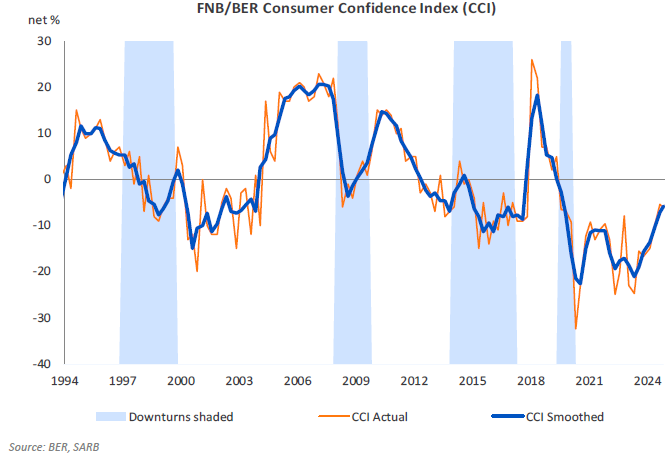

Although the consumer confidence index decreased slightly, consumers are still willing to spend, which will be good for economic growth.

Consumer confidence slipped by one point in the fourth quarter, but it still looks better than it did a year ago and indicates the best festive season reading since 2019.

According to the FNB/BER Consumer Confidence Index, consumer confidence edged lower in the fourth quarter to -6, after soaring from -15 index points in the first quarter of 2024 to afive-year high of -5 in the third quarter.

The latest reading remains slightly below the long-term average, but Mamello Matikinca-Ngwenya, chief economist at FNB, points out that the -6 recorded in the fourth quarter is the best festive season consumer confidence reading since 2019 and far better than the -17 index points measured during the fourth quarter of 2023.

“Despite the one-point decline in consumer sentiment compared to the third quarter, the upsurge in the index since the end of 2023 indicates a marked increase in consumers’ willingness to spend during this holiday season.”

ALSO READ: GNU talks: Consumer confidence remains in limbo

Reasons for slip in consumer confidence

She says the marginal decline in the index during the fourth quarter can be ascribed to a slight deterioration in the economic outlook and household finances sub-indices of the index. After increasing from -9 to -7 in the third quarter, the economic outlook sub-index of the index reverted to its second-quarter level of -9 in the fourth quarter.

The household finances sub-index declined from 14 to 11 index points but remained above the level recorded during the first half of 2023. In contrast, the sub-index measuring the appropriateness of the present time to buy durable goods, such as vehicles, furniture, household appliances and electronic goods, continued its upward trajectory, with an improvement from -23 to a two-year high of -21 in the fourth quarter.

A breakdown of the index per household income group shows that sentiment among high-income households improved further, but the confidence levels of middle-income households lost ground.

After soaring from -16 to a five-year high of -6 in the third quarter, the confidence levels of high-income households earning more than R20 000 per month increased further to -4 in the fourth quarter.

However, the confidence levels of middle-income households earning between R5 000 and R20 000 per month retreated to -7 after jumping from -9 to -3 in the previous quarter. Consumer sentiment among low-income households remained steady at -7 index points.

ALSO READ: SA consumer confidence improves slightly in first quarter of 2024

This is why consumer confidence improved this year

“A string of favourable developments has seen consumer confidence riding much higher since the second quarter of 2024, including the formation of a government of national unity (GNU), the termination of load-shedding, a substantial deceleration in inflation, two interest rate cuts and the implementation of the two-pot retirement system.

“However, headwinds started to emerge in November, arresting the upward trajectory of consumer confidence. These include a marked depreciation in the Rand exchange rate, a 25-cent per litre increase in the petrol price, lower stock prices on the JSE and concerns about the outlook for global trade and South African exports since the re-election of Donald Trump as the US president.”

Even so, Matikinca-Ngwenya says, heading into the festive season with consumer confidence only one point shy of a five-year high bodes well for consumer-oriented companies.

ALSO READ: Consumers under pressure: South Africans spiral as their disposable income shrinks

Economist: consumer confidence and spending will increase in 2025

Jee-A van der Linde, senior economist at Oxford Economics Africa, agrees that although the index dipped marginally, consumers continue to demonstrate an increased willingness to spend. “We believe consumers’ spending ability will also strengthen in 2025, but these improvements will be gradual.”

Following the quarterly drop, he points out that the latest headline reading remains somewhat below the long-term average of the index. He says although the -6 recorded in the fourth quarter is the best festive season consumer confidence reading since 2019, economic realities continue to bite.

“The latest national accounts data showed that South Africa’s growth prospects remain flimsy. However, benign domestic inflation, lower fuel prices compared to the beginning of the year and retirement fund reform should support the domestic economy as we transition to 2025.

“Interest rate cuts by the South African Reserve Bank will provide an added boost to the economy. Consequently, we expect consumer confidence to improve gradually next year.”

ALSO READ: Increasing business confidence shows cautious optimism

Consumer confidence surveys show their attitudes and expectations

According to the Bureau for Economic Research (BER) which surveys for the index, consumer confidence surveys provide regular assessments of consumer attitudes and expectations and are used to evaluate economic trends and prospects.

“The surveys are designed to explore why changes in consumer expectations occur and how these changes influence consumer spending and saving decisions.”

The FNB/BER consumer confidence index combines the results of three questions posed to adults in South Africa, namely the expected performance of the economy, the expected financial position of households and the rating of the appropriateness of the present time to buy durable goods, such as furniture, appliances and electronic equipment.