The FSCA list of employers with pension fund contributions in arrears includes 149 municipalities in South Africa.

The Financial Sector Conduct Authority (FSCA) has published a new list of 2 330 employers with arrear pension fund contributions after receiving reports from 51 pension funds that 7 770 employers are not paying over pension fund contributions amounting to R5.2 billion.

Although this amount is only 0.2% of the R3.15 trillion in assets from pension funds under FSCA supervision, it affects 31 000 pension fund members who receive no benefit payments.

The names of the pension funds and employers are contained in the FSCA Communication 41. Not paying over pension fund contributions is a contravention of section 13A of the Pension Funds Act, which prescribes how contributions and other benefits should be paid to a retirement fund.

Keabetswe Tsuene, senior analyst for Retirement Funds Conduct Supervision at the FSCA said at a media roundtable on Friday that the FSCA received reports of a total of 7 770 employers that contravened section 13A of the PFA by 31 December 2023 from retirement funds supervised by the authority:

- 2 003 of them have outstanding contributions of more than R50 000 for more than 5 months;

- 200 of them have outstanding contributions of more than R50 000 but the last contribution date was not provided;

- 113 of them have outstanding contributions of less than R50 000, but the outstanding late payment interest is more than R50 000 and has been outstanding for more than 5 months; and

- 20 of them did not contribute since the date of participation in the retirement fund.

The rest of the employers (5 440) were not included in the publication as they do not meet these thresholds.

ALSO READ: Two-pot retirement system: Nothing for thousands of pension fund members

Who are the employers with pension fund contributions in arrears?

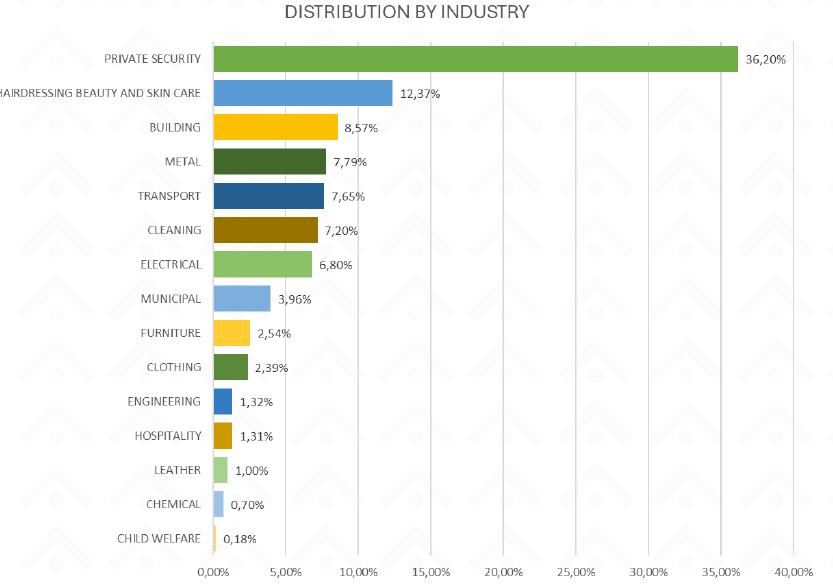

Most of them are small employers with variable incomes and contract employees, such as contract cleaning, private security, electrical contracting, transport, construction and clothing and furniture manufacturing. This graph shows how much is owed in each industry:

Although some employers, such as private security companies, only pay when they are operating, Tsuene noted that some of them are getting new contracts while they are still in arrears, which means they should be able to pay contributions. “How can they get new contracts, sometimes government contracts, if they are in arrears?”

Tsuene said employers’ failure to pay retirement fund contributions has severe consequences for members. “It affects their withdrawal benefits, as we have seen with the introduction of the two-pot retirement system, investment returns and applicable risk benefits.”

ALSO READ: Stop stealing your staff’s future

Withholding payment of pension fund contributions serious criminal offence

She also pointed out that withholding these contributions despite deducting the contributions from employees’ salaries is a serious offence that could amount to theft and in some cases, fraud.

The FSCA oversees regulated entities, which include retirement funds and their boards but employers participating in retirement funds are not considered regulated entities under the Pension Funds Act or the Financial Sector Regulation Act.

Tsuene said this limits the FSCA’s ability to directly address non-compliant employers but this should be remedied by the introduction of the Conduct of Financial Institutions Bill (CoFI) expected early next year.

ALSO READ: FSCA names 3 262 employers with retirement fund contributions in arrears

What retirement fund boards are doing to get payment

Retirement fund boards reported that they resorted to legal action, bargaining council enforcement processes, lodging complaints with the Office of the Pension Funds Adjudicator and reporting contraventions to the police in an effort to recover outstanding contributions.

“The FSCA will continue to engage with the National Prosecution Authority (NPA) and the Directorate for Priority Crime Investigations (DPCI) to ensure that responsible parties are brought to book. The Authority also welcomes the arrests of the officials involved in the non-payment of contributions in the Kai !Garib, Renosterberg and Kamiesberg municipalities.”

So far, 130 cases have been opened against companies that fail to pay over the pension fund contributions of their employees.

She said pension fund members affected by employer non-compliance should engage with their employers and retirement funds directly and if this does not work, they can lodge complaints with the Office of the Pension Funds Adjudicator.

ALSO READ: ‘There is no money’: EFF on municipal workers who can’t withdraw from two-pot retirement system

Concern about municipalities with pension fund contributions in arrears

FSCA commissioner, Unathi Kamlana, said he is concerned about the R1.4 billion in pension fund contributions that municipalities did not pay over to the South African Local Authorities Pension Fund.

“Failure to pay over the contributions puts members’ savings at risk.”

The lists of employer names can be accessed here.