The CFD platform appears to be still trading after the FSCA withdrew its licence.

Controversial trading platform Banxso seems to continue to trade and accept client deposits despite its licence being provisionally revoked and its bank accounts being frozen.

Moneyweb can confirm that its trading platforms remain active, and that some clients were directed to deposit money into the Absa bank account of Ahead Start more than two weeks after its accounts were frozen.

This comes after Nedbank, Standard Bank, and Capitec froze Banxso’s bank accounts on 1 October, following the Financial Intelligence Centre’s (FIC) instructions. The Asset Forfeiture Unit subsequently seized the remaining funds, and the Financial Sector Conduct Authority (FSCA) provisionally withdrew its financial licence.

The FIC stated in court papers that it believes Banxso is a “criminal enterprise designed to defraud innocent members of the public”.

One victim has also launched liquidation proceedings.

Banxso denied that it is currently conducting any business or accepting any new business and is working with the authorities to limit the impact on clients. (See below)

Arthur Peace, the CEO of Ahead Start, confirmed to Moneyweb that he wasn’t aware of the FIC’s actions at the time but terminated the relationship after being made aware. He also said that deposits continue to be paid into the account but are being retained pending legal proceedings and interaction with the FIC and the FSCA.

ALSO READ: Banxso victim launches liquidation application

Instruction to pay deposits into Ahead Start’s bank account

Two Banxso clients contacted Moneyweb when the news broke that the banks had frozen Banxso’s bank accounts. They said their Banxso success managers instructed them to pay additional deposits into Ahead Start’s Absa account.

Moneyweb has seen proof of payments of the transactions and that the amounts were credited to the client’s Banxso trading accounts. Both individuals spoke to Moneyweb on the condition of anonymity.

The first client said their Banxso success manager emailed the bank details, which listed the account name as AS Banxso PTY LTD.

They deposited a substantial amount into the account on 15 October, two weeks after the banks froze Banxso’s accounts. The payment was credited to the trading account on the same day.

The second client deposited a substantial amount into the account on 16 October. This client showed Moneyweb screenshots of a WhatsApp conversation in which a Banxso success manager included a screenshot of Ahead Start’s banking details. The account name was listed as Ahead Start PTY LTD.

The client’s Banxso trading statement reflects that the money was credited to the account on the same day, as well as a very substantial “trading bonus”.

ALSO READ: WATCH: Banxso defies licence suspension

Banxso response

Hendrik Theron of Hanekom Attorneys, representing Banxso, denied that the trading platform remains active or is accepting new business.

“Banxso reiterates that it is not conducting, nor accepting any new business. Pursuant to the notice of provisional withdrawal issued by the FSCA on 15 October 2024, a number of nuanced operational concerns and difficulties have come about, specifically in dealing with clients that held open positions as at the date of the provisional withdrawal.

“This is a critical and time-sensitive issue that has been raised with the FSCA. The company is taking all steps within its power to protect the clients against any adverse consequences of these positions remaining open during the freeze imposed on the company’s bank accounts, and moreover, the provisional withdrawal of its license.”

ALSO READ: The FIC busts Banxso

Ahead Start

Peace stated in response to Moneyweb questions that Ahead Start terminated its agreement with Banxso but said deposits are still being made into the account.

He said the business relationship started when Banxso contracted Ahead Start “to process payments in the normal course of business with an entity that was fully FSCA compliant”.

He said the agreement was terminated. “We have learnt about the pending liquidation application and have, as a result on advice from our attorney retained any Banxso funds on hand and are awaiting the outcome of the pending liquidation application and other legal pending matters, which will present our legal obligations as how to deal with the funds on hand.

“There were deposits made subsequent to the suspension of Banxso.

“The gateway functionality has been suspended, but direct deposits cannot be stopped from Ahead Start’s side,” he said.

“These funds will similarly be retained whilst awaiting the outcome of the pending litigation or directives from FIC or regulatory bodies.”

Peace said they are contacting the FSCA and FIC through their legal representative “for further guidance”.

ALSO READ: AfriMarkets: Banxso’s emerging twin?

Banxso platform continues to facilitate trade

Moneyweb, which has access to a Banxso trading account, can confirm that Banxso’s trading platforms have remained active. Moneyweb completed a trade on Banxso’s platform on Tuesday (29 October), and the account holder also continues to receive trading tips from the Banxso success manager team via email.

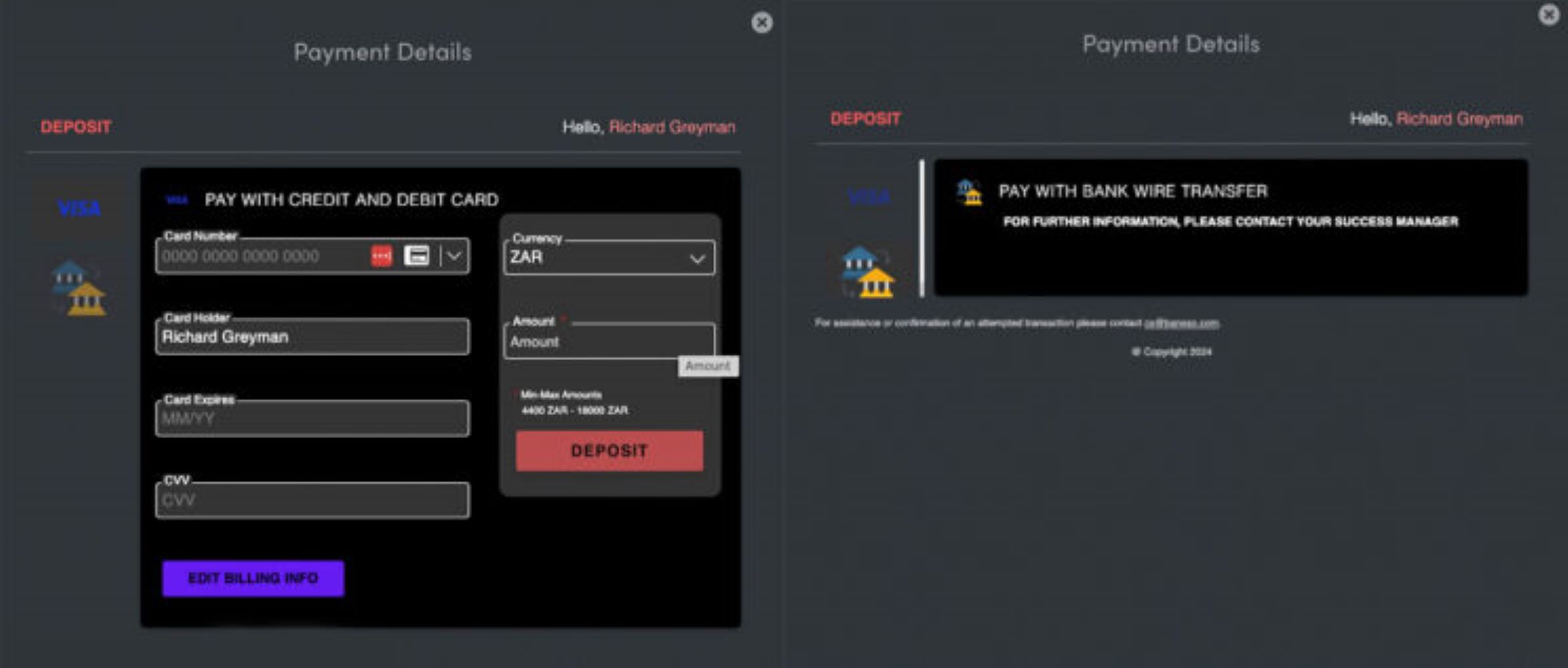

It also seems clients can still deposit monies through a credit card payment facility on Banxso’s trading platform (see image below). However, the option to do an electronic fund transfer is not available.

Moneyweb’s database of individuals claiming to have lost money has grown to over 220. These investors claim they have collectively lost more than R118 million.

Existing Banxso clients are welcome to contact the author at ryk@moneyweb.co.za.

This article was republished from Moneyweb. Read the original here.