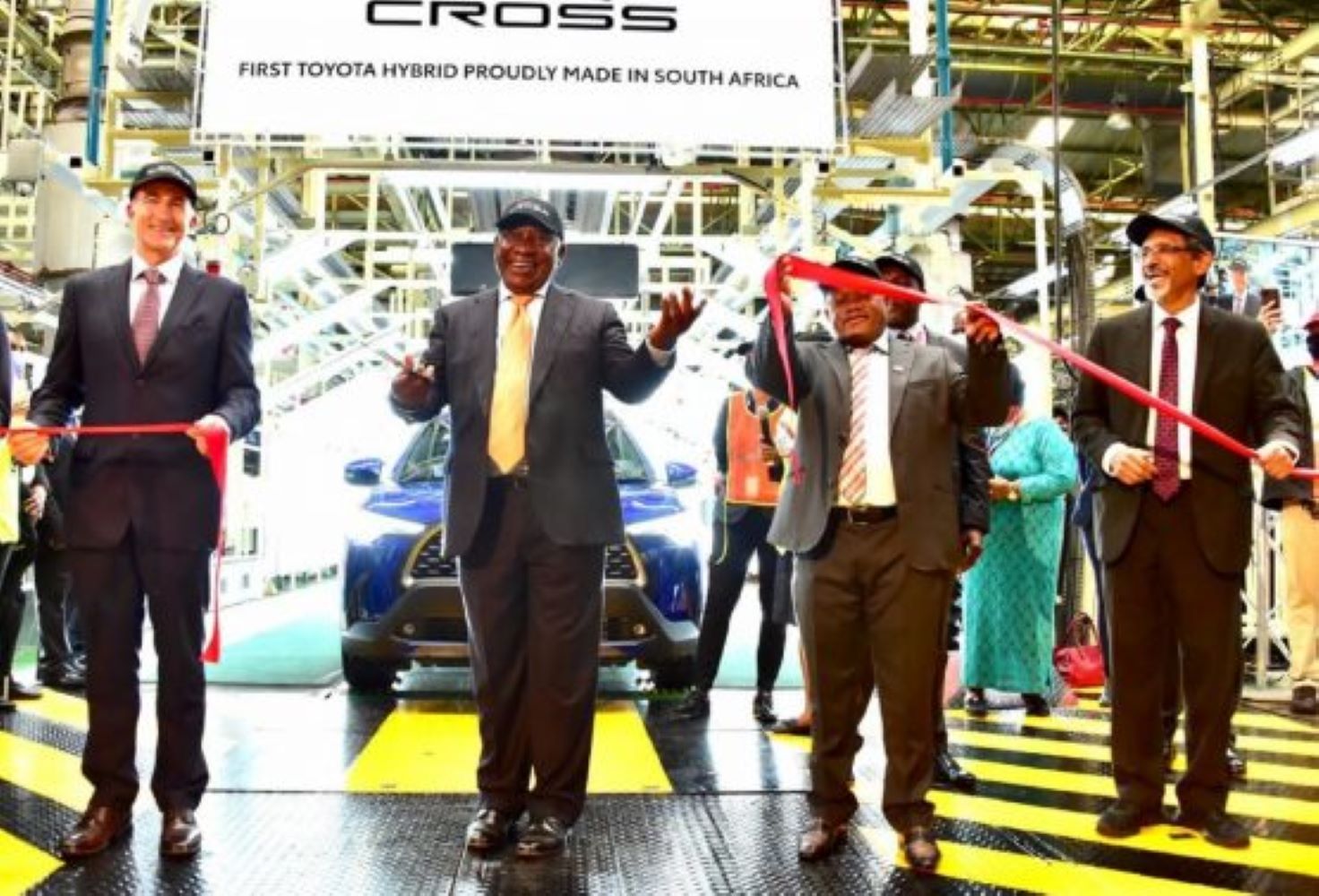

Andrew Kirby, past president of Naamsa and president and CEO of Toyota SA Motors, said South Africa’s automotive industry needs to ensure it is globally competitive and continues to play a strong role in the global supply chain.

Kirby said this means it will need to transition to NEVs, especially to continue exporting to Europe.

He added that the transition by the local market to purchasing lower and zero emission vehicles has not been that clear over the last few years, but he believes there is now very good alignment between the auto sector, government and social partners that those are the three areas they need to focus on.

Kirby said the industry now also knows that the direction in terms of supporting manufacturing competitive NEVs is along the lines of supporting capital investments by OEMs.

“We have some high expectations that a similar structure will be put in place for all the different forms of NEVs and that we can achieve the same timeframes that were envisaged around March 2026,” he said.

Kirby stressed that support to make NEVs more affordable and attractive for the SA public is very important – as is the acceleration of decarbonisation of the vehicle market, and that this cannot just be export-driven.

“We also need the South African market to transition and not to be left behind from what is happening in the rest of the world,” he said.

ALSO READ: Global confidence in car industry decreasing

APDP review?

Kirby said Naamsa has been asking that the review of the Automotive Production & Development Programme (APDP II), originally scheduled for 2026, be brought forward because the automotive business environment has changed substantially.

“Our basic premise is that APDP II is a very solid foundation. We are not recommending dramatic changes to it, but we do need to also have selective policies where we can have target approaches to increasing local content.

“We currently have a broad approach. We can learn from other countries, for example Thailand, where they specifically target specific commodities and, in that way, we think we can make a breakthrough in terms of local content, especially as we transition to NEVs,” he said.

Tau told SA Auto Week the APDP has provided critical incentives and policy frameworks to help drive investment, innovation, and job creation in the automotive sector, which has enabled SA to remain globally competitive.

He said the APDP since its inception in 2011 has disbursed R20.7 billion to component manufacturers and OEMs, with the Automotive Incentive Scheme providing funding to over 150 projects.

Tau said this has resulted in over R76 billion in investments from the 2016/17 financial year to September 2024, generating a simple investment multiplier of five.

“This means that for every R1 of incentive spending, R5 of investment was spent by the project. Over this period, the average grant disbursed was 20% of the total investment generated by the project.”

This article was republished from Moneyweb. Read the original here.