JSE has fined the company R500 000.

JSE-listed Ayo Technology Solutions has been fined R500 000 for not releasing a Sens announcement with full details of a share buyback after agreeing to a settlement agreement with the parties on 23 March 2023.

On Thursday, the JSE said in a Sens update that the fine is wholly suspended for five years, provided the technology company is not found to be in breach of similar provisions of the listings requirements during the suspension period.

Read: Ayo suspended from JSE

This comes after Ayo announced that its parent company, Sekunjalo Investment Holdings, led by controversial businessman Iqbal Survé, planned to buy out minority shareholders before the company delisted.

In the Sens, Ayo said Sekunjalo will acquire the offer shares, a maximum of 155 331 790 shares, for which valid acceptances are received prior to the closing date of the offer, for a total offer consideration of R80 772 531.

Read: Iqbal Survé’s R50bn grand plan for Ayo [Apr 2019]

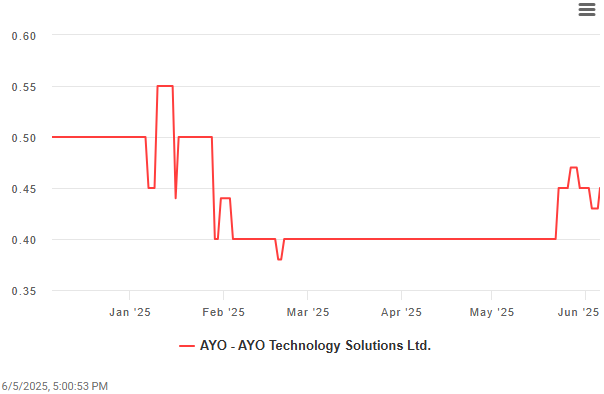

In February 2025, the JSE suspended trading in Ayo shares for failing to publish its annual report for the year to August 2024.

“I believe we have done everything within our power to ensure compliance with the listings requirements, however, the release of our results is contingent on the external quality reviewer, the independence and process of which we respect,” said Ayo CEO Amit Makan in a statement.

Read: Ayo shareholders agree to repay R619m to PIC [Jun 2024]

For this new offence, the JSE says the company was found to be in breach of paragraph 11.25 of the listings requirements, and the purpose of these requirements is to ensure that a repurchase of shares by a company from specifically named parties is conducted transparently and fairly.

The stock exchange says this rule highlights the need to keep investors informed by sharing important updates on Sens, especially when it could impact investment decisions or share value.

Read: Ayo shareholders agree to repay R619m to PIC

“The JSE finds it unacceptable that Ayo failed to immediately inform shareholders that it had agreed to repurchase its shares from the parties as part of the settlement agreement.”

The company’s shares have dropped to 40c, down 99% from the peak of R45 in 2017.

This article was republished from Moneyweb. Read the original here.